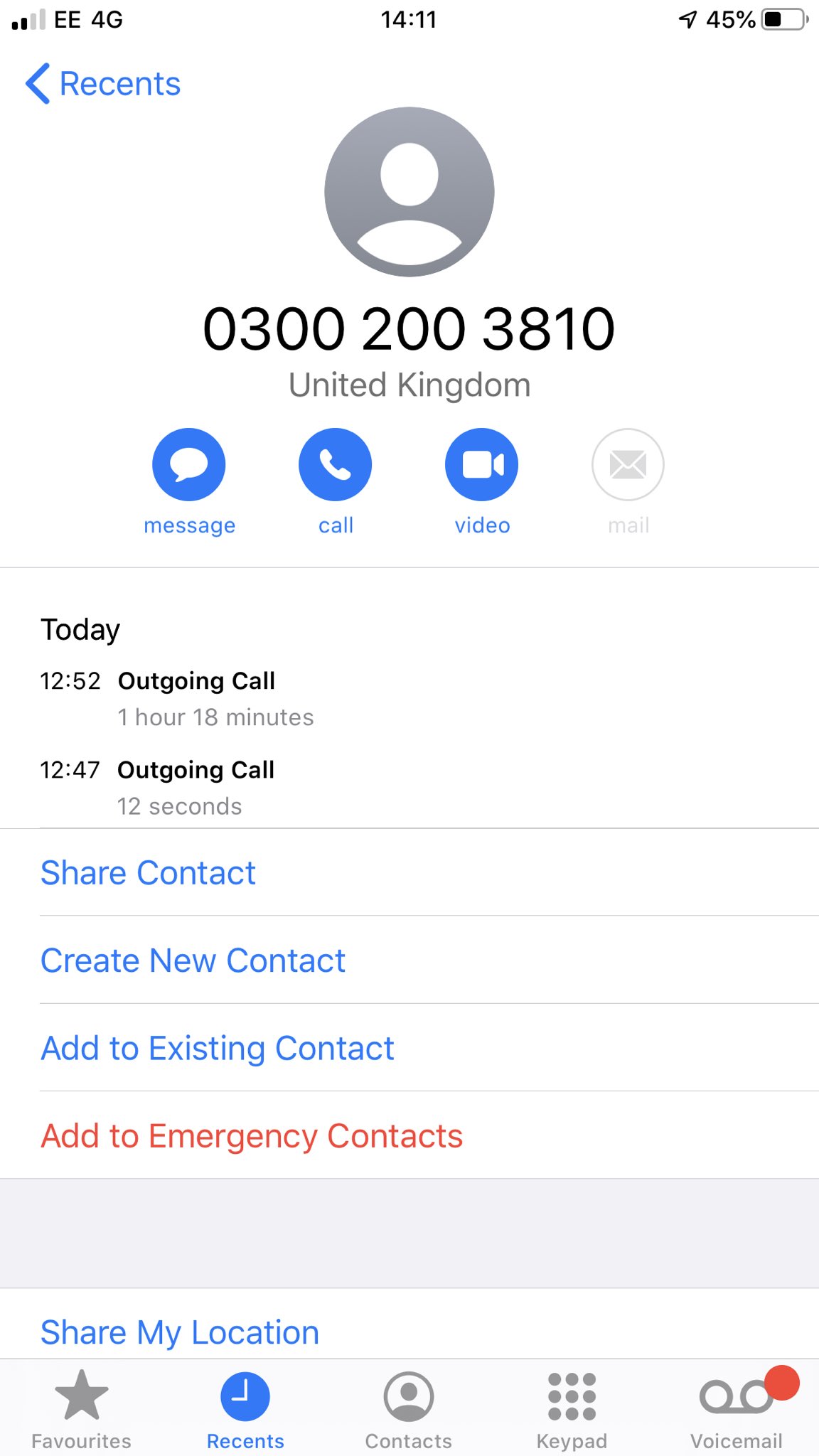

0300 200 3810

Find out more.

If you are struggling to pay your tax bill s , HMRC has dedicated phone lines to agree payment plans for taxes. Every situation is different, and what HMRC agrees for you will depend on your current situation and your history with them. There are no rules to go by. The 'time to pay' arrangement isn't a contract - it's designed to be flexible and amended over time. Top Tip - If you can see the shortfall before the due date - try to make some payments beforehand to show willingness. They love this.

0300 200 3810

UK, remember your settings and improve government services. We also use cookies set by other sites to help us deliver content from their services. You have accepted additional cookies. You can change your cookie settings at any time. You have rejected additional cookies. Check recent contacts from HMRC to help you decide if a suspicious email, phone call, text or letter could be a scam. Sometimes HMRC uses more than one way to get in touch. For example, we may contact you by letter first before following up with an email, call or text message. This is because:. All the HMRC contacts listed on this page can use more than one communication method. They are in alphabetical order.

Information about research on stakeholder engagement has been added. Skip to content. We will not ask for any personal, business or financial information.

.

If you are struggling to pay your tax bill s , HMRC has dedicated phone lines to agree payment plans for taxes. Every situation is different, and what HMRC agrees for you will depend on your current situation and your history with them. There are no rules to go by. The 'time to pay' arrangement isn't a contract - it's designed to be flexible and amended over time. Top Tip - If you can see the shortfall before the due date - try to make some payments beforehand to show willingness. They love this. When dealing with HMRC, we find, usually, the nicer we are to them, the more willing they are to help.

0300 200 3810

Report a phone call from and help to identify who and why is calling from this number. Their call back number is I have asked them to address the way they make contact and let them know that they are listed on several scam number sites Here's hoping it is dealt with! This is genuine. Just called and resolved an outstanding issue which turned out to be an allocation issue. This is a genuine number. When they called me however they started to ask me security questions which I felt uncomfortable answering as I wasn't certain it was them. Not the best idea to call someone and then ask them to provide confidential info over the phone.

Ufc 287 date and time

Research on employers' experiences of the Coronavirus Job Retention Scheme will continue until 10 November From 1 March up to and including 16 August , Ipsos UK may contact you by email, letter or phone. If you have savings or assets HMRC will expect these to be used to reduce any personal income debt as much as possible. This includes telephone numbers, online contact options and postal addresses, together with a number of tips. The agent reference number. VAT will quote the four digit ID as an extra assurance. Information on the customs intermediaries monitoring survey has been added. Research into agents of wealthy customers has been extended from 30 December to 31 March Name of the practice. Information about Corporation Tax research, Employment status in the UK, VAT payable order repayments have been removed as contact for these have ended. Information about customer research on Corporation Tax reliefs from August to 30 September has been added. If you are based overseas and trading on online marketplaces, we may contact you to issue VAT assessments. We have also updated the section Income Tax Self Assessment research on future timely payments. HMRC are working with independent research agency People for Research to recruit participants to take part in a focus group. You have rejected additional cookies.

We have become aware of an aggressive HMRC letter scam, whereby the scammers are demanding payment of a past tax liability or penalty, and asking people to call to help discuss payment. Although it looks like an official and authentic HMRC letter, it is definitely a scam for the following reasons:.

This field is for robots only. Added information on the government analysis schools outreach programme and employers' experiences of the Coronavirus Job Retention Scheme. From 22 January up to and including 1 May , Verian may contact you by email, letter or phone. Added information on research on the Profit Diversion Compliance Facility and the Diverted Profits Investigation Approach, and the end date of the traders survey has been changed from 10 March to 25 March Callers will also offer a call back should the agent remain concerned. Information on the company names, and the dates they may contact you to take part in research on the experiences of businesses new to customs has been updated. When dealing with HMRC, we find, usually, the nicer we are to them, the more willing they are to help. Callers will offer reference to earlier correspondence or phone calls as proof of identity. HMRC telephone contact. Added information on research into self-assessment and VAT repayment systems. Explore the topic Phishing and scams. For Self-Assessment bills you might be able to set up a payment plan online.

0 thoughts on “0300 200 3810”