10 lpa in hand salary

CTC vs In Hand Salary is the tricky truth of Corporate Economics which is relevant to every individual who is the part of the corporate sector specifically in India. Cost to company CTC is a term for the total salary package of an employee. Tax is also deducted from the cash amount the employee receives directly.

In every professional field, employees get paid at the end of the month by their employers. This payment is called the salary. The amount they receive is usually mentioned in their contract as well as the pay slip. The salary has many components that may vary among different employers. Below is a list of the most common breakdown of the salary structure. There is no formula to calculate this amount.

10 lpa in hand salary

.

The allowance only covers railway ticket prices and airfares. It also reflects the total deductions. Does the salary calculator show the deductions?

.

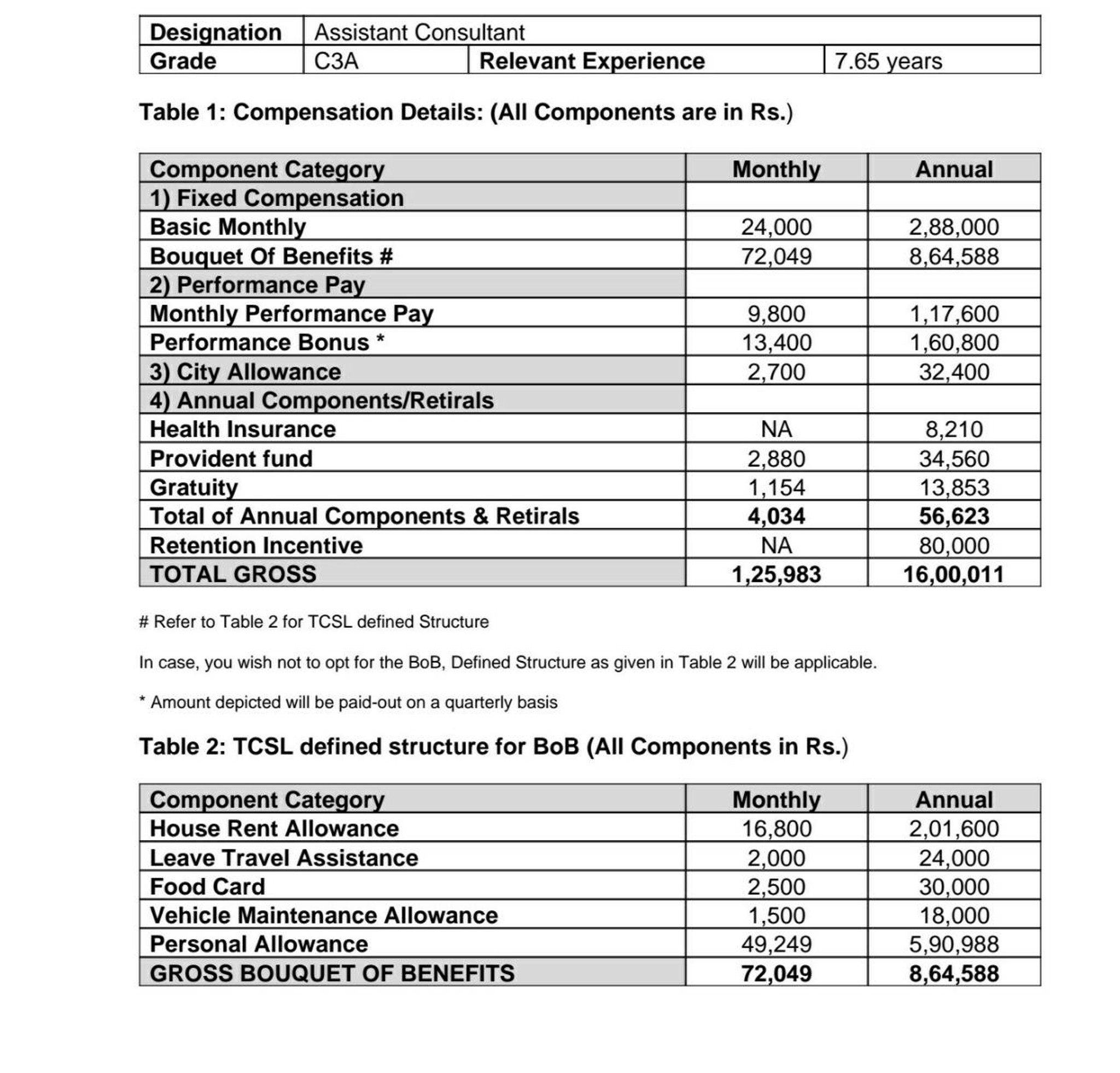

Do you always get confused with the salary terms? Learn what CTC calculation, the monthly salary calculator and others in this detailed article are. The complete structure of CTC will contain several components; therefore, for understanding your salary better, it is essential to know about the CTC components. The cost to the business, or CTC, is the cost a company incurs when recruiting a new employee. These allowances may include free meals or meal coupons from companies like Sodexo, office space rent, transportation service to and from the office, and subsidized loans, among other things. All of these variables, when added together, make up the total Cost to Company. CTC does not equal take-home pay; instead, it includes a variety of allowances, as stated above. Your CTC is frequently used to determine annual appraisals and raises. CTC is made up of numerous parts.

10 lpa in hand salary

Salary is compensation that companies pay to their employees for their services in the company. Your salary slip has two main sections. One section is income or earnings. And the second part is deductions. Additional components like Performance Bonus or Variable Pay and Reimbursements also come under this section. The second part, i. All these details can be intimidating and overwhelming for a salaried person to get an idea about their in-hand salary.

Pantie cream pie

Let see how to calculate Gratuity? Don't miss out on this out-of-the-world banking experience. Let's breakdown how to calculate take home pay after the taxation. To do away with the tedious calculations, most people prefer the take-home salary calculator in India. CTC vs In Hand Salary is the tricky truth of Corporate Economics which is relevant to every individual who is the part of the corporate sector specifically in India. Follow the three steps given below:. Download now. We show daily updated currency exchange rates and more facts about it. It is levied on the tax payable, and not on the income generated. How much gratuity amount is deducted from salary? The entire bonus amount is fully taxable. Components of Your Salary Slip In every professional field, employees get paid at the end of the month by their employers. Weekly tips and tricks from outer space Subscribe. Its powerful mechanism offers you the required data in a jiffy and without any errors. Manage your money better.

In every professional field, employees get paid at the end of the month by their employers.

Once you provide the data, the calculator will show the other relevant salary components in no time. Don't miss out on this out-of-the-world banking experience. Bonus is a component of the gross salary that the employers may pay as a performance encouragement. Most companies deduct around 4. This is a fixed amount your employer may pay above your basic salary. You may change the percentage based on your requirements. For taxable income you need to have the following values:. Let see how to calculate Gratuity? How to Calculate Gratuity? You need to submit proof of travel to receive the tax benefit. The tool can make the process easy for you; read on to know more. Everyone is curious what their take home pay will be once an organization decides the appraisal for the employee or share the new offer letter to a candidate. You can easily find the TDS amount on your salary slip.

Certainly. And I have faced it. Let's discuss this question. Here or in PM.

It was and with me. Let's discuss this question. Here or in PM.