16 lpa in hand salary

Click here to know how much tax you have to pay for the above salary. The employer makes regular payments to the employee for the work done.

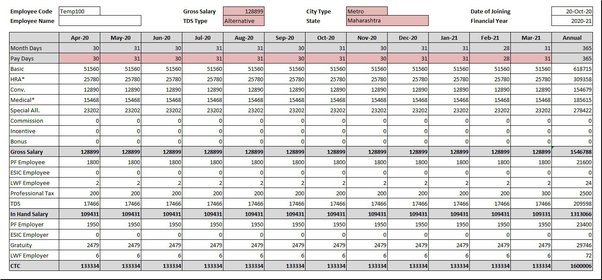

With the help of a simple salary calculator, you can quickly determine the take-home salary post deductions such as travel allowance, bonus, house rent alliance, provident fund, and professional tax. With the help of this Salary Builder , you can get valuable insights regarding your salary growth and compare your salary with your peers. A regular payment made to employees in exchange for the work performed by them is known as a salary. A salary is determined based on comparing similar positions in the same industry or region. A salary is paid at fixed intervals, generally on a monthly basis.

16 lpa in hand salary

Search Result For "Salary break up for 16 lpa" - Page 1. Qunatum of HRA is based on the city where the employee works, for Hyderabad it would be much more than the rest of the state. Need help regarding salary break up. The package is 6. What is choice pay? And how do we get to ask for choice pay with tax benefits. In the previous company, the gross was 40, and the n Hi There!!!! Thanks for telling me about the bonous amendment… I would highly appreciate if someone helps me in suggesting t Thanks in advanceST.

Ambani wedding is depressing to watch.

Who can do a better job as the CEO of Google? Ambani wedding is depressing to watch. What has Modi achieved in his 2 terms? Why India, why? Topic says it all. What is the inhand salary after tax deduction of 16 lakhs per annum base pay.

Do you always get confused with the salary terms? Learn what CTC calculation, the monthly salary calculator and others in this detailed article are. The complete structure of CTC will contain several components; therefore, for understanding your salary better, it is essential to know about the CTC components. The cost to the business, or CTC, is the cost a company incurs when recruiting a new employee. These allowances may include free meals or meal coupons from companies like Sodexo, office space rent, transportation service to and from the office, and subsidized loans, among other things.

16 lpa in hand salary

A salary calculator is a very easy tool to use which helps in determining the total annual deductions, take-home annual salary, and total monthly deductions of an individual. This inhand salary calculator uses some basic components such as the basic salary, House Rent Allowance, Leave Travel Allowance, Professional Tax, Bonus, Special Allowance, Employee contribution to provident fund etc to calculate the salary. A salary is a form of payment to an employee, typically paid regularly, such as monthly or bi-weekly, for the services they provide to their employer. Salaries are typically calculated as a fixed amount rather than based on the number of days worked or the amount of work completed. Some employees may receive additional benefits and incentives, such as health insurance, retirement plans, or stock options, in addition to their salary.

Cid ff archive

Whereas, the amount that an employee takes home is known as the net salary. You are paid twice a month, usually in the middle of the month. The salary calculator will show you the deductions such as the employer and employee provident fund, professional tax, employee insurance, and the take-home salary. The ClearTax Salary Calculator calculates the take-home salary based on whether the bonus is a fixed amount or a percentage of the CTC. India NEW. Additional Deduction 1. The basic salary is fully taxable. The new tax regime was introduced in the Union Budget applicable from April, FY with lower tax rates. It is a fully taxable component of your salary. Email: customercare sbmbank. Video Editing Free Course. It is the total salary an employee gets after all the necessary deductions. Hardware Engineering. The ClearTax Salary Calculator shows you the take-home salary in seconds.

Consult an Expert. Talk to a Lawyer. Talk to a Chartered Accountant.

If u are not able to wait till salary i think inhand salary wilp be lot. Who can do a better job as the CEO of Google? Updated on Jan 10, You must deduct the total EPF contributions by you and your company. This is the amount that is arrived at before any deductions, increments, bonuses, or allowances. These deductions will vary depending on the CTC. There is no right answer to it. The basic salary would remain the same, unlike other aspects of the CTC. Before we get started, here are a few salary-related terms you need to know:. Employees must submit proof of travel to claim the allowance. Sort by Scan QR code to download the app.

I apologise, but, in my opinion, you are mistaken. I can prove it. Write to me in PM, we will communicate.