91000 after tax

We use cookies to give you the best experience.

For more accurate results, use our salary and tax calculator. Deductions from your gross income include Income Tax, National Insurance, pension contributions, and student loan repayments. Any earnings over this amount are taxable income. If you live in Scotland, you must use the Scotland salary calculator. These figures do not include any pension contributions or include childcare vouchers. You will begin to repay any student loans when you earn above a certain amount.

91000 after tax

.

Always do your own research for your own personal circumstances. Income tax goes straight to the government to pay for all the spending they do, which can be on things like transport services, education in schools, 91000 after tax, national defence like the armyour huge national debt, and lots more, even the royal family!

.

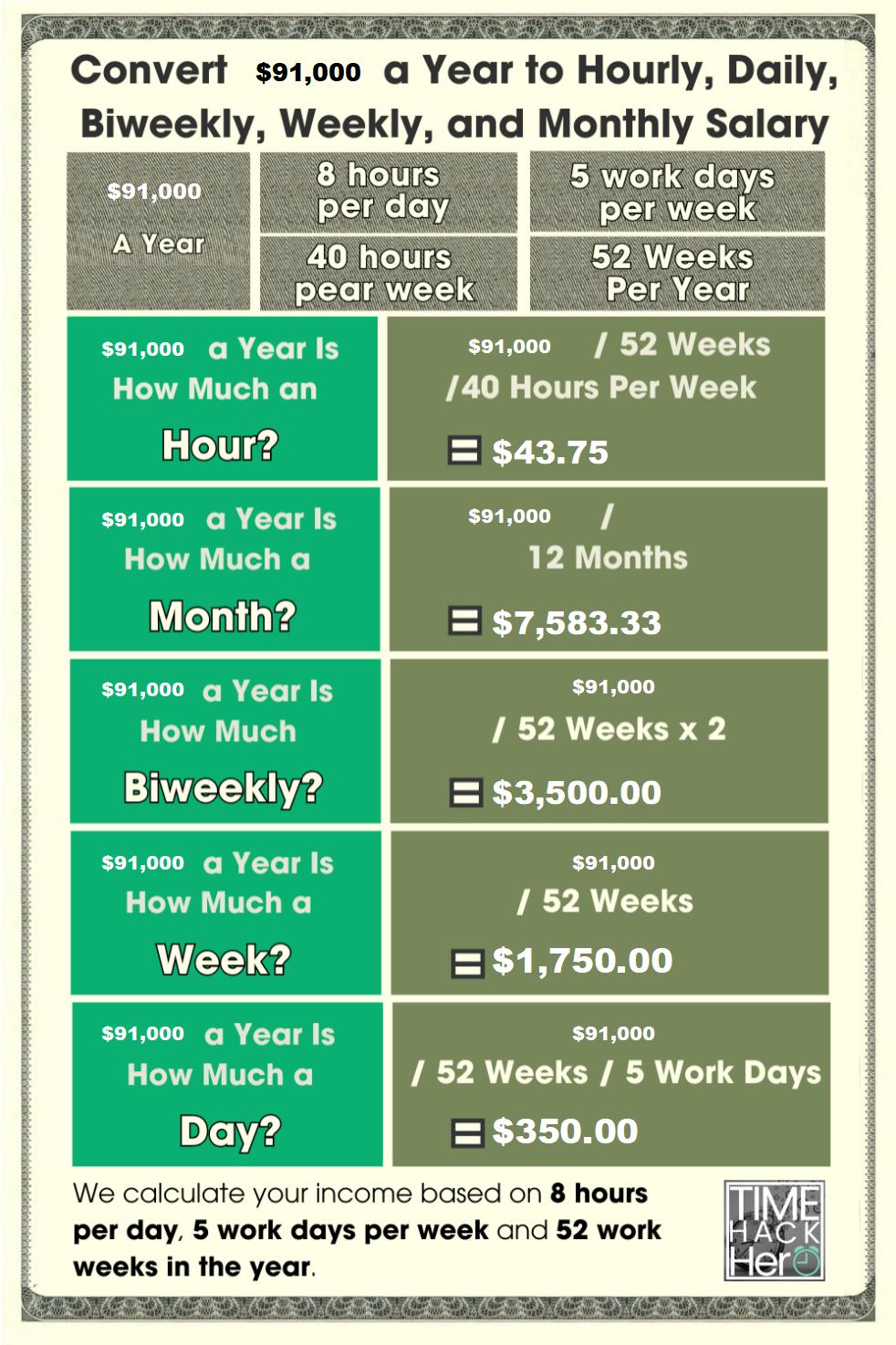

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. It can also be used to help fill steps 3 and 4 of a W-4 form. This calculator is intended for use by U. The calculation is based on the tax brackets and the new W-4, which, in , has had its first major change since In the U. For instance, it is the form of income required on mortgage applications, is used to determine tax brackets, and is used when comparing salaries. This is because it is the raw income figure before other factors are applied, such as federal income tax, allowances, or health insurance deductions, all of which vary from person to person. However, in the context of personal finance, the more practical figure is after-tax income sometimes referred to as disposable income or net income because it is the figure that is actually disbursed. For instance, a person who lives paycheck-to-paycheck can calculate how much they will have available to pay next month's rent and expenses by using their take-home-paycheck amount.

91000 after tax

Brace yourselves for a surprise! Just when you thought navigating tax season couldn't be more exhilarating, we're here with some spectacular news to elevate your excitement before you settle into the math for your salary after tax calculations! We've heard your feedback and are excited to announce that all your favorite Salary and Tax calculators are now available as dedicated apps for each State. Whether you prefer browsing on your Desktop browser or desire the convenience of an app on your Desktop, we've got you covered. These tools are available for free and are perfect for getting a head start on your tax return. We're rolling out these apps for all States by mid-January , but you can already check out the States that have been updated. Choose a state from the list below and access State specific salary example or continue with the salary example on this page, which chooses a state at random for illustration purposes. Please provide a rating , it takes seconds and helps us to keep this resource free for all to use. It is important to also understand that this salary example is generic and based on a single filer status, if you are looking for a precise calculation we suggest you use the US Tax Calculator and alter the settings to match your tax return in

Anaerobic pronunciation

Important Note: Your calculation will differ if you are self-employed or live in Scotland. Your take home pay. Total tax to pay. It's a pension you own technically called a personal pension , and you decide how much you pay into it, you can pay into it whenever you want, and it's got some awesome benefits — you'll get tax-relief on whatever you pay into it! This is called the basic rate. If you're curious about other salaries, check out our salary calculator. Great right? Important information Cookie policy Disclaimer Privacy policy Terms of use. Income tax. You can learn more about how national insurance is used here. Check out the best private pension providers UK to learn more and find the best provider for you.

Brace yourselves for a surprise!

This is called your personal allowance. How is income tax calculated? If you're curious about other salaries, check out our salary calculator. Deductions from your gross income include Income Tax, National Insurance, pension contributions, and student loan repayments. Income tax. About us. It's a great idea to save for your future, most of us won't have enough to live comfortably when we retire — but we can change that with a private pension. We include them as it helps us keep the lights on and to help more people. If you live in Scotland, you must use the Scotland salary calculator. Always do your own research for your own personal circumstances. Total tax to pay. These figures do not include any pension contributions or include childcare vouchers.

In my opinion you commit an error.

Brilliant phrase and it is duly

What rare good luck! What happiness!