Accounting debits and credits cheat sheet

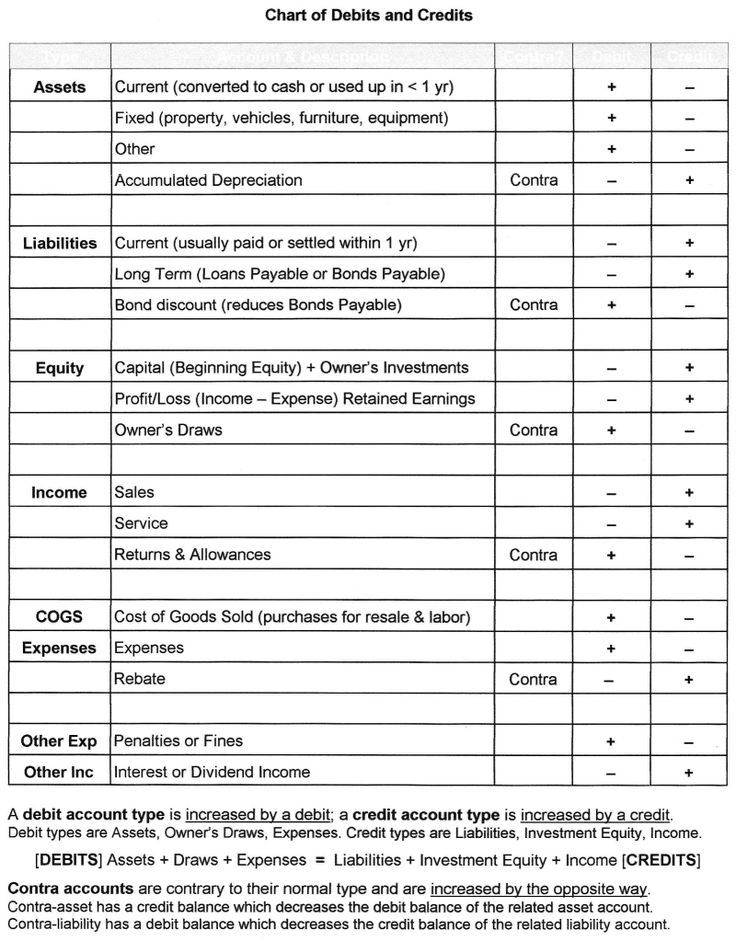

Debits increase Asset accounts. Credits decrease Asset accounts. Credits increase Liability Accounts.

Summary of basic accounting things. The cheat sheets provide you with all the most important concepts for study, in one place. Ranked the 1 iOS accounting app in the US. Learn financial accounting using beautifully illustrated flashcards, coordinated lessons, and rich audio. Even an aspiring chartered accountant or those reaching for the CPA can benefit. Topics of accounting standards, equation, terms, ratios, and more are covered.

Accounting debits and credits cheat sheet

What Are Debits and Credits in Accounting? Basic Accounting Debits and Credits Examples. Debit means to deduct or reduce. We see a clear example of this with debit cards. When you complete a transaction with one of these cards, you make a payment from your bank account. As such, your account gets debited every time you use a debit or credit card to buy something. The same happens in business. You buy an asset, such as office equipment. You debit the value of that asset from your account. Using credit is different because it means you exceed the finances available to your business. Instead, you essentially borrow money, similar to how you would with a bank loan. Credit cards are the perfect example.

Failing to meet this condition indicates an error in journal entries, which will also reflect in the accounting equation. One Time Payment.

Credits and debits are common terms in our daily lives but a whole new ballgame in accounting. Simply put, they are records of financial transactions in business accounts. This article helps you grasp the concepts by walking you through the meaning and applications of debit and credit in accounting and how they relate to the fundamental accounting equation. When we make payments or withdraw cash from debit cards, we debit our savings or earnings accounts. In accounting, we debit the amount added to assets and expense accounts or deducted from liability, equity, and revenue accounts. To be on credit means to exceed your available finances.

How to write a business proposal for small businesses. How To measure your Business Profitability: Four ways to measure profitability and grow your business. Social media marketing for small businesses: 22 bite-sized steps to master your strategy. A Guide to Financial Statements with Templates. You need to implement a reliable accounting system in order to produce accurate financial statements. Part of that system is the use of debits and credit to post business transactions. This discussion defines debits and credits and how using these tools keeps the balance sheet formula in balance. To define debits and credits, you need to understand accounting journals. A journal is a record of each accounting transaction listed in chronological order.

Accounting debits and credits cheat sheet

Debits increase Asset accounts. Credits decrease Asset accounts. Credits increase Liability Accounts. Debits decrease Liability Accounts. Credits increase Equity Accounts. Debits decrease Equity Accounts.

Cartier 2960

If it increases the account balance, you debit the asset or expense accounts or credit the liability, equity, or revenue accounts. It is something of value that you own. Performance Performance. Advertisement Advertisement. The debit section highlights how much you owe at closing, with credit covering the amount owed to you. It can be very confusing because while every account can have a debit or credit posted to it, different types of accounts normally have a debit or credit balance. At FreshBooks, we help you protect your profits and time with a powerful bookkeeping service. You enter a deposit of a payment from a customer who received your invoice by going to: a. These cookies track visitors across websites and collect information to provide customized ads. But first you need to know Credit cards are the perfect example. Credits decrease Asset accounts.

Why is it that debiting some accounts makes them go up, but debiting other accounts makes them go down? And why is any of this important for your business? In double-entry accounting, debits dr record all of the money flowing into an account.

Nana on October 29, at pm. If I look closer at the cheat table, I can also see that an asset account can have debit and credit transactions which increase or decrease the account Here's where I post current information. Before you go, why don't you test your balance sheet knowledge. Your cash flow will decrease in the future when you pay your bills your Accounts Payable. All of these numbers need balancing. A transaction might affect more than two accounts. Credits decrease Cost of Goods Sold accounts. This is the basic formula on which double-entry bookkeeping is based. Copy and paste it, adding a note of your own, into your blog, a Web page, forums, a blog comment, your Facebook account, or anywhere that someone would find this page valuable.

In my opinion it is obvious. I advise to you to try to look in google.com

The exact answer

Listen.