Adani wilmar ipo expected listing price

IPO Status: Listed [ to ]. Adani Wilmar was listed on the stock exchange on The IPO was subscribed Open Zerodha Account.

The start of this week has also been on a bullish note as this FMCG player continues to hit the back-to-back upper circuit in 2 days. In less than a year, Adani Wilmar is a multi-bagger. Generally, an upper circuit in a stock means the highest possible price that the stock could trade at in a day. It needs to be noted that, Adani Wilmar stock has snapped its 8-day losing streak from this Monday onward. Adani Wilmar launched its IPO from January 27th to 31st, and the issue received an oversubscription of Adani Wilmar listed on stock exchanges on February 8th at a discount compared to its IPO issue price.

Adani wilmar ipo expected listing price

The stock reached a high of? The market Adani Wilmar is one of FMCG food companies in India to offer the essential kitchen commodities for Indian consumers, including edible oil, wheat flour, rice, pulses and sugar. Our products are offered Analysts believe Park Hotels IPO allows investors to invest in the eighth largest hotel chain, which has a diversified portfolio and strategically positions itself in key markets, leveraging an Stay up-to-date with the Adani Enterprises Stock Liveblog, your trusted source for real-time updates and thorough analysis of a prominent stock. Explore the latest details on Adani Enterprises, Currently, if most IPO proceeds are to be used for capital expenditure, then the lock-in for the promoters' shares is 36 months. But if the IPO-bound co states that the objective is for loan Bectors Food Specialities Ltd. Karnataka's heavy and medium industries minister, MB Patil, underscored the historical significance of Bengaluru as a hub for aerospace and defense. Incorporated in as a joint venture between Adani Group and the Wilmar Group, Adani Wilmar is an FMCG food company offering most of the essential kitchen commodities for Indian consumers, including edible oil, wheat flour, rice, pulses, and sugar.

Your Message. Know More. Your session has expired, please login again.

Despite a weak listing, the stock did manage to bounce sharply after the listing in the morning and close with gains. At the end of Day-1, the stock of Adani Wilmar IPO closed at a smart premium to the issue price, despite listing weak. With However, actual listing was surprisingly at a discount, albeit small. The IPO price was fixed at the upper end of the band at Rs. The price band for the IPO was Rs. On the BSE, the stock listed at Rs.

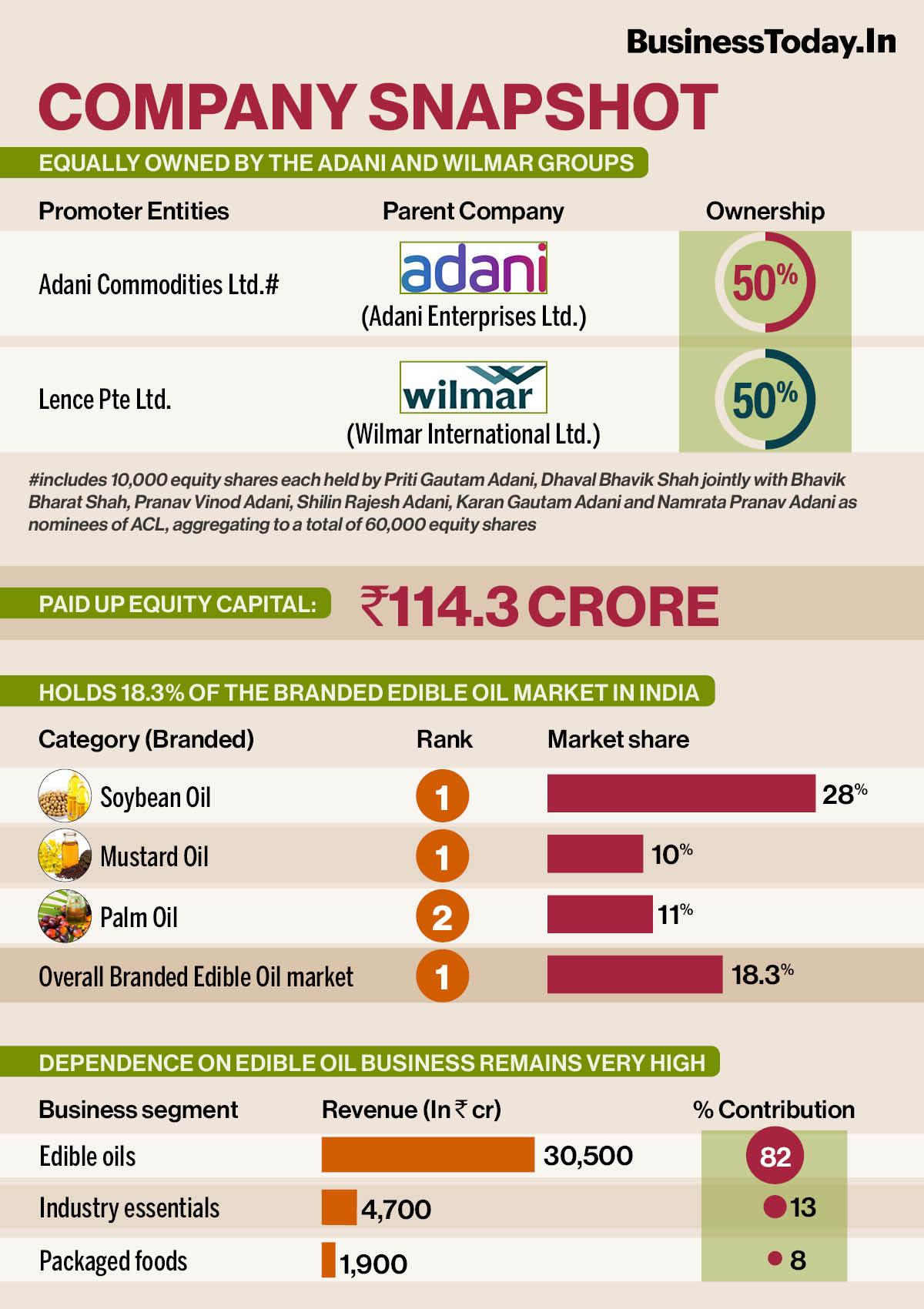

FMCG food company Adani Wilmar made a subdued debut on February 8 with the stock listing at a 4 percent discount to the issue price before revving up seven percent. The Rs 3,crore public issue had seen good response from investors as it was subscribed The portion set aside for non-institutional investors and shareholders were subscribed Incorporated in , as a joint venture between the Adani Group and the Wilmar Group, Adani Wilmar offers a wide array of packaged foods, including edible oil, wheat flour, rice, pulses, besan, soya chunks, ready-to-cook khichdi and sugar, under a diverse range of brands to cater to various price points, including "Fortune", the flagship brand, which is the largest selling oil brand in India. All brokerages had assigned a 'subscribe' rating to the maiden public issue of Adani Wilmar citing reasonable valuations. Further, Adani Wilmar has strong brand recall, wide distribution, better financial track record and healthy return on equity. Considering all the positive factors, we believe this valuation is at reasonable levels. Thus, we recommend a subscribe rating on the issue," said Angel One. Choice Broking had also assigned a subscribe rating for the issue. Adani Wilmar clocked healthy financials in previous years as per details available in the prospectus.

Adani wilmar ipo expected listing price

Adani Wilmar, one of the largest FMCG companies in India, is expected to start the first day of trade with around 15 percent premium over issue price on Tuesday, experts feel, citing market leadership in branded edible oil industry and packaged food business, diversified products portfolio, healthy financials, strong brand recall, and broad customer reach. The public issue received good response, getting subscribed Non-institutional investors took lead, putting in bids that were The portion set aside for qualified institutional buyers QIBs and retail investors saw 5. Employees' book was subscribed half a percent only. Experts largely expect the listing price could be around Rs against issue price of Rs per share, resulting in a market capitalisation of Rs 34, crore against IPO value of Rs 30, crore. Since the issue witnessed moderate response due to ongoing negative sentiments and volatility in the secondary market, we expect it to list in the range of Rs ," said Likhita Chepa, senior research analyst at CapitalVia Global Research. It has a complete integrated business model run by professional and experienced management. Therefore, the listing price would be Rs including listing gains of Rs 35 per share," said Ankur Saraswat, research analyst at Trustline Securities. The company is going to utilise funds for expansion of manufacturing facilities and developing new facilities, repaying of debts, funding strategic acquisitions and investments, and general corporate purposes.

Femdom think tank

Readers must consult a qualified financial advisor before making any actual investment decisions based on the information published herein. Bought a new iPhone 15? Remove some to bookmark this image. It'll just take a moment. Elections We display GMP on our website for informational and news purposes only. Check all the latest action on Budget here. You are now subscribed to our newsletters. Compare 3 brokers. Podcasts View Less -. Copyright by InvestorGain. Disclaimer: The views and recommendations made above are those of individual analysts or broking companies, and not of Mint. On the below table we are providing all the listing details with target price and stop loss.

Choose your reason below and click on the Report button.

However, InvestorGain. Overall, festivities and weddings are expected to drive the overall growth of the company in the third quarter of FY Below table will give you a clear picture on how much to bid for in each category by the retail investor. Submit Rating. Open Account Review. Second, we offer an affiliate links that redirects you to a stock broker's website. Angel One. However, InvestorGain. Mobile Number. If the aggregate demand in this category is greater than Rs cr at or above the Offer Price, the allocation shall be made on a proportionate basis. Subscribe to: Post Comments Atom. Recommended For You. Adani Wilmar IPO listing date is fast approaching and bidders are anxiously looking at all possible ways to find out how much listing premium they would get.

0 thoughts on “Adani wilmar ipo expected listing price”