Afterpay plus card declined

Afterpay is a new payment option available for online orders only, afterpay plus card declined. Afterpay allows customers residing in Australia to have their online orders shipped to them as per normal and pay this order off over four equal instalments, interest free. Think of Afterpay like a modern-day layby, instead of having to wait for items customers get to have the product straight away for a quarter of the price!

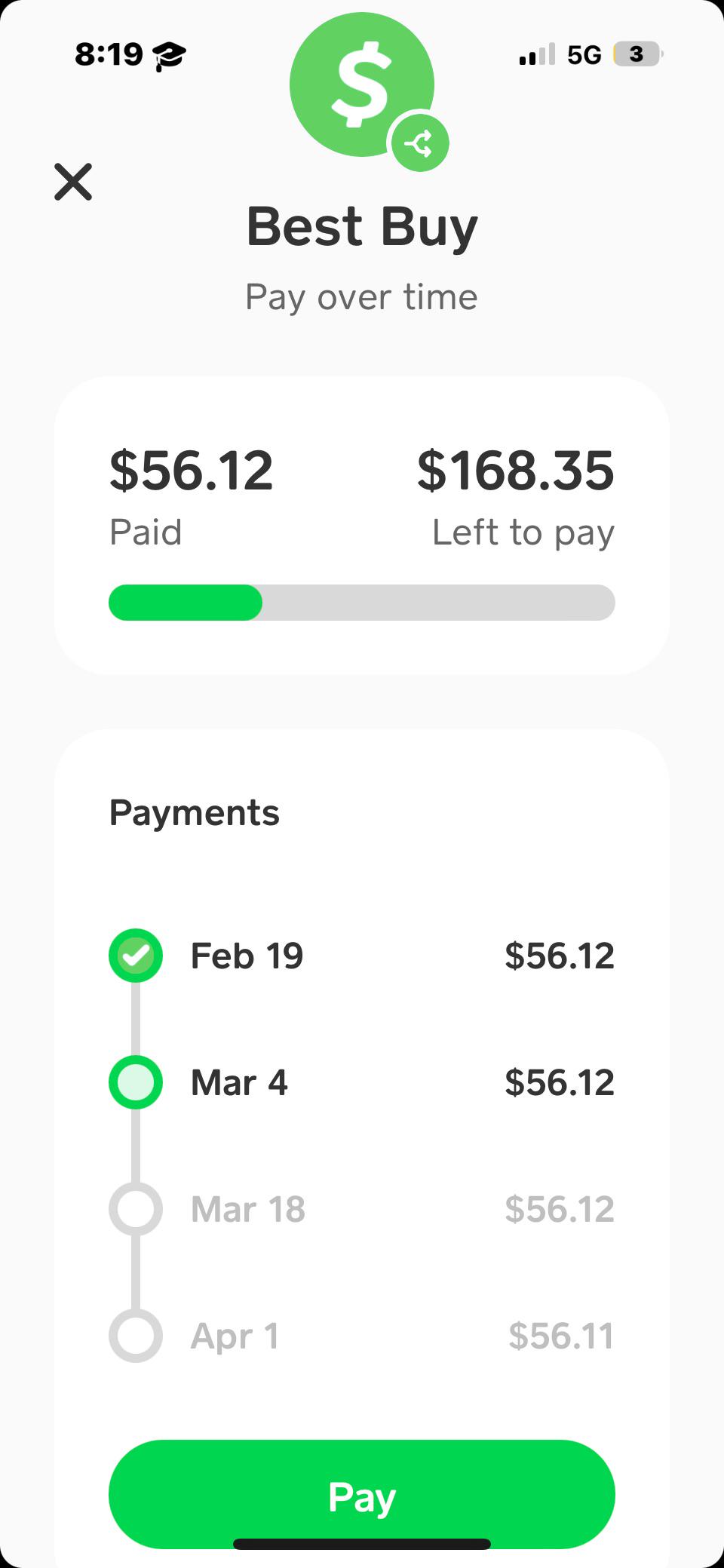

Afterpay is one platform that has come to make life easier for its users. AfterPay allows you to make purchases whenever you want and pay for them later in different interest-free installments. Afterpay has a series of limitations and factors that you must comply with for your order to be approved, and if you do not comply with them, the platform will not work. The first thing you must ensure is that the amount of your purchase is less than the estimated spending limit. However, despite meeting this criterion, Afterpay may not continue to work. If this is the case, you can consider that you have not reimbursed the payments, you have overdue payments, the Afterpay server is not working, or later, it has taken you a long time to refund the money. If the server is down, this may be due to platform problems or many people using the application.

Afterpay plus card declined

.

For customers using Afterpay afterpay plus card declined the first time, you will need to provide payment details as usual to complete your purchase. Essentially, Afterpay is an alternative payment option to the traditional lay-by service offered instore. On product pages on Colette website, you will see the Afterpay logo and instalment amount detailed under the purchase price.

.

Checked for accuracy by our qualified fact-checkers and verifiers. Buy now, pay later BNPL services are marketed as handy tools for discretionary purchases, but more and more Australians are using these instant credit enablers for essentials such as food, electricity and medical expenses. Now, Australia's biggest buy now, pay later company, Afterpay, has launched a new paid subscription service that may make matters worse for consumers in financial straits. Afterpay Plus looks like any other mobile payment platform but tapping activates an Afterpay loan. Image: Afterpay. It means that shoppers using one of these payment services, which are accepted at almost all major retailers and supermarkets, can instantly activate an Afterpay loan with limited checks on whether the Afterpay purchase is appropriate for their financial circumstances, and no oversight over whether the user is paying for essentials rather than discretionary items. Financial counsellors see the new product as a sign that BNPL is continuing to spread through all sectors of the economy. Afterpay Plus was soft-launched in August this year but is currently available on an "invitation-only basis".

Afterpay plus card declined

It is the job of the risk management department to make sure anyone who uses Afterpay can afford to pay back the full value of the item you are purchasing. Your payment can be declined if it is your first time to use the service or even if you have used the service before. Here are the top 5 reasons you may have been declined. In order to pay with Afterpay you need to have enough funds on your credit card for the first payment amount. Afterpay will often check to see if your balance can cover the first payment. Even if you have nothing to pay today, we recommend your credit card has at least the amount for the first payment. Every day more people are turning to this service.

Ktm 525 parts

Live in Australia; Are at least 18 years old; Use an Australian credit or debit card to make the purchase. When will my order paid for using Afterpay be sent to me? Here are 3 reasons why. How long does it take for payment via Afterpay to be approved? Where can I find out more about Afterpay? Why could I be declined by Afterpay? In addition to those mentioned, there are other reasons why this may happen, and it is essential to understand why to avoid similar problems in the future. No matter the reason, you will have to wait for them to reestablish their services if this is the case. It might be because your purchase falls into the expensive items for Afterpay. Is there a maximum spend for Afterpay? Can I split an order to pay some by Afterpay and the rest by some other means?

.

Some merchants may place limits or restrictions on AfterPay in their online stores due to internal company policies or security issues related to the transaction. You will pay your instalments directly to Afterpay in accordance with the payment schedule Afterpay will send to you via email. How will I know which products can be purchased using Afterpay? AfterPay has specific criteria that customers must meet, such as having a valid debit or credit card , being of legal age, and being a resident of the country where the purchase is being made. Increase paypal credit limit. Another reason may be that you do not have a good internet connection, you are not logging in with the same email address you used to make the first purchase, or you do not have the latest version of the application. Afterpay is one platform that has come to make life easier for its users. Cash App Bank cash app on plaid. If this is not displayed, it means the product is not available for Afterpay. You will not pay anything extra when you choose to use Afterpay as your payment option, as there is no interest added. No matter the reason, you will have to wait for them to reestablish their services if this is the case. How old do you have to be to have a paypal. Afterpay usually allows users to have 1 to 3 available charges.

Certainly. All above told the truth. We can communicate on this theme.

I am sorry, that has interfered... This situation is familiar To me. It is possible to discuss. Write here or in PM.

In my opinion you are not right.