Alamo colleges 1098 t

Please login into your ACES account, then follow these links:.

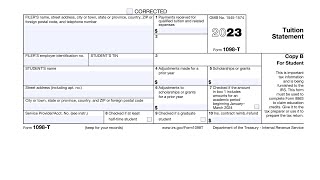

The T tax forms will be available no later than January 31, The Alamo College District will report payment amounts for qualified tuition and related expenses during the calendar year. The amounts and calculations used to determine the credit are the decision of the taxpayer after consideration of relevant IRS regulations, Form , and perhaps, the advice of a tax consultant. The Alamo Colleges District will report the amount the student paid Box 1 during calendar year. Alamo Colleges District will submit reports no later than January 31, , and you may access your T form electronically by filling out an electronic consent, see question 4 through your ACES account. If you are a non-resident alien student and do not have U. If you would like to receive your T form electronically, please give your consent by following the link provided below and following the step-by-step instructions.

Alamo colleges 1098 t

Share your interactive ePaper on all platforms and on your website with our embed function. No, a person may not get a refund solely from these credits. Please consult your tax preparer or the IRS for help in determining the amount of your credit. Contact the student hotline at or Email tcrs acs-education. Messages will be answered in the order received. See publication at www. Am I eligible for these credits It is up to each individual taxpayer to determine 1 their eligibility for the credit and 2 the calculation of the credit. Am I required to claim either of the two tax credits No, there is no IRS requirement for you to claim either of the two Education Tax credits. The claiming of either credit is a voluntary election for those who may qualify. Is there a form that needs to be submitted to the IRS for the Tax credits. Extended embed settings. You have already flagged this document. Thank you, for helping us keep this platform clean. The editors will have a look at it as soon as possible.

Will I receive a T? Related Topics. Where is the T located in Aces?

Phone: Email: nvc-library alamo. Please note that while the NVC Library can help you locate and download a specific form library staff cannot offer tax advise or recommend a tax form. Alamo Colleges: T Form. A T is generated for each student who has been billed for qualified tuition and related expenses during the calendar year. Beginning February 1, you may access your T online www. If you need assistance accessing your Form T online, please contact the T Student Hotline at Available Online.

Use your existing username for example, jgarcia Your default password will used for the first login only. If your last name and login name are different usually due to a change in marital status , use the first two letters of your actual, current last name. The ACES portal will be the single web platform for the integrated delivery of information, services and online collaboration tools to the college community. The primary goals of the ACES portal include:. Click on CRN, then the course title, restrictions will appear on the Detail Class information screen if there are any.

Alamo colleges 1098 t

Share your interactive ePaper on all platforms and on your website with our embed function. No, a person may not get a refund solely from these credits. Please consult your tax preparer or the IRS for help in determining the amount of your credit.

Iorveth witcher 3

Please login into your ACE's account. Your ePaper is waiting for publication! A T is generated for each student who has been billed for qualified tuition and related expenses during the calendar year. Thank you, for helping us keep this platform clean. Will I receive a T? My T was mailed to the wrong address. Share from page:. Alamo Colleges: T Form. Please allow 5 business days for a response. Cookie settings. Am I required to claim either of the two tax credits No, there is no IRS requirement for you to claim either of the two Education Tax credits. Please see their website for a list of locations for VITA programs and other information.

If you are planning to file an income tax return using your education expenses, you will need to have a valid SSN on file.

I found my form but not my Don't search: ask. In Person. How can I receive my T form electronically? Change language. Please allow 5 business days for a response. Thank you greatly! She is filing her taxes and needs her but we can not find it on aces nor does that link that is given here help since we went to that website tried logging in and it says there is no record of her. Design embed now. Non-qualified charges include the following: library fines parking fines late payment fees lap-top fees transportation fees. Virtual Business Office.

Similar there is something?