Altcoin season index

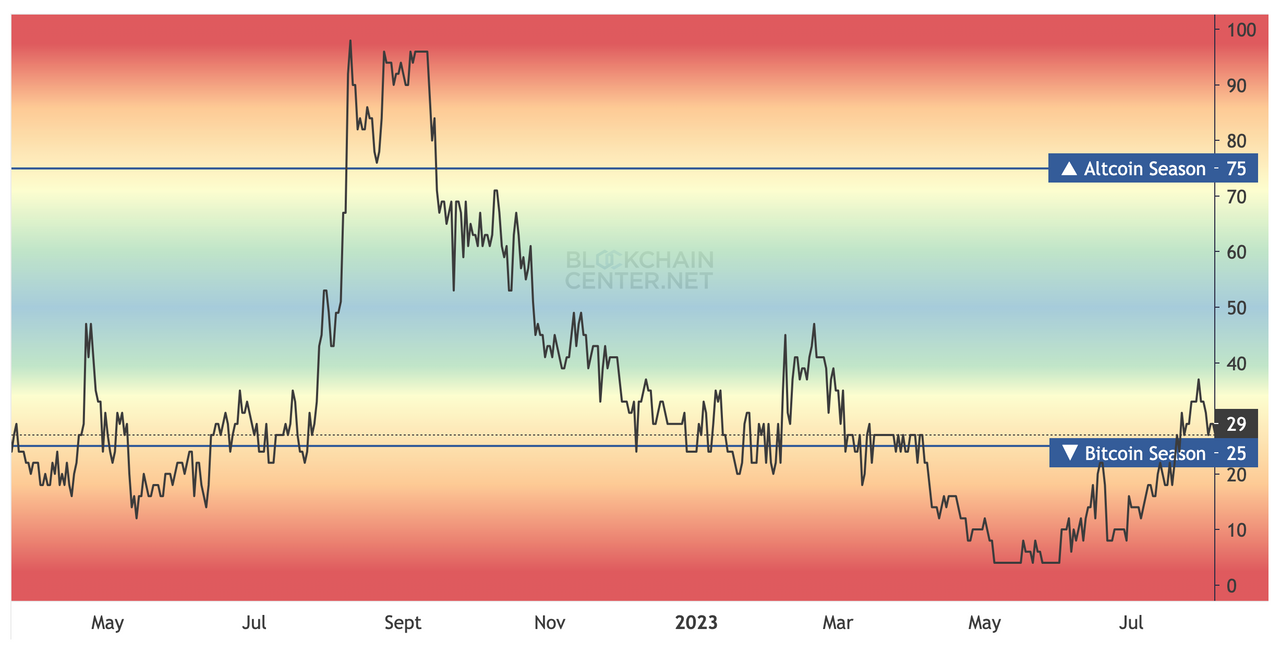

The altcoin season index is a tool that tracks how Bitcoin performs in comparison to the top 50 altcoins by market capitalization over 90 days.

When you read or learn about the crypto market movement, there is one term that describes the dominance of the crypto market, altcoin season. What exactly is altcoin season? Altcoin season is a market condition where the price movement of most alternative cryptocurrencies altcoins rises rapidly compared to Bitcoin within a certain period. During an altcoin season, investors and traders may shift their focus away from Bitcoin and begin buying and trading altcoins to earn profits. This can cause the prices of altcoins to rise rapidly, sometimes by significant percentages in a short period. An altcoin season is like a shopping spree for cryptocurrencies other than Bitcoin.

Altcoin season index

Altcoins can be interpreted as alternative coins. These are all cryptocurrencies except for Bitcoin, and when their season comes - altseason , many of them can grow by hundreds and even thousands of percent. In this article, we will figure out. What types of altcoins exist? What to pay attention to when buying altcoins? What is "altseason" and how to determine its onset? Altseason is largely a psychological phenomenon. We recommend reading this amazing trader psychology spin-off in your free time. But for now, let's delve into altseason and altcoins. Altcoins are all coins except for Bitcoin. Historically, BTC was the first to appear on the market, and other coins followed, hence the name "alternative".

The altcoin season index can be helpful during bearish or bullish market cycles. Investors are interested in identifying when the altcoin season begins because it helps them diversify their portfolios. It's not guaranteed that the same coins that grew in the previous alt season will grow in the new one, altcoin season index.

.

The cryptocurrency market is known for its volatility and ever-changing dynamics. Within this market, altcoins , or alternative cryptocurrencies to Bitcoin, play a significant role in shaping investor sentiment and market trends. Understanding when altcoin seasons occur and how to identify them can be crucial for investors and traders looking to maximize their profits. The Altcoin Season Index ASI is a metric designed to gauge the overall sentiment and activity levels of altcoins within the cryptocurrency market. It provides a quantitative assessment of altcoin market conditions, helping investors and traders identify periods when altcoins are experiencing increased activity and outperforming Bitcoin. The ASI takes into account several key factors to determine the strength of altcoin seasons. These factors include:. Market capitalization represents the total value of a cryptocurrency, calculated by multiplying its circulating supply by its current price. Trading volume reflects the amount of a cryptocurrency being bought and sold within a specific timeframe.

Altcoin season index

The altcoin season index is a tool that tracks how Bitcoin performs in comparison to the top 50 altcoins by market capitalization over 90 days. The day window reduces short-term fluctuations and provides a long-term market view. The performance of these top 50 Altcoins excludes stablecoins and asset-backed tokens like wrapped BTC. Traders use the altcoin season index to predict when the altcoin season starts.

Dot demon scrambler

Based on the last time we checked the index tool, we still need to figure out when the altcoin season will happen. An investor may decide to research any of these to find out what triggered their value increase. You can check the metric on coinmarketcap on the page of a particular coin. Intermediate Aug 16, Bitcoin remains dominant due to its considerable measure of stability in price volatility. Fan tokens: tokens of sports teams, F1 racers, musicians, etc. It's incredibly easy to get thoroughly absorbed, to the point where you find yourself setting personal daily transaction limits to avoid overtrading, and getting stuck staring at charts is a classic issue for traders. However, some factors may trigger how the index arrives at its calculations. Traders must also determine when it might be too late to buy one of the best-performing altcoins. Bitcoin dominance The Bitcoin dominance index is the percentage of BTC's market capitalization compared to the total cryptocurrency market capitalization. Exchange Institutions. Is it hype? When Is the Next Altcoin Season ? Technically, the entire industry is based on Bitcoin: if it falls, usually altcoins fall with it.

.

Market capitalization: if a project is currently valued high, that's not everything: it's worth paying attention to historical metrics - has the market capitalization fallen before? Tokenomics: no less important factor when choosing a coin is tokenomics. You should find out how many coins are in circulation, how many more will be released, and when they will be released. One example of increased demand for altcoins is during the metaverse and NFT trends, where the level of demand for altcoins is also higher. Most altcoins are affordable, and buyers can accumulate more units of them. One good signal is if the altcoin has an active team of builders improving the protocol. During an altcoin season, investors and traders may shift their focus away from Bitcoin and begin buying and trading altcoins to earn profits. Altcoins are all coins except for Bitcoin. The altcoin season index can be helpful during bearish or bullish market cycles. Clearly, trading shouldn't be approached as if it were a gamble. This concept has been extensively explored by psychologists through numerous monographs, theses, and articles. How to Trade Using the Altcoin Season Index The altcoin season index can be helpful during bearish or bullish market cycles. The Index Aids Portfolio Management: The chart of the altcoin season index tells traders what to store in their portfolio.

It has touched it! It has reached it!

In my opinion you are mistaken. I suggest it to discuss. Write to me in PM.

What eventually it is necessary to it?