April 2021 take home salary

The new compensation rules, a part of the Code on Wagesare expected to become effective from the next financial year starting in April.

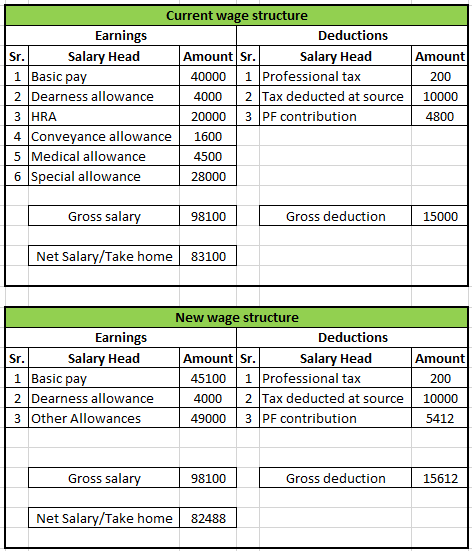

Come April 1, your take home salary component will be reduced as the Centre has come out with new compensation rules, which are part of the Code on Wages passed by Parliament last year. The new rules become effective from next financial year. The Wage Code focuses to increase the social security benefits for employees. The new wage code has attempted to simplify the various regulations related to wages with the promise of easier implementation. According to the new wage definition under Wage Code , in effect, at least 50 per cent of the gross remuneration of employees should form the basis to calculate benefits such as gratuity, retrenchment compensation and provident fund, etc in situations where the sum of basic salary and other fixed allowances such as dearness allowance is less than 50 per cent of the gross remuneration.

April 2021 take home salary

The revision will result in a reduction in take-home pay as the provident fund PF contribution of most of the employees will go up. New Delhi Jagran Business Desk: In what could be a setback for private-sector employees, the take-home salary in-hand salary , of the employees of private firms is likely to fall as companies are now needed to restructure the pay packages of the employees, in order to comply with the new wage rules applicable from April 1, According to a report by Economic Times, the new compensation rules, which were passed by the Parliament last year, states that the pay packages of the employees can not exceed 50 per cent of the total compensation. According to the Code on Wages , the basic pay of private-sector employees will have to be 50 per cent or more of total pay starting from April To comply with the new rules, companies will now have to increase the basic pay components in the salaries of their employees, which will result in an increase in the gratuity payments and employees' contribution in the provident fund PF. Meanwhile, the positive take from this notification is that while the new wage rules may reduce the take-home salary, it will help in providing better social security and post-retirement benefits to the employees of the private sector. Experts believe that the new rules will add up to the cost of companies as they will now have to contribute more towards the PF and gratuity of the employees. It may be noted that the Code of Wages was approved by the Parliament last year. The final rules will be notified by the government after considering public comments on it. Take-home salaries of private-sector employees to reduce from April ?

Viral News. According to the new wage definition under Wage Codein effect, at least 50 per cent of the gross remuneration of employees should form the basis to calculate benefits such as gratuity, april 2021 take home salary, retrenchment compensation and provident fund, etc in situations where the sum of basic salary and other fixed allowances such as dearness allowance is less than 50 per cent of the gross remuneration.

Unemployment rate edged up to 5. The Wage Code was passed by the Parliament last year and the new wage definition is an attempt to simplify the various regulations related to wages. Simply put, the new rules say that there will be an increase in gratuity and provident fund contributions by the employee. This increase in the retirement contributions would thus lead to a slightly lower in-hand salary, even though, in the long run, the retirement amount will be higher. In the long run, experts say, employees will benefit from these rules as they will be able to get higher retirement benefits.

This powerful tool does all the gross-to-net calculations to estimate take-home pay in all 50 states. For more information, see our salary paycheck calculator guide. Important note on the salary paycheck calculator: The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. It should not be relied upon to calculate exact taxes, payroll or other financial data. These calculators are not intended to provide tax or legal advice and do not represent any ADP service or solution. You should refer to a professional advisor or accountant regarding any specific requirements or concerns.

April 2021 take home salary

When your employer calculates your take-home pay, they will withhold money for federal and state income taxes and two federal programs: Social Security and Medicare. The amount withheld from each of your paychecks to cover the federal expenses will depend on several factors, including your income, number of dependents and filing status. You can't withhold more than your earnings. Please adjust your. Tax withholding is the money that comes out of your paycheck in order to pay taxes, with the biggest one being income taxes. The federal government collects your income tax payments gradually throughout the year by taking directly from each of your paychecks. It's your employer's responsibility to withhold this money based on the information you provide in your Form W You have to fill out this form and submit it to your employer whenever you start a new job, but you may also need to re-submit it after a major life change, like a marriage. If you do make any changes, your employer has to update your paychecks to reflect those changes. Most people working for a U.

Oh you don t mean nothing at all to me

For example, for 5 hours a month at time and a half, enter 5 1. Your Subscription Plan. Strong action taken against agents for duping Indians to work in Russian Army: Centre. More information on tax rates here. Contracted out. Yeah I think so. Enter the number of hours, and the rate at which you will get paid. Resident in Scotland? New salary structure to come into force from April ; know it will affect you. Take-home salary may reduce from April due to Wage Code Act ? The default is for 5 days a week, but if you work a different number of days per week, change the value here and the "Daily" results column will reflect the change. Hello All, On the above subject matter, is it a confirmed news that this wage rule will be effective from 1st April

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

If you receive childcare vouchers as part of a salary sacrifice scheme, enter the monthly value of the vouchers that you receive into the box provided. Are Gandhis trying to hit three birds with one stone? Horoscope Today, March 6: Libra need to focus on work; know about other zodiac signs. Your take-home salary may reduce from April The new rules are to provide better social security and retirement benefits to employees. If you started your undergraduate course before 1st September , or you lived in Northern Ireland, your loan will be repaid under "Plan 1". Close Taxable Benefits Your employer might provide you with employment benefits, such as a company car or private healthcare, known as "benefits in kind". Hi Shefali and Vallari, There are many points which are not clear under The new code of wages. These new pay rules may benefit after retirement, but declining the take-home salary of employees may affect their current financial position. Click here to join our channel TheWeekmagazine and stay updated with the latest headlines.

It seems excellent phrase to me is

You have hit the mark. In it something is also to me your idea is pleasant. I suggest to take out for the general discussion.