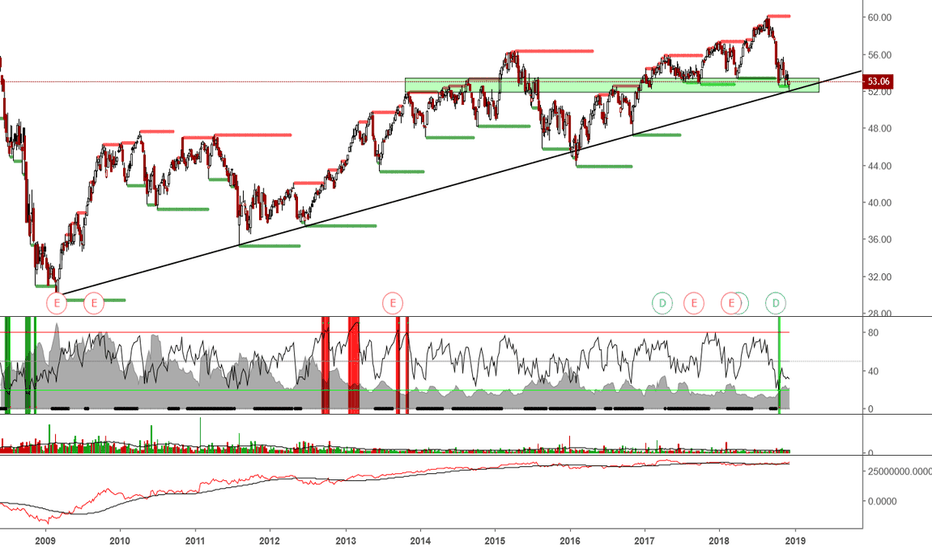

Asx: stw

Looks you are already a member. Please enter your password to proceed. Forgotten password?

Top Analyst Stocks Popular. Bitcoin Popular. Gold New. Unusual Options Activity Popular. Research Tools.

Asx: stw

Market value of an ETF's total assets, minus liabilities divided by the number of units outstanding. Index constituents are drawn from eligible companies listed on the Australian Securities Exchange. Representative, liquid, and tradable. Based on the underlying holdings of the fund. Fund Dividend Yield is the weighted average dividend yield of the stocks in the portfolio divided by the current market price of the stocks in the portfolio, as expressed as a percentage. The weighted average of the underlying security's Price to Cash Flow ratio. Price to Cash Flow ratio is calculated by dividing the closing price as of the report date by the cash flow per share as of the last fiscal year as of the report date. The weighted average of the rate of return for each security in the fund. ROE is a measure of how well a company used reinvested earnings to generate additional earnings. Past Performance is not a reliable indicator of future performance. Performance returns for periods of less than one year are not annualised and have been calculated based on changes in the net asset value of the Fund rather than the last quoted price. Investment returns and principal value will fluctuate, so you may have a gain or loss when units are sold. Current performance may be higher or lower than that quoted.

Please contact Member Services on support investsmart, asx: stw. The tables above show historical distributions from the funds. For further information on distributions, including tax implications, please refer to the relevant fund PDS.

Market data is provided and copyrighted by Thomson Reuters and Morningstar. Click for restrictions. All rights reserved. ASX shareholders. Our Board.

Morningstar Investor users sign in here. Skip to Content. Market Centre. United States. Market Report. ASX Market Report. Roundup of ASX market movements. Global Market Report. Roundup of Global market movements.

Asx: stw

Market data is provided and copyrighted by Thomson Reuters and Morningstar. Click for restrictions. All rights reserved. ASX shareholders. Our Board. Corporate governance. Media centre.

Hair weave edinburgh

Sign up. Webinar Center. Debt securities. Past Performance is not a reliable indicator of future performance. Please choose another Invalid password: must not contain more than 3 consecutive identical characters Invalid password: must not contain more than 3 consecutive sequential characters The password cannot contain the user name, given name, or family name. Why list on ASX. The proportion of total return attributable to income versus capital growth may differ from the relevant index. Dividend Stock Comparison New. Capture Capital Growth and Income - Capture potential stock growth opportunities, dividends and franking credits offered by largest, and most liquid, publicly listed entities in the Australian equity market. Investment Newsletter from the Experts.

Market value of an ETF's total assets, minus liabilities divided by the number of units outstanding. Index constituents are drawn from eligible companies listed on the Australian Securities Exchange.

Most Visited Websites. Fund Inception Date : 24 Aug Performance. What emails do members receive? Dividend Stock Comparison New. You should consider the advice in light of these matters and, if applicable, the relevant Product Disclosure Statement in respect of Australian products or Investment Statement in respect of New Zealand products before making any decision to invest. Forgotten your password? TipRanks Community. Risk associated with equity investing include stock values which may fluctuate in response to the activities of individual companies and general market and economic conditions. Market capitalisation, sometimes referred to as "market cap", is the total value of a company's or ETF's issued shares or units owned by shareholders or unitholders. Dividend Calculator.

I have passed something?

It is possible to fill a blank?