Australia salary percentile

Additional Information. Australian dollar prices are adjusted using changes in the Consumer Price Index.

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering. When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes. While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers will benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach. To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form. As such, any recommendations or statements do not take into account the financial circumstances, investment objectives, tax implications, or any specific requirements of readers. Readers of our stories should not act on any recommendation without first taking appropriate steps to verify the information in the stories consulting their independent financial adviser in order to ascertain whether the recommendation if any is appropriate, having regard to their investment objectives, financial situation and particular needs. Providing access to our stories should not be construed as investment advice or a solicitation to buy or sell any security or product, or to engage in or refrain from engaging in any transaction by Forbes Advisor Australia.

Australia salary percentile

Do you think you're middle income? See how you really compare to the rest of the country's taxpayers. It will help you understand how you're faring, compared to other taxpayers in the country. Below is a searchable table of the income distribution of Australia's taxpayers. It's based on data provided by the Australian Taxation Office for the financial year the most recent year for which we have the most complete tax data. This unique dataset refers to the taxpaying population. The ATO has collected data on The ATO has then divided this distribution into "percentiles. If you're at the "30th percentile," that means you had an annual taxable income higher than 30 per cent of people who were required to pay income tax, while 70 per cent earned more than you. If you're at the "50th percentile," you're bang in the middle. You earned more than 50 per cent, and 50 per cent earned more than you.

This percentage dropped even further again, down to 0.

Overall, increased women's employment and a lower pay gap between men and women contributed to countering the increase in household income inequality over the past 15 years. In Australia, the bulk of increase in market income inequality in the past 15 years is due to the widening of the earnings dispersion. This was due to a large decline in hours worked for low-paid men and a larger increase in hourly wages of highly-paid men. For women, the opposite occurred: high paid women saw a decline in hours worked while there was a large increase in hourly wages for low-paid women. But non-standard workers do not face substantial wage penalties once other demographic and job characteristics are taken into account. In terms of hourly wages, part-time workers have actually higher rates than full-timers with similar characteristics.

How does your income compare to everyone else's? Most people struggle to accurately estimate how their income compares to other Australians. See if you can do better. The latest ABS employment figures could be bad news for wages, with rising unemployment and underemployment adding downward pressure on pay packets. If you haven't had a pay rise in a while, it can feel like your income is inadequate to meet your daily needs, and that you're struggling more than most. How did you go? It turns out most of us are pretty bad at making estimates like this. A recent ANU study found almost 95 per cent of people had misconceptions about either the level of inequality in Australia or their position in the national income distribution.

Australia salary percentile

Data from to has been reprocessed which has resulted in small differences to the historical data. To learn more about our different labour measures, their purpose and how to use them, see our Guide to labour statistics. It provides summary information on labour market topics including Earnings similar to income data. The Survey of Income and Housing SIH provides the most comprehensive source of information for calculating Gini coefficients and measuring income inequality. Gini coefficients from Personal Income in Australia should be considered complementary information, which provide insights for lower geographic levels. For more information about Gini coefficients, see the Methodology. The Gini coefficient is a summary indicator, usually between 0 and 1 that indicates the degree of inequality among total incomes within a region.

Stand alone patio

Here's how to read it. Accessed February 24, Sixty-six millionaires paid no tax in By presenting the income distribution for the population that paid income tax, it provides a useful alternative way to think about workers in the tax system. Data files. Supplementary notes. On the other side of the average, Butcher, baker, cane furniture maker — take a look at the average income for all the jobs in Australia. When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes. Poverty rates, while being slightly above the OECD average, have not increased since The ATO has then divided this distribution into "percentiles. We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals to buy or sell particular stocks or securities. To bring the figures up to date, we have adjusted them in line with changes in the consumer price index for all goods up to

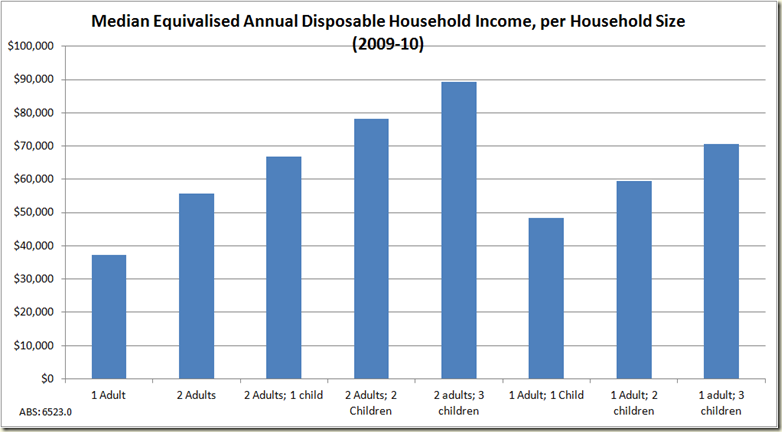

Key information from the Survey of Income and Housing —20 including distribution of income and wealth by various household characteristics. In —20, compared to —18, average equivalised disposable household income and average net worth for Australian households, saw no statistically different changes. In contrast, average total liabilities for households and the proportion of households servicing total debt three or more times their annualised disposable income had statistically different increases.

Next release Unknown. If you're at the "50th percentile," you're bang in the middle. Profit from the additional features of your individual account. The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering. There are many different factors that affect your salary, with age just one of them. The method of data collection used for the OECD Income Distribution Database aims to maximise international comparability as well as inter-temporal consistency of data. Demographics Population in Africa , by country. Prior to , statistics were published in: Characteristics of Employment The percentile with the lowest growth was the bottom 10th percentile, increasing 3. Australia has legislated tax cuts for higher income earners, but they will leave a large budget black hole. Weekly earnings of employees, including distribution of earnings and hourly earnings, by State, Occupation, Industry and Qualifications. Download xlsx [6.

It seems to me it is good idea. I agree with you.