Best asx copper stocks

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resourcesand more. Learn More. ASX copper shares are gaining traction among investors, who are realising that the red best asx copper stocks is going to play a huge role in global decarbonisation.

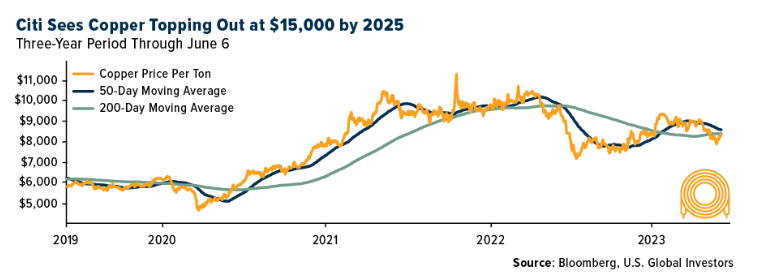

What are the largest Australian copper companies? These five ASX copper stocks are the biggest on the exchange by market cap. Despite copper's recent setbacks, many market watchers have a positive long-term outlook for the metal. With few new mines poised to come online and demand from the energy transition set to grow, a future breakout could be coming. Australian investors looking for exposure to these trends have plenty of options when it comes to stocks.

Best asx copper stocks

Copper prices hit record a record high in , and some companies continue to ride that wave this year. Here are the best-performing copper stocks on the ASX so far in Copper prices have traded at record highs in recent years, and although the red metal is facing strong headwinds in , experts have positive expectations for the market in the years ahead. Prices for the base metal pulled back to three-month lows in mid-February, dampened by continued lagging economic indicators in China. However, in the long term, market watchers see tight supply and higher consumption from sectors like the electric vehicle industry creating a robust outlook for copper. Against that backdrop, the top ASX copper stocks have put on impressive year-to-date share price performances. Read on to learn more about them. Xanadu Mines Yearly gain: In the last quarter of , the company released an upgraded mineral resource estimate for Kharmagtai as part of its work toward completing a pre-feasibility study PFS for the project. The new resource estimate is s1. Xanadu is on track to complete the PFS and a maiden ore reserve estimate by Q3 Yearly gain:

ELT managing director Joe David says this demonstrates the potential for Oropesa to be further extended and expanded beyond what is in the basis of design for the definitive feasibility study DFS.

Copper is already among the world's most highly consumed industrial metals. But experts predict demand will double over the coming decade. This is because copper is a key component of solar and wind energy systems, which will be crucial to the global renewable energy transition. ASX copper stocks provide investors with exposure to the copper industry. As their fortunes rest almost entirely on the value of the red metal, their share prices will be sensitive to movements in the market price of copper.

April 11, June 20, Jessica Cummins. There is no denying the world is on an unprecedented path of growth and industrialisation as it gears up for the transition to a greener economy. Metals and mining will be put to the test to provide vast quantities of raw materials for things such as electric vehicles, wind power, solar photovoltaic, batteries, 5G technology and hydrogen production. This is especially good news for copper bulls — when the red metal is in demand it usually means industries and economies are moving forward due to its broad application uses. Combined with detailed re-logging of previous holes, Bosio says this suggests there may be multiple bornite zones within the Emmie IOCG mineralised system. MATSA contains three underground mines with a central processing plant capable of producing ktktpa. The views, information, or opinions expressed in the interviews in this article are solely those of the interviewee and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article. It's free.

Best asx copper stocks

January 23, January 23, Jessica Cummins. This economic rebound, as well as expectations that the Federal Reserve will move to a less hawkish monetary policy, will be of the two biggest tailwinds driving firmer copper prices in , Fastmarkets head of metals research and strategy Boris Mikanikreza told Stockhead. Meanwhile, the long-term outlook for copper — an economic bellwether and a key material for the energy transition — is a particularly rosy one with experts tipping everything EV-linked to be where the opportunities lie in As the world moves towards a more sustainable future, Fastmarkets predicts demand growth to be exponentially stronger over the next 10 years due to the electrification of the world. The tipping point for copper will come in when the increase in demand from the green economy outpaces that from the brown economy based on fossil fuels in tonnage terms. The challenge, however, remains on the supply side with insufficient capex in the mining sector resulting in the highly likely chance of deficits — starting as soon as Phase 1 of the project would produce 25,tpa of copper over an initial 6. NWC is targeting an update to its scoping study of a recently announced 48pc increase in resource base at the Antler Copper Project in Arizona this quarter, before submitting mine applications and wrapping up a feasibility study in the second half of the year.

Career runs leaders

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy. In its fiscal year, Sandfire reported production of 84, tonnes of contained copper. Top Stocks. Copper is an important component in renewable energy systems, such as solar panels and wind turbines. The EPS also fell from Biotech Cannabis. Psychedelics Pharmaceuticals. It is currently 44 cents. Why invest in copper stocks? Global EV sales are a key growth sector for copper demand over the outlook. Market Close Update. Soul Pattinson and Co. These are as follows:.

Copper is already among the world's most highly consumed industrial metals.

Updated Copper recycling helps to ensure long-term sustainability. The drawback to investing in copper is that its value tends to correlate with changes in the broader economy. June 30, June 30, Jessica Cummins. You know what to do. Join k investors Get a full U. Against that backdrop, the top ASX copper stocks have put on impressive year-to-date share price performances. The team worked to increase efficiencies and optimise operations at these mines in the Mount Isa region of Queensland. Follow us on. The final assays have once again extended the extent of copper-molybdenum mineralisation beyond the existing Briggs Central Inferred Resource of Mt at 0. Cleantech Emerging Tech. This could see demand for the red metal quickly outstrip supply, pushing up the market price for copper. Aeris has announced copper guidance of 40, to 50, tonnes for the year.

Excellent idea

Ur!!!! We have won :)