Best paying dividends asx

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering. When covering investment and personal finance stories, best paying dividends asx, we aim to inform our readers rather than recommend specific financial product or asset classes. While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers best paying dividends asx benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach. To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form.

Our analysts weigh in on their future dividend prospects. In a recent article I tried to answer a question I hear frequently. Is it feasible to retire off dividends alone. In response to my article, I heard numerous success stories from retirees. These are real life examples of the premise of my article. You can retire off dividends.

Best paying dividends asx

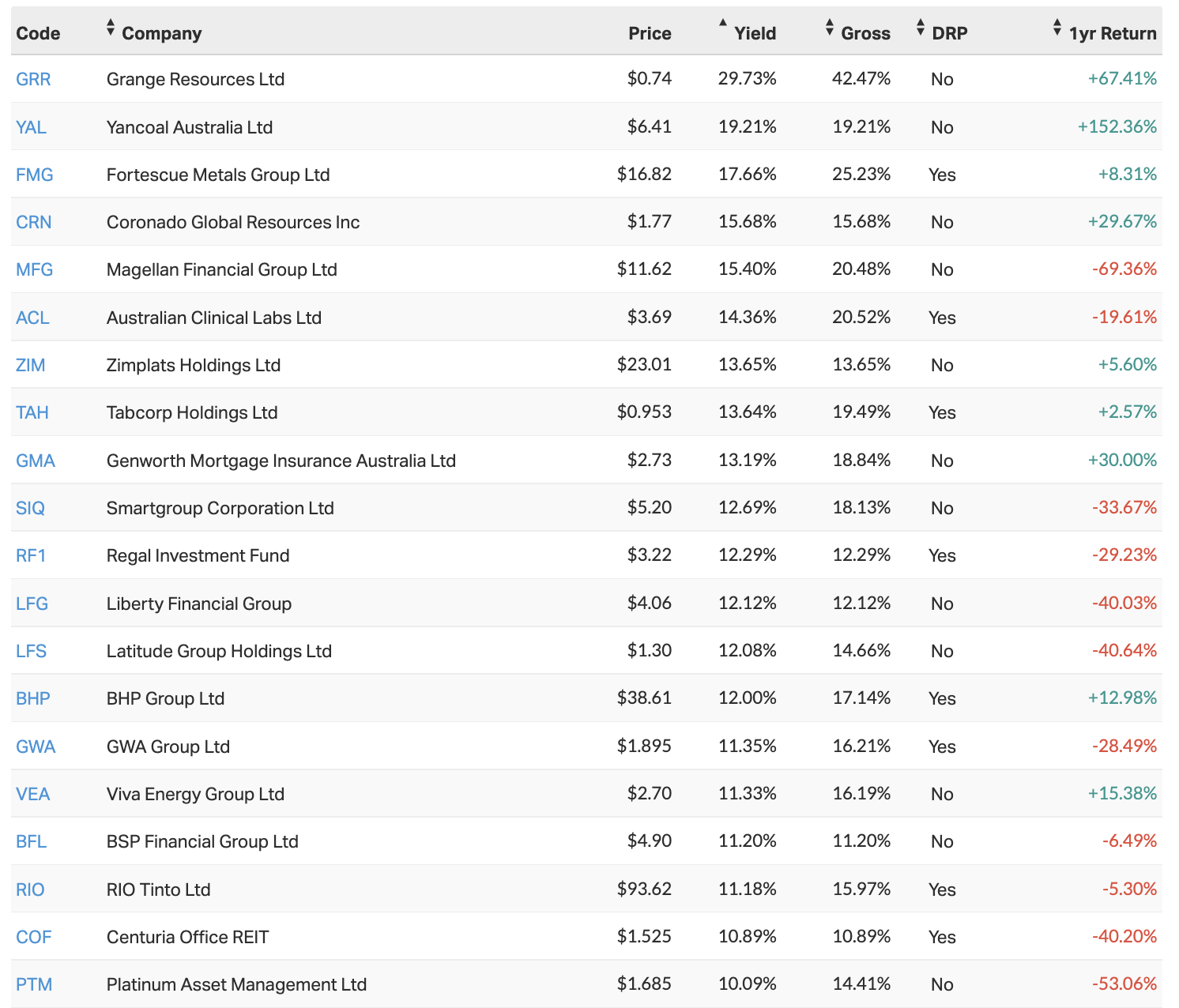

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. With interest rates as high as they are and the best savings accounts delivering 5. The ASX bank shares and mining shares are well-known for delivering some of the highest dividend yields in the market year after year. But if you do some digging, you'll find other great dividend payers in other market sectors. Typically, the companies that will pay you the best dividend yields are the ASX large-cap shares. Most of them have been operating for decades, bringing in sustainably strong earnings every year. Let's look at which ASX large-cap shares are trading on the highest trailing dividend yields today. If you're using this data to research ASX dividend shares , just remember that trailing dividend yields represent last year's earnings as a percentage of today's share price. This is particularly the case with mining stocks, oil shares and any other stock associated with commodities.

Tiger Brokers Exclusive. To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form.

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. The ASX financial shares include banks , insurers, and investment houses and plenty of them pay handsome dividends. So, let's look ahead and see how much passive income the experts predict these stocks will pay in FY For the purposes of this article, we're going to limit our research to ASX large-cap financial shares. They're some of the market's bigger, more well-established businesses and hence they are able to share more of their profits with investors. Among the ASX financial shares are 10 large-caps.

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering. When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes. While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers will benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach. To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form. As such, any recommendations or statements do not take into account the financial circumstances, investment objectives, tax implications, or any specific requirements of readers. Readers of our stories should not act on any recommendation without first taking appropriate steps to verify the information in the stories consulting their independent financial adviser in order to ascertain whether the recommendation if any is appropriate, having regard to their investment objectives, financial situation and particular needs. Providing access to our stories should not be construed as investment advice or a solicitation to buy or sell any security or product, or to engage in or refrain from engaging in any transaction by Forbes Advisor Australia. In comparing various financial products and services, we are unable to compare every provider in the market so our rankings do not constitute a comprehensive review of a particular sector. While we do go to great lengths to ensure our ranking criteria matches the concerns of consumers, we cannot guarantee that every relevant feature of a financial product will be reviewed.

Best paying dividends asx

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. What could be better? We only found out this week that Australia's annual inflation rate is running at 6. This technically means that if a dividend yield is under that threshold, the payments alone are not keeping your returns above breakeven. But finding high-yield ASX dividend shares is a bit of a risky business. There are plenty out there, to be sure. A company's trailing dividend yield reflects the past, not the future. Otherwise, there would be more buyers, pushing the yield lower.

Synonym for incredulity

Account Fees No monthly account or subscription fee for classic account. Liberty Financial Group Pty Ltd, functioning in the finance sector, offers a range of lending and financial services. You can retire off dividends. To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form. The company operates primarily in Queensland and New South Wales and engages in oil, gas, agriculture and port operations. The net profit margin of Capital at risk. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. They're some of the market's bigger, more well-established businesses and hence they are able to share more of their profits with investors. The sustainability of dividend payments is another concern, as financial challenges may force companies to cut or eliminate dividends. Additionally, diversifying your investments and regularly monitoring and adjusting your portfolio can enhance potential returns. Buy through an online broker Frequently asked questions.

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. ASX dividend shares are in the spotlight in today's ultra-low interest rate environment.

If you're using this data to research ASX dividend shares , just remember that trailing dividend yields represent last year's earnings as a percentage of today's share price. ASX Market Report. This helps identify companies with a strong foundation for consistent dividends. March 10, James Mickleboro. The company offers investors a company with solid foundations as well as one looking to the future with sustainability and community as a focus. Morningstar Investment Conference for Individual Investors. Getting started. When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes. Account Fees No monthly account or subscription fee for classic account. Where a platform charges different fees for both US and Australian shares we show the lower of the two.

0 thoughts on “Best paying dividends asx”