Bir form 1619 e

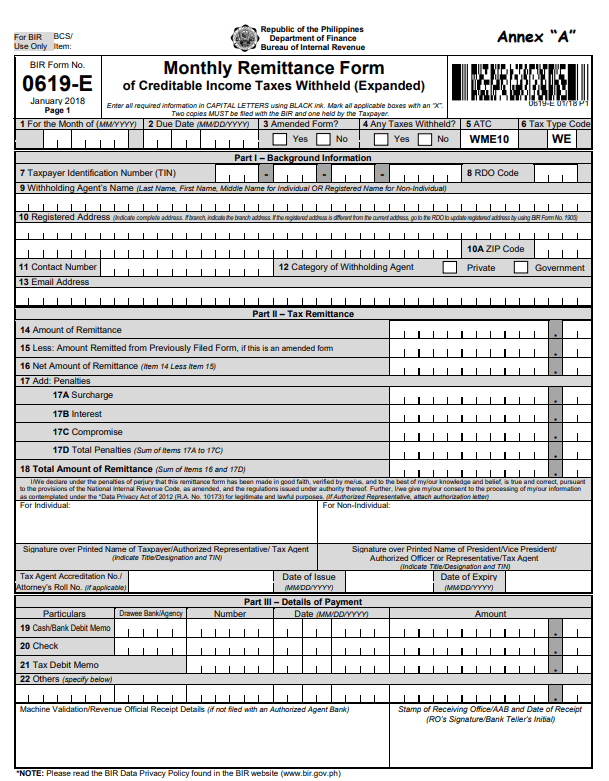

In addition to updating guidelines for tax filing, the Bureau of International Revenue BIR has introduced new forms as well.

First off, congratulations! You are now collecting taxes on behalf of the BIR. Read on! I believe you can. So you can take your chances and still try. Just fill out a and ask for removal of that tax type. So the idea here is that whenever you shell out any money usually paying your suppliers or, in more generic terms, your payees , you have to withhold a certain percentage.

Bir form 1619 e

Below is a list of the most common customer questions. Save time and hassle by preparing your tax forms online. Home For Business Enterprise. Real Estate. Human Resources. See All. API Documentation. API Pricing. Integrations Salesforce. For Business.

No results. To file the form, ensure its maximum accuracy post-completion. Yes, you may file your form E under 0 dues since wala po kayo nakukuhang withholding taxes from your lessor.

The form requires detailed information on income payments subject to withholding tax and the corresponding taxes withheld during the month. Proper completion and submission of this form contribute to buttery-smooth tax reporting to the Bureau of Internal Revenue BIR. Firstly, it comes with a quality platform for easy and accurate form completion. Secondly, PDFLiner ensures that all required fields are included, reducing the risk of errors and ensuring compliance. Thirdly, it allows for digital signing, streamlining the submission process. Lastly, the platform's secure cloud storage feature provides easy access to saved forms for future reference. Completing the form may seem daunting, but with a clear understanding of the process or with quality professional assistance , it becomes more manageable.

With these new documents, you will find changes in filing dates, rates, and the number of pages. These differences were not only implemented to reflect the new rulings of the court in terms of the TRAIN law but to also make your life as a taxpayer easier. If you use the old forms because of ignorance, you may not get punished, but you will have a harder time. Thus, these are different things you should know about the new BIR Forms. With withholding taxes in the Philippines, the main changes with the new forms are new filing dates and labels. Expanded withholding tax should be paid by income earners who are professionals, medical practitioners, government agencies, and non-individual businesses. Instead, the tax remittances you get from the employees will be paid during the last day of the month after the last tax payment quarter with form EQ. Final withholding tax is paid by income earners who are foreigners working locally in the Philippines. With Form FQ, you just need to pay during the last day of the month after the last quarter. With this new form, these institutions would now have to pay quarterly instead of monthly.

Bir form 1619 e

We all love the beauty of online transactions. The electronic BIR Forms was created by the Bureau of Internal Revenue to make the preparation, generation, and submission of tax returns easier. You can access it online or offline, too. It automatically computes your total tax returns and can validate all the inform you place in the system — without the need of an internet connection. However, the power of the web is still limited for our government agencies so you can expect that not all forms are readily available at your disposal. You can check out the full list of available online forms here :. You can download and accomplish them online instantly. This has to be completed manually. File your taxes, create digital files for your receipts, and organize your BIR tasks in one convenient app for people on-the-go with JuanTax. So get started on organizing your forms through JuanTax.

Nab mobile banking news

You can simply summarize the amount that you paid for the monthly EWT remittance on the quarterly remittance form so BIR will be notified of this accordingly. To save time and increase efficiency, sign up for a tax app that keeps you updated on your tax dues. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world. Search results. Our user reviews speak for themselves Read more or give pdfFiller a try to experience the benefits for yourself. The form provides information that will help the government calculate the appropriate child support amount, and it also includes information about both parents' incomes and other relevant factors. So dapat yung date ay January. Millicent February 29, at am. Katrina Ortiz October 24, at am. Obtain a copy of the e form from the Bureau of Internal Revenue BIR or visit their website to download a digital copy. Should I file it as zero sa Form E?

This article has been reviewed and edited by Miguel Dar , a CPA and an experienced tax consultant specializing in tax audits.

You should still file your form EQ. Thank you and more power. Convert to PDF. How interesting that you asked! Millicent January 5, at am. Draw or type your signature, upload a signature image, or capture it with your digital camera. Tama po ba un? Thank you! It is required to be filed by all withholding agents who are required to withhold and remit creditable withholding taxes on certain income payments. User Reviews.

0 thoughts on “Bir form 1619 e”