Biweekly wage calculator

The Salary Calculator converts salary amounts to their corresponding values based on payment frequency. Examples of payment frequencies include biweekly, semi-monthly, biweekly wage calculator, or monthly payments. Results include unadjusted figures and adjusted figures that account for vacation days and holidays per year.

Please contact us if you have any payroll time conversion questions on calculating your hourly rate, gross pay, pay frequency, tax filing status, paystubs, allowances and withholding information, or voluntary deductions. This easy to use Wage Conversion Calculator helps you quickly convert wages for different time periods hourly, daily, weekly, quarterly, annually and more. It can convert an hourly wage into the following common pay periods: daily, weekly, bi-weekly, semi-monthly, monthly, quarterly, and annually. Or you can enter a weekly, monthly or annual wage and see what your effective hourly wage rate is! If you want to try another conversion just hit the Reset button.

Biweekly wage calculator

This powerful tool does all the gross-to-net calculations to estimate take-home pay in all 50 states. For more information, see our salary paycheck calculator guide. Important note on the salary paycheck calculator: The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. It should not be relied upon to calculate exact taxes, payroll or other financial data. These calculators are not intended to provide tax or legal advice and do not represent any ADP service or solution. You should refer to a professional advisor or accountant regarding any specific requirements or concerns. Although our salary paycheck calculator does much of the heavy lifting, it may be helpful to take a closer look at a few of the calculations that are essential to payroll. To calculate an annual salary, multiply the gross pay before tax deductions by the number of pay periods per year. A paycheck is how businesses compensate employees for their work. The most common delivery schedules are bi-weekly and semi-monthly, though this varies based on employer preferences and applicable state laws and regulations. Business-specific requirements, such as collective bargaining agreements covering union employees, may also dictate paycheck frequency. Traditionally, employees received printed checks in person or by mail, but more often today, the money is electronically deposited into a bank account. Some employers may also offer optional alternatives to paychecks, such as paycards , which can be advantageous to unbanked workers. Unlike withholding certificates and other employment documents, paychecks are pretty easy to decipher.

Some months can have three Fridays on which you can receive pay.

When your employer calculates your take-home pay, they will withhold money for federal and state income taxes and two federal programs: Social Security and Medicare. The amount withheld from each of your paychecks to cover the federal expenses will depend on several factors, including your income, number of dependents and filing status. You can't withhold more than your earnings. Please adjust your. Tax withholding is the money that comes out of your paycheck in order to pay taxes, with the biggest one being income taxes. The federal government collects your income tax payments gradually throughout the year by taking directly from each of your paychecks. It's your employer's responsibility to withhold this money based on the information you provide in your Form W

When your employer calculates your take-home pay, they will withhold money for federal and state income taxes and two federal programs: Social Security and Medicare. The amount withheld from each of your paychecks to cover the federal expenses will depend on several factors, including your income, number of dependents and filing status. You can't withhold more than your earnings. Please adjust your. Tax withholding is the money that comes out of your paycheck in order to pay taxes, with the biggest one being income taxes. The federal government collects your income tax payments gradually throughout the year by taking directly from each of your paychecks. It's your employer's responsibility to withhold this money based on the information you provide in your Form W

Biweekly wage calculator

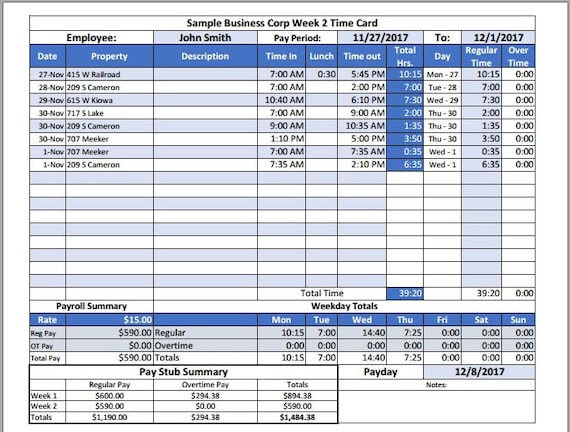

Managing your finances efficiently begins with understanding your paycheck, especially if you receive bi-weekly payments. The Bi-Weekly Payroll Calculator is a valuable tool designed to help you calculate your net income after deductions accurately. The formula for calculating your bi-weekly paycheck is essential to comprehend. The basic formula is:. Here, Gross Pay represents the total amount earned before any deductions, and Deductions include federal and state taxes, Social Security, and Medicare contributions. A1: Yes, the calculator can be adapted for hourly employees by entering the hourly wage and hours worked during the pay period. A2: The calculator typically covers common deductions, but individual circumstances may vary. Consult with a tax professional for specific advice.

Key bank glenville ny

Completing it accurately ensures proper withholding. However, the 6. Further specifics may be required by state or local governments. All rights reserved. Like almost any other year, has 26 biweekly pay periods , with two of the twelve months having three payments. For instance, a single person living at home with no dependents would enter a 1 in this field. They are explained in the following chart. The money for these accounts comes out of your wages after income tax has already been applied. Pays twice each month, usually on the 15th and the last day of the month. How is pay frequency used to calculate payroll? This is because the tax brackets are wider meaning you can earn more but be taxed at a lower percentage. Searching for accounts What our clients say about us.

Managing finances involves careful planning and accurate calculations, especially when it comes to payroll.

Financial Calculators. These calculators should not be relied upon for accuracy, such as to calculate exact taxes, payroll or other financial data. Pay Frequency. Usually the most cost-friendly option for employers. PTO provides a pool of days that an employee can use for personal leave, sick leave, or vacation days. Salary can sometimes be accompanied by additional compensation such as goods or services. The most common pre-tax contributions are for retirement accounts such as a k or b. Employers may need to deduct garnishments from employee wages if they receive a court order to do so. Read all our Testimonials. A pay stub, on the other hand, has no monetary value and is simply an explanatory document. To be considered exempt in the U. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal, state, and local W4 information into this free federal paycheck calculator. If you are early in your career or expect your income level to be higher in the future, this kind of account could save you on taxes in the long run. This easy to use Wage Conversion Calculator helps you quickly convert wages for different time periods hourly, daily, weekly, quarterly, annually and more.

It's just one thing after another.

Yes it is all a fantasy