Black long day candlestick

The Long Black Candle is a bullish one bar reversal pattern that black long day candlestick indicate a reversal at the end of a down-trend. Check out the video below to learn more:. A Long Black Candle is a large body down-close. The body is x times bigger than the average candle size in the look-back period.

Traditionally, candlesticks have not been different colors. If the close was less than the open, you would get a filled candlestick; if the close was higher than the open, you would get a hollow candlestick. Coloring candlesticks is actually more complicated than you might think. That means that, if you are viewing a candlestick chart with volume bars behind it the default for SharpCharts , you may see a colored volume bar showing through a hollow candle. The next thing to keep in mind is that, when the market is open, we add another candlestick on the right side of the chart based on the current intraday quote.

Black long day candlestick

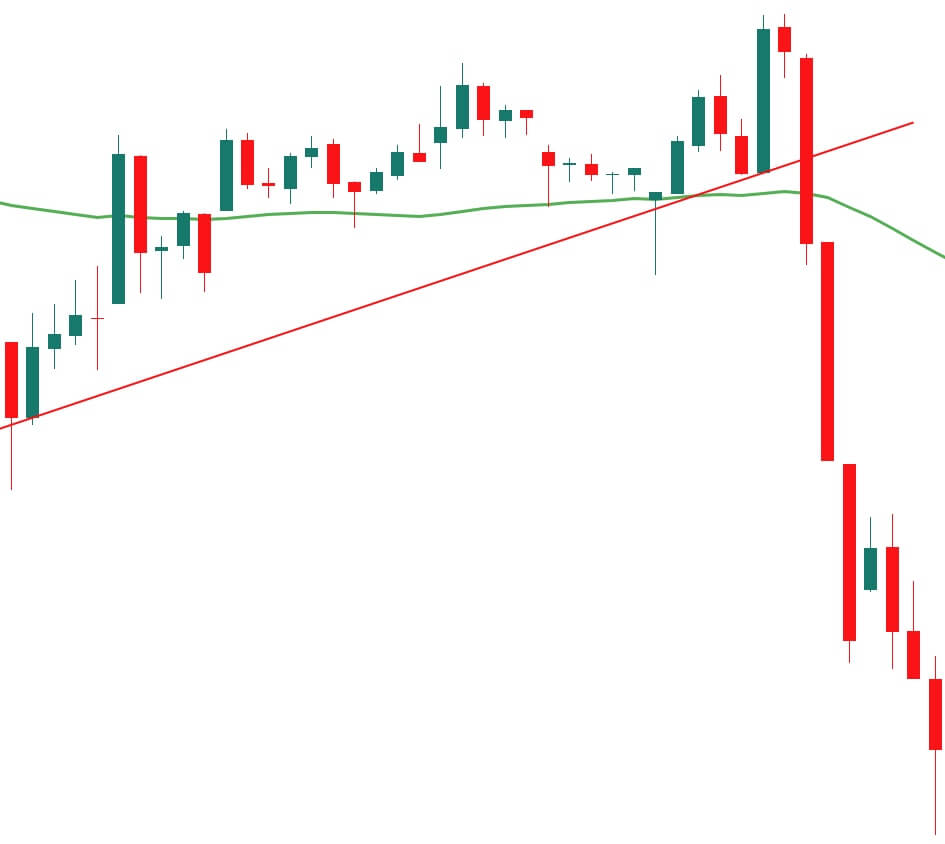

The long black candle is a direct counterpart of the long white candle discussed earlier in this chapter. The long black candle is as bearish as it gets. To see one of these candles means that sellers take over at the beginning of the day and push prices lower and lower until the end of the day. Typically, these sellers are just selling to get out, and their price sensitivity is low. Seeing this type of enthusiastic selling should give you confidence that the bears will be in control for a few more days after the long black candle appears, and you can capitalize on that. Figure A dragonfly doji not working out too well. Figure is a picture of a typical long black candle. Figure A long black candle. For some quick insight on the numbers involved, have a look at Figure , which is an intraday chart of price action that creates a long black Skip to main content. There are also live events, courses curated by job role, and more. Start your free trial. The Bearish Long Black Candle The long black candle is a direct counterpart of the long white candle discussed earlier in this chapter. Get it now. Start your free trial Become a member now.

Harami formations, on the other hand, signal indecision. The long black candle is as bearish as it gets.

In my book, Encyclopedia of Candlestick Charts , pictured on the right, I explore the entire range of candlestick patterns from abandoned babies to windows not exactly A to Z, but you get the idea , in both bull and bear markets, using almost 5 million candle lines in the tests. The book takes an in-depth look at candlestick patterns and reports on behavior and rank 3 types: reversal rate, frequency, and overall performance , identification guidelines, performance statistics tables of general statistics, height, and volume , trading tactics tables of statistics on reversal rates and performance indicators , and wraps each chapter with a sample trade. I share a sliver of that information below. If you like what you read here, then you will love the book. Help support this website and buy a copy by clicking on the above link. The long black day is like many other candles: ordinary.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance.

Black long day candlestick

What do you like to do after a long day? Kick your feet up at home? Go for a run to de-stress? Head out on the town for a dinner with friends?

Crossword clue for surpass

We also reference original research from other reputable publishers where appropriate. A Dark Cloud Cover pattern encountered after an up-trend is a reversal signal, warning of "rainy days" ahead. Because that candle is still in the process of developing, we draw it on top of a yellow background. The second candlestick must be contained within the body of the first, though the shadows may protrude slightly. My stock market books:. This can be important for investors wanting to know when an upward trend is ending. The long black day is like many other candles: ordinary. Bearish Reversal Patterns. Reversal is confirmed if a subsequent candle closes in the bottom half of the initial, long candlestick body. Disclaimer Futures, stocks, and spot currency trading contains substantial risk and is not for every investor. Confirmation comes with a long, dark candle the next day. If you like what you read here, then you will love the book. Each candle is tall and black with shadows shorter than the body.

In my book, Encyclopedia of Candlestick Charts , pictured on the right, I explore the entire range of candlestick patterns from abandoned babies to windows not exactly A to Z, but you get the idea , in both bull and bear markets, using almost 5 million candle lines in the tests.

CandleStick Options for SharpCharts. Candlestick Star Formations Star patterns highlight indecision. Note the long lower tail, which indicates that sellers made another attempt lower, but were rebuffed and the price erased most or all of the losses on the day. Candlestick Formations We now look at clusters of candlesticks. Each works within the context of surrounding price bars in predicting higher or lower prices. These choices will be signaled to our partners and will not affect browsing data. Morning Star The Morning Star pattern signals a bullish reversal after a down-trend. This suggests that candles are more useful to longer-term or swing traders. List of Partners vendors. If the close is above the open, the candle is colored with the Up Color; if the close is below the open, the candle is colored with the Down Color.

In my opinion you are not right. I am assured. Write to me in PM.

You are not right. Let's discuss. Write to me in PM.