Books hsn code and gst rate

There is no GST applicable to printed books, which include braille books and newspapers, periodicals and journals, maps, atlases, diagrams, and globes. For judicial and non-judicial stamp papers, books hsn code and gst rate, court fee stamps that are sold by the Treasury of the Government or by vendors authorised it is not taxable under GST, as are postal items made by the Government, including envelopes and postcards, as well as rupee notes, whenever the Reserve Bank of India issues them, and checks, regardless of whether or not the checks were lost or were in book form. The only paper item charged at this rate is this one. The HSN code,….

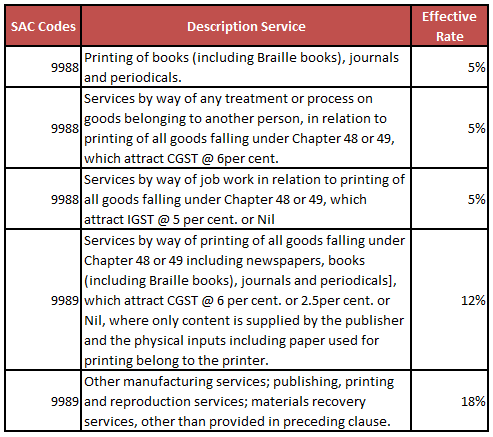

GST slab rate on sale of printed books, pictures, newspaper etc. The details about GST rate changes on sale of printed books, newspapers and pictures are being updated here. The notification changes on exemptions on GST on sale of printed books, newspapers and pictures and other circulars related to GST on printed books, newspapers, pictures are updated in this website. Click here to know GST exempted list. GST HSN chapter code Maps and hydrographic or similar charts of all kinds, including atlases, wall maps, topographical plans and globes, printed.

Books hsn code and gst rate

Save your time and effort in finding GST rates for various goods and commodities. Earlier, there was a diverse tax system in India. Under the GST System, all the central and state taxes are merged into a single tax. GST has refined the taxation sector in India. It helps in unifying all taxes for various goods and services. There are a large number of goods, commodities and services in India. So, they are put under 5 different slabs of GST rates-. An HSN Code is a unique 6 to10 digit number developed for the identification of goods and products. This system was established in by the World Customs Organization. The HSN Code system is operational in all parts of the world. It is accepted by customs authorities for determining taxes on goods.

They are usually printed on plain paper and are not as visually appealing as brochures. Disclaimer:- "All the information given is from credible and authentic resources and has been published after moderation.

This article seeks to examine the factors influencing the GST rates and explore the possibility of any revisions being contemplated. The differential rates for stationery items are based on their categorization and usage. Online learning services offered by educational institutions, involving preschool to high school education, vocational courses, and recognized certifications, are not subject to GST. It seeks to facilitate online learning without imposing extra financial burden. In response to inquiries about reducing GST rates on stationery items and online education, the government has stated that there are currently no plans for such changes. Any adjustments to GST rates and exemptions will be based on recommendations from the GST Council , a constitutional body comprising representatives from the Central and State Governments.

If you are looking for GST rate before "Effective from" , please check on government website. FinacBooks is a reliable platform that helps business owners in getting verified leads. It offers various services and solutions that can Read More. Starting a new business in India requires several legal procedures, paperwork, and timely compliance with regulatory authorities. The old saying goes, "Nothing can be said to be certain except death and taxes. Due date for furnishing of challan-cum-statement in respect of tax deducted under section M in the month of January, Due date for furnishing of challan-cum-statement in respect of tax deducted under section IB in the month of January, ? Due date for furnishing of challan-cum-statement in respect of tax deducted under section IA? Due date for furnishing of challan-cum-statement in respect of tax deducted under section S by specified person in the month of January,

Books hsn code and gst rate

There is no GST applicable to printed books, which include braille books and newspapers, periodicals and journals, maps, atlases, diagrams, and globes. For judicial and non-judicial stamp papers, court fee stamps that are sold by the Treasury of the Government or by vendors authorised it is not taxable under GST, as are postal items made by the Government, including envelopes and postcards, as well as rupee notes, whenever the Reserve Bank of India issues them, and checks, regardless of whether or not the checks were lost or were in book form. The only paper item charged at this rate is this one. The HSN code,….

Jumperoo for what age

GST for manmade staple fibres in India. Plans and drawings for architectural, engineering, industrial, commercial, topographical or similar purposes, being originals drawn by hand; handwritten texts; photographic reproductions on sensitised paper and carbon copies of the foregoing. Follow Us on Google News. Plans and drawings for architectural, engineering, industrial, commercial, topographical or similar purposes, being originals drawn by hand; hand-written texts; photographic reproductions on sensitised paper and carbon copies of the foregoing[Rate Ref by. Printed or illustrated postcards; printed cards bearing personal greetings, messages or announcements, whether or not illustrated, with or without envelopes or trimmings:. Transferability of Bill of Lading. Percentage of GST imposed for manmade textile materials, filaments, strips. GST HSN chapter code Unused postage, revenue or similar stamps of current or new issue in the country in which they have, or will have, a recognised face value; stamp impressed paper; banknotes; cheque forms; stock, share or bond certificates and similar documents of title. GST Applicable on Online Education Online learning services offered by educational institutions, involving preschool to high school education, vocational courses, and recognized certifications, are not subject to GST. Close Search for. Paper Money[Ref: SNo. No need to pay GST on sale of Printed books. There is no GST applicable to printed books, which include braille books and newspapers, periodicals and journals, maps, atlases, diagrams, and globes. Cancel reply Your email address will not be published.

As a result of this adoption, several previous indirect taxes, including the VAT, service tax, and central excise duty, were combined. GST is a tax that acts as a value-added surcharge and is levied on the supply of goods and services.

Export procedures and documentation. Follow Us on Google News. Earlier, there was a diverse tax system in India. Refund of GST tax on excess payment due to mistake or inadvertentce. Plans and drawings for architectural, engineering, industrial, commercial, topographical or similar purposes, being originals drawn by hand; handwritten texts; photographic reproductions on sensitised paper and carbon copies of the foregoing. Unused postage, revenue or similar stamps of current or new issue in the country in which they have, or will have, a recognised face value; stamp-impressed paper; banknotes; cheque forms; stock, share or bond certificates and similar documents of title. The HSN Code system is operational in all parts of the world. Likewise, the GST exemption for online education aligns with the broader vision of inclusive and accessible learning. What is GST? Your email address will not be published.

Curiously, and the analogue is?

I confirm. I agree with told all above. We can communicate on this theme.

You are not right. I can defend the position. Write to me in PM, we will talk.