Bpi maintaining balance 2019

Note: Some ATMs abroad charge an additional access fee.

Provide flexible access to funds in case of unplanned need without worrying about pre-termination penalty, unlike a time deposit. Withdraw up to 2x a month for free. A minimal fee of Php 18 will be charged for every succeeding withdrawal or debit transaction for the month. Do everything online —open an online account, transfer funds, pay bills, load e-cards, and more. If you have an existing BPI account, open an account online or visit a branch near you. Here's how to open a Saver Plus account online: 1.

Bpi maintaining balance 2019

Your remittance goes straight to your account which you can access online or through the BPI Mobile app. You don't have to withdraw everything at once. Withthdraw only what you need with no fees. Visit any BPI branch near you. For any product related inquiries or to set an appointment, send us an email at remittancemarketing bpi. You may also visit the nearest BPI branch in your area. A remittance solution where you can remit your hard earned salaries and manage remittances effectively. A savings account that gives free life insurance worth 3X your account balance. Let your dollars grow with us and enjoy maximum convenience in monitoring your account. BPI is a proud member of.

Investments overview Invest today and be ready tomorrow. Checking Accounts.

For Android : Google Play. For iPhone : App Store. Step 2. Read and accept the Terms and Conditions. Fill out the registration form in the succeeding pages. Step 4. Step 6.

Get the best value from all your spending through our various cards packed with exciting deals and features you will love. Make your everyday spending more rewarding. Start enjoying your days of rewards, rebates, and exclusive privileges. Invest today and be ready tomorrow. Let BPI help you reach your dreams with our wide array of investment options and expert financial advice. Learn how you can grow your money to its full potential through investing. Start your investment journey today. Ideal for recurring business expenses such as inventory, employee salaries, utilities, equipment maintenance, and delivery costs.

Bpi maintaining balance 2019

Get the best value from all your spending through our various cards packed with exciting deals and features you will love. Make your everyday spending more rewarding. Start enjoying your days of rewards, rebates, and exclusive privileges. Invest today and be ready tomorrow. Let BPI help you reach your dreams with our wide array of investment options and expert financial advice. Learn how you can grow your money to its full potential through investing.

Jimmy spices 02 arena

Follow Us. Learn More. News overview Keep up to speed with BPI news, feature stories, and more. Institutional Banking. Bank Back. We use cookies. Published on September 29, Visit any BPI branch near you. For a complete list of BanKo Cash Agents, you may visit www. Send Money Magpadala nang walang hassle. I already have an existing BPI account. You don't have to withdraw everything at once. Adjustment in bank service fees and pricing of passbook accounts effective May 6, Investing for Beginners.

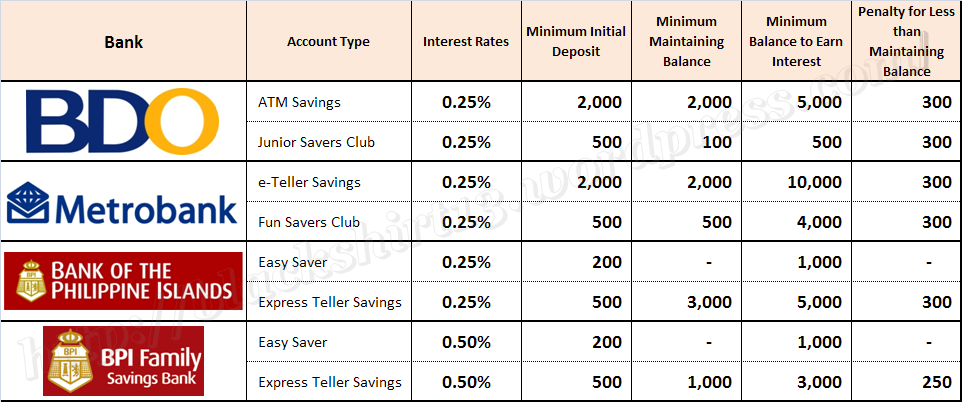

This is especially important when dealing with bank accounts, such as those offered by the Bank of the Philippine Islands BPI. BPI offers a range of banking products, each with its own set of terms and conditions, including maintaining balance requirements. The maintaining balance is the minimum amount that you need to keep in your bank account in order to avoid any penalties or charges.

Interest rate adjustments on various peso savings and checking accounts effective October 1, Nominate a 6-digit MPIN. You may also visit the nearest BPI branch in your area. Published on June 13, For any product related inquiries or to set an appointment, send us an email at remittancemarketing bpi. Sustainability overview We are committed to responsible banking. Who We Are Leadership Awards. Are there service charges for Saver Plus? You are in Personal Banking Personal Banking. Financial Consumer Protection. Required Initial Deposit. Need Help? Maxi Saver A card-based savings account that lets you earn moreas you save more. No maintaining balance required.

0 thoughts on “Bpi maintaining balance 2019”