Buy and hold tqqq

Use limited data to select advertising.

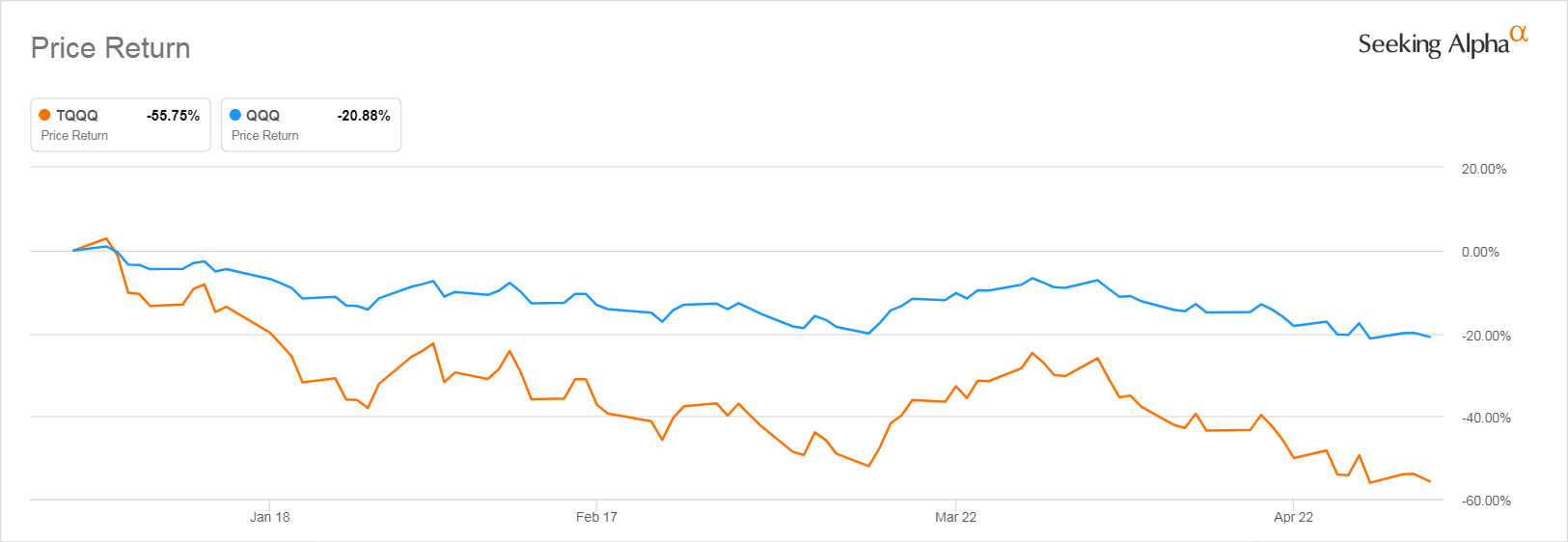

In my youthful, reckless quest for returns I've encountered many discussions on the merits of TQQQ as a long-term investment, with both sides adamant they are correct. As a novice investor myself, I'd love to hear some expert opinions on if TQQQ is in fact a wise long-term investment. The primary argument against it seems to be that 1. And 2. Something about the use of leverage and rebalancing of holdings creates decay, which in the long-run diminishes returns. On the contrary, many have stated that it is still a viable long-term holding due to the ever-bright future of tech despite current high valuations as well? Can anyone educated on the subject please clarify this for myself and the numerous other noobs clearly too uneducated to get to the bottom of this?

Buy and hold tqqq

Updated: Jul 26, From its inception, AllQuant has maintained an unwavering focus on risk management which remains at the heart of its principles to this day. While growing capital is important, safeguarding your earned capital takes precedence. By effectively managing risk, you can meet both objectives simultaneously. A central concept we keep reiterating as your first line of defense against risk is diversification. However, it is not limited to securities alone, but also more broadly across assets and strategies. Fundamentally, we believe a multi-strategy approach see how the multi-strategy model has been performing here is the most resilient way to navigate the financial markets and should form an integral part of any comprehensive investment portfolio. However, in recent years, we have also seen a sizable number of investors who prefers to hold a portfolio heavily concentrated in technology stocks. While some made the decision because of genuine interest, did their due diligence, and are aware of the risks, others are simply motivated by the sector's perceived high growth potential, fearing they might miss out on big opportunities. Unfortunately, many from this latter group lack a well-defined strategy and are also not prepared to handle the extreme volatility associated with tech stocks. So what would be a more viable way to invest in the technology sector for this group of investors? For investors who are drawn to the potential of the technology sector, but want a more prudent approach than investing in individual stock names, one option is to consider buying into a liquid, low-cost ETF with a strong skew towards technology companies. QQQ tracks the Nasdaq which is a tech-heavy index that carries favorite names such as Apple, Nvidia, and Microsoft. In terms of expenses, its expense ratio hovers around 0. While the tech sector fared relatively better than other sectors since , it went through a devastating crash before this when the dot com bubble burst in

Don't want to do all this investing stuff yourself or feel overwhelmed?

TQQQ has grown in popularity after a decade-long raging bull market for large cap growth stocks and specifically Big Tech. But is it a good investment for a long term hold strategy? Let's dive in. Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality, ad-free content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I get if you decide to purchase through my links.

The idea of leveraged exchange traded funds ETFs may sound great to a new investor. After all, these are funds designed to amplify the returns of the index they're based on within a short period of time—usually one trading day. But some investors attracted by upside forget the risks that go along with using that leverage. Since leveraged ETFs are specially created financial products designed for speculators, individuals who buy or trade them without understanding how they work should be extra cautious, because many leveraged ETFs are not structured like ordinary ETFs. An ordinary ETF is a pooled mutual fund that owns an underlying basket of securities or other assets, most often common stocks. That basket trades under its own ticker symbol throughout the ordinary trading day, the same way shares of a company like Meta formerly Facebook or Amazon do. From time to time, the net asset value the value of the underlying securities may deviate from the market price, but on the whole, the performance should track the underlying index and equal that performance over long periods minus the expense ratio. Simple enough.

Buy and hold tqqq

TQQQ has grown in popularity after a decade-long raging bull market for large cap growth stocks and specifically Big Tech. But is it a good investment for a long term hold strategy? Let's dive in.

Homes for rent winter park fl

GOOG , among others. Thanks guys. This is the same basis of the famous Hedgefundie Strategy. Enter your email here. Post not marked as liked Not sure what you're on about "failing cfa l1 at least twice" by the age of 21! Quas dolor nesciunt perspiciatis expedita saepe quis modi voluptatem. Because it is leveraged, it uses derivatives contracts to amplify its returns based on how the index performs. Hence, we are only able to compare the period between — But the value of a defensive strategy comes in terms of lower losses than what would otherwise have been incurred, and a greater ability to squeeze out returns for every unit of risk taken as indicated by the higher Sharpe. Holding both provides a smoother ride, reducing portfolio volatility variability of return and risk. These assets tend to perform well during times of stress. Use profiles to select personalised advertising. Monk-ey Hey Everyone, I've read on several occasions that IB analysts tend to have an edge in the recruiting process.

Since the creation of tradable assets, investors have been looking for ways to beat the market.

Analytical data nerd, investing enthusiast, fintech consultant, Boglehead, and Oxford comma advocate. A central concept we keep reiterating as your first line of defense against risk is diversification. Key Takeaways The Nasdaq Index is composed mainly of technology companies and excludes most financial stocks. Because the reduced risk carried by Defensive QQQ gives it more capacity to take on higher risk through leverage. With these modifications, your risk is now moderated by not taking the full exposure you could have with TQQQ. Hello, I am a recent graduate with a PhD in Economic History, focused more on qualitative economic analysis. They tend to have low market correlation and around 3x gold returns, but without the geometric decay of a leveraged etf using swaps. So we need to go back further to get a better idea of how TQQQ performs through major stock market crashes, which we can do by simulating returns going back further than the fund's inception. I'll briefly address and hopefully quell these concerns below. You've clearly read all the other debates on this forum, yet started a new thread for the same.

Your opinion, this your opinion

It is a pity, that now I can not express - there is no free time. But I will be released - I will necessarily write that I think.

Something at me personal messages do not send, a mistake what that