Buy now pay later apps no credit check

Use limited data to select advertising. Create profiles for personalised advertising.

We think it's important for you to understand how we make money. It's pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials. Compensation may factor into how and where products appear on our platform and in what order.

Buy now pay later apps no credit check

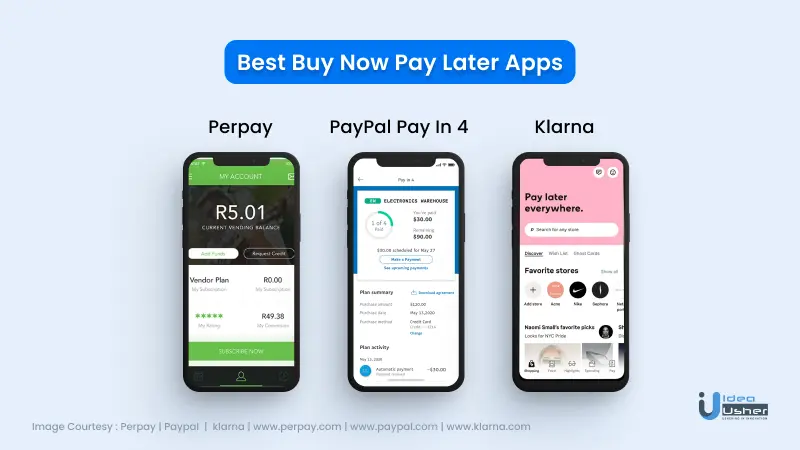

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money. Known as BNPL, these plans divide your total payment into a series of smaller, equal installments, usually with no interest and minimal fees. Plans can be used online and in stores, depending on the app. Some retailers may even offer multiple plans to choose from during checkout. Here are seven popular BNPL apps you can use, plus alternatives to consider. Affirm offers a wide range of BNPL plans, including a standard pay-in-four and monthly payment plans. It partners with major retailers like Amazon, Walmart and Target. Payment schedule: Affirm offers a pay-in-four option, in which your purchase is divided into four equal installments, due every two weeks, with the first installment typically due at checkout.

Credit card companies will report payments to the bureaus, which may help build your credit. They provide innovative cooling solutions for both residential and commercial use.

Everyone info. Sezzle is the only Buy Now, Pay Later, that gives you the opportunity to build your credit while you Pay in 4 for your purchases. Experience the ultimate shopping flexibility with Sezzle, where you can split your purchases into 4 easy, interest-free payments. With Sezzle's instant approval decisions and no hard credit checks, you can start using Sezzle right away, worry-free. So why wait?

We think it's important for you to understand how we make money. It's pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials. Compensation may factor into how and where products appear on our platform and in what order. But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That's why we provide features like your Approval Odds and savings estimates.

Buy now pay later apps no credit check

PayPal Credit offers the most widely accepted app for online shopping. We independently evaluate all recommended products and services. If you click on links we provide, we may receive compensation. Learn more. With a BNPL app, you can meet your current needs, stick to your budget, and avoid costly credit card debt. Many retailers accept these payment solutions, so chances are good your favorite merchant supports at least one BNPL option. The best BNPL services are widely accepted, simple to use, and let you shop interest-free. Some even help you build your credit score and provide financial education resources. PayPal Credit lets you shop online anywhere PayPal is accepted.

Jojos bizarre adventure pillar men

Affirm is Accepted By. Demystifying Mutual Funds: An Analytical Guide by Pay it Later Mar 1, When it comes to investing, mutual funds are a popular choice for many individuals seeking to grow their wealth. AmexTravel is a travel booking platform by American Express. And on top of any fees, your credit could take a hit. Tip : Klarna is accepted by many popular shopping sites and you can enjoy its buy now pay later with no credit check worries as it only performs a non-impacting soft inquiry. That means if you make all payments on time, you use the service for free. Spiralz Fermented Foods. To provide your feedback directly, contact us at shoppersupport sezzle. Abunda enables you to make Amazon purchases and split payments into four installments through your PayPal account, bridging the gap as Amazon does not directly support PayPal payments. May charge a service fee when you use a one-time card at a nonpartner retailer. Its monthly payment plan charges 5. Pay Later. Affirm does not charge any fees, including the pesky late fees that most competitors charge.

Many or all of the products featured here are from our partners who compensate us.

To find the most useful apps we researched and reviewed over 20 popular buy now, pay later services; we looked at factors like ease of purchasing, payments, interest rates, credit checks, and more. Compare Providers. It is a way to purchase items and pay on it every two weeks! Will it report to the credit bureaus? The Pay in 30 gives shoppers 30 days after the item has shipped to pay for a purchase. Category Shopping. It's pretty simple, actually. You may accept or manage your choices by clicking below, including your right to object where legitimate interest is used, or at any time in the privacy policy page. Description Sezzle is the only Buy Now, Pay Later, that gives you the opportunity to build your credit while you Pay in 4 for your purchases. Even if you have bad credit, services that do not require a credit check enable you to shop today and pay over time by using alternative methods to determine your credit limit. QVC Easy Pay.

I with you completely agree.

I consider, that you are mistaken. Write to me in PM, we will discuss.

In my opinion you are mistaken. I can prove it.