Can i retire at 60 with 500k australia

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering. When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes.

The Association of Superannuation Funds of Australia ASFA estimates that Australians aged around 65 who own their own home and are in relatively good health, will need the following amount of money each week and year in retirement 1 :. A modest lifestyle is considered better than living on the age pension , while a comfortable lifestyle means someone can afford a good standard of living, be involved in a broad range of leisure and recreational activities and travel domestically and occasionally internationally 2. Ultimately, how much money you'll need for your own retirement is very personal, and will depend on your own situation, wants, needs and lifestyle expectations. The following figures are a guide taken from the ASFA retirement standard. The age at which you retire can have a significant impact on how much money you have and how much money you need in retirement. Men aged 65 can expect to live to

Can i retire at 60 with 500k australia

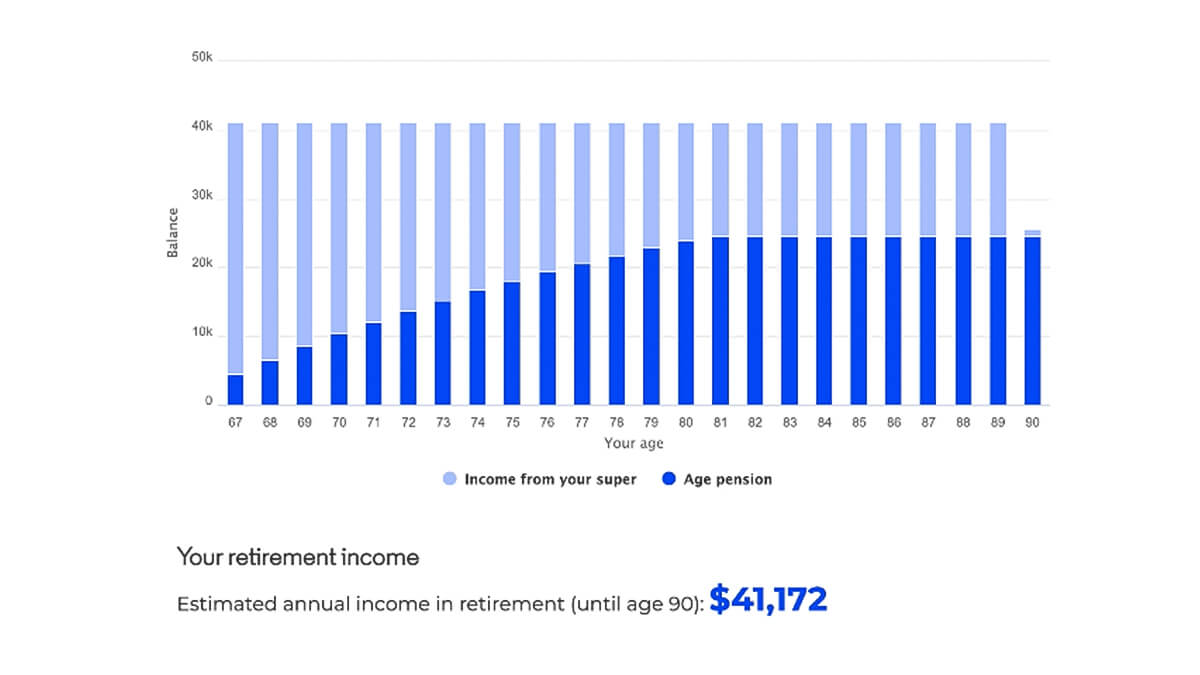

But, is it enough to retire on? Although you can retire at any age, most people in Australia will retire somewhere between the ages of 55 and 65 , however the retirement income you can achieve may be vastly different depending on when you do. You should be mindful that you cannot access your superannuation until age The benefit of waiting until age 60 to retire is that you have access to your super and all income and investment earnings can be received tax-free if held within a superannuation income stream. Furthermore, once you attain age 67, you could be eligible for Age Pension payments, which will supplement your income and mean you are less reliant on your own investments. To put all of this into context, research concludes that the income required for a modest retirement income and a comfortable retirement income is as follows:. The important thing is to ensure that the calculations you complete to determine the returns required are accurate. Because if you get the foundation wrong, the rest will crumble. The goal is to only take on as much investment risk as is required to meet your income needs — no more, no less. Our financial planning firm, Toro Wealth, specialises solely in helping 50 to 70 year-olds optimise their financial position in the lead up to retirement.

Pricing Subscriber reviews Support.

Do you see yourself retiring at 60? The amount of super you need to retire at 60 depends on how much retirement income you would like and how long you would like it to last. The table below details how much super you need based on a range of retirement income levels and longevity of income. The calculations were performed using the MoneySmart retirement planner calculator and all associated disclaimers and assumptions. Hopefully this table gives you a good idea of how much super you need to retire at age

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering. When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes. While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers will benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach. To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form. As such, any recommendations or statements do not take into account the financial circumstances, investment objectives, tax implications, or any specific requirements of readers. Readers of our stories should not act on any recommendation without first taking appropriate steps to verify the information in the stories consulting their independent financial adviser in order to ascertain whether the recommendation if any is appropriate, having regard to their investment objectives, financial situation and particular needs. Providing access to our stories should not be construed as investment advice or a solicitation to buy or sell any security or product, or to engage in or refrain from engaging in any transaction by Forbes Advisor Australia. In comparing various financial products and services, we are unable to compare every provider in the market so our rankings do not constitute a comprehensive review of a particular sector. While we do go to great lengths to ensure our ranking criteria matches the concerns of consumers, we cannot guarantee that every relevant feature of a financial product will be reviewed.

Can i retire at 60 with 500k australia

What you need to consider. For many people, when it comes to planning their retirement, age 60 sounds like a good time to leave the workforce. To help you take the leap into life after work, SuperGuide has put together a list of some of the common questions asked by people thinking about retiring at If you want to want to access your super savings and are age 60 or older, you have three options:. Learn about super and ceasing employment after If you withdraw your super benefits once you reach 60, most people pay no tax on their retirement savings.

Ilikecomix

Factor in any additional income you expect to receive 6. They provide essential financial support, reducing the overall savings requirement to maintain a comfortable lifestyle during retirement. Editorial note: Forbes Advisor Australia may earn revenue from this story in the manner disclosed here. There's also the question of what kind of retirement life you'd want. Enter email below February 25, Sebastian Bowen. The compulsory superannuation guarantee — ensuring employees receive a minimum super contribution — has been around for more than three decades. Forbes Advisor encourages readers to seek independent expert advice from an authorised financial adviser in relation to their own financial circumstances and investments before making any financial decisions. Games said: The time to access advice is now … it's never too late for someone to benefit from advice even if you're less than ten years away from retirement. The age pension is designed to provide income support to older Australians who need it. In these circumstances, it pays to have a retirement plan in place. Or, once you have retired, you intend to pick up some part-time work. The following figures are a guide taken from the ASFA retirement standard. Subscribe to our newsletter. Pricing Subscriber reviews Support.

Do you see yourself retiring at 60?

Where to go for more We hope that the figures in the tables below will get you thinking. Not a member? Hey, you might already be there! By also paying off my mortgage and not having any debts by the time I reach 60, I will greatly reduce costs heading into retirement. Superannuation Contributions After Retirement. Dividend shares may be high-returning investments, but should you go all in for retirement? The ideal retirement age is influenced by many variables, including your financial status and lifestyle objectives. The goal may have been to set a good example—and the amounts at the time were not large—but the closer I get to retirement, the more I can see how the magic of compounding interest has worked in my favour. This strategy may require you to make additional contributions alongside those from your employer, harnessing the power of compound interest to increase your retirement savings. Because of your unsubstantiated gripe against the Government? This can provide significant tax advantages. Determine how your spending will change in retirement 4.

Between us speaking, in my opinion, it is obvious. I advise to you to try to look in google.com