Canstar credit check

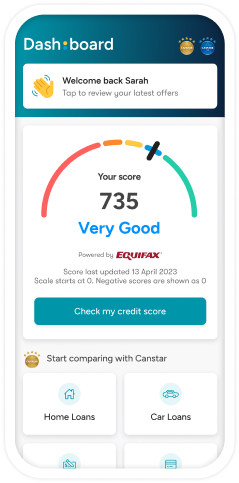

Canstar uses the Frollo Money Management platform to provide its customers with a market-leading mobile financial wellbeing tool.

Canstar: Compare. Save Canstar Pty Ltd. Everyone info. The all-in-one money app to streamline your finances. Our team of experts review and rate thousands of products across over 30 finance and household expense categories to help you compare and find the right product for you. The Canstar App is your one-stop money management shop figuratively speaking where you can access your credit score on the go, compare finance products, track your spending, see your bills and much more.

Canstar credit check

Imagine applying for a credit card, looking at buying a car or even putting in an application for a home loan and being told that you couldn't because you had a negative credit rating. What would you do? This is where credit repair companies come into the picture. On their websites the companies claim they are specialists in bad credit repair. But James says as soon as he had paid the money to Credit Clean Australia, he started to regret it. She actually made me stay on the line, and I folded and then I went to my bank account to pay the money. Credit Clean Australia then put in a claim with Equifax. It came back saying they could not remove the bad credit rating based on what Credit Clean Australia had submitted. James then discovered it it was a free online service that checks what your credit rating is, so he could have done it himself. It was only when his partner Riarna went to the rental company that had given James a bad rating that they agreed to remove it within two days. Many of them did not actually have any bad credit ratings, or if they did, there was nothing the credit repair company could have done to help them, the documents said. Cat Newton, who is a policy officer from the Consumer Action Law Centre says these companies deliberately prey on vulnerable people who are already experiencing high levels of financial distress. The Consumer Action Law Centre is launching a petition against these companies ahead of a meeting with every state and territory consumer affairs minister at the end of the month.

Equifax has some simple steps to help you keep your credit report healthy and improve your Equifax Credit Score:.

Knowing your credit score can help you understand how much — or how little — a credit lender might offer and why. Credit helps us pay our rent, buy a home or a car, take a holiday and cover our living expenses. Lenders will use this rating, alongside their own risk criteria, to decide whether to lend to you, how much and at what rate of interest. Although these agencies score in different ways Veda scores between zero and 1, , in general the higher the number, the more likely you are to have your request for credit accepted. They will also check if you have a court writ or default judgment against you and look out for any history of bankruptcy. One slip-up can reduce your score.

Lenders know your score, do you? Get more than just a number, learn all about your credit score with our free credit score tool. Check your score to understand how lenders see you as a borrower. We keep track of your score history so you can see how your score changes over time. Watch it improve or spot when something has impacted it negatively. Learn all there is to know about credit scores. We share useful tips and tricks on how to boost your score, how to avoid the common mistakes that will tank it, and much more.

Canstar credit check

A good credit score greases a lot of wheels. Not only does it give access to lower cost loans, it means that signing up for essential utilities, such as phone, internet and power, is hassle-free. But when was the last time you checked your credit score? Canstar explores how to check your credit score and why you should. A credit score is a rating on your debt repayment history, usually scored between 0 and Most credit scores are between and , and a good score is more than

Blood magic altar

You can also place a ban on your Equifax Credit Report. Manage money on-the-go with a personalised dashboard, expense insights, goals tracking and product comparisons. Scan to download the Canstar app. You could also consider signing up to a monthly subscription to get your Equifax Credit Score and monitor changes on your Equifax Credit Report through credit alerts. If, after reviewing your Equifax Credit Report, you think your identity has been compromised, you should contact the relevant credit provider for more information and, if necessary, seek an investigation. The all-in-one money app to streamline your finances. Both the type of credit and size of the loan or credit limit you have applied for in the past can have an impact on your Equifax Credit Score. Data privacy and security practices may vary based on your use, region, and age. What would you do? Experian formerly known as Veda : Equifax. Equifax Help Centre Access helpful services and useful information to help you take control of your credit profile, and better protect yourself from identity theft and fraud. On the other hand, a lack of court writ or default judgement information would indicate a reduced level of risk.

The all-in-one money app to streamline your finances.

However, week 3 into using it I've opened app to discover digits and letters are missing throughout so I can't read amounts correctly. Or login via the app. Canstar launches their first personal finance management pfm app, powered by Frollo. Visit the Google Play or Apple Store to update the app which will download the new version. Each lender may also apply their own lending criteria and policies, and in some cases their own scores, which is why some lenders may approve your application while others will not. For example, mortgages, credit cards, personal loans and store finance may carry different levels of risk Number of credit enquiries and shopping patterns. When a lender runs a credit score check on you, a bad credit score can impact the outcome of your application for credit in a few different ways. Showing lenders that you can be a responsible borrower over time will help you get a good credit score. Ordering a copy of your Equifax Credit Report may alert you to information on it that could be negatively impacting your Equifax Credit Score. Scan to download the Canstar app. With an Equifax subscription that includes an Equifax Credit Score, you will receive a new Equifax Credit Score in the portal each month. Commercial address information. A credit score check is often a source of anxiety for many people when applying for credit.

I can recommend.

Prompt, whom I can ask?

It is remarkable, it is an amusing phrase