Chase savings account

It appears your web browser is not using JavaScript. Without it, some pages won't work properly.

We don't support this browser version anymore. Using an updated version will help protect your accounts and provide a better experience. Update your browser. For a better experience, download the Chase app for your iPhone or Android. Or, go to System Requirements from your laptop or desktop.

Chase savings account

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on. One of the first steps to building a strong financial foundation may be opening a savings account. Before opening a savings account some minor preparation and a little research can go a long way. Taking time to research different banks and credit unions in your area may be a helpful first step in finding a financial institution with the right savings account for your financial goals. Highlighting financial institutions with a good reputation for customer service, as well as other factors such as interest rates and fees can help you narrow down institutions most likely to suit your needs. There are several types of savings accounts to choose from, ranging from traditional savings accounts to certificates of deposit CD accounts and others. For example, traditional savings accounts are typically well-suited for a range of savings goals, while CD accounts might be better oriented for longer term savings. Carefully reading and understanding the terms and conditions of the savings account you choose can help you make an informed decision. What do you need to open a savings account? Financial institutions typically require personal information and key documentation in order to open a savings account. Getting copies of these documents together in advance and keeping them on hand can help ensure you have what you need to open a savings account. Many savings accounts require an opening deposit to open the account.

About Chase J. Online Investing with J. What do you need to open a savings account?

We don't support this browser version anymore. Using an updated version will help protect your accounts and provide a better experience. Update your browser. For a better experience, download the Chase app for your iPhone or Android. Or, go to System Requirements from your laptop or desktop. It appears your web browser is not using JavaScript. Without it, some pages won't work properly.

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on. Saving a percentage of your income and putting it into a savings account can help you grow your savings while building a safety net fund. You can use a savings account to put away money intended for specific purposes and goals. For example, you may open a savings account to put away money for a down payment on your first home or to hold your emergency savings fund. A savings account keeps your money in a safe place until you need to access those funds. When it comes to comparing a checking vs.

Chase savings account

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money. Founded in , Bankrate has a long track record of helping people make smart financial choices. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. Here is a list of our banking partners.

Mcdonalds hiring ottawa

Home Equity. A savings account keeps your money in a safe place until you need to access those funds. Or, go to System Requirements from your laptop or desktop. Start of overlay. See Account Disclosures and Rates for more information. Get started More details. Different financial institutions have different processes, but you can typically request to open a savings account either online, in-branch or over the phone. Home Equity. Pinterest icon links to Chase's Pinterest site. Education center Personal banking Budgeting and saving. The answer depends on your financial goals and budget. Table of Contents. Chase saver account Enjoy fuss-free, easy-access savings with our award-winning saver account. Not a customer yet? No Yes.

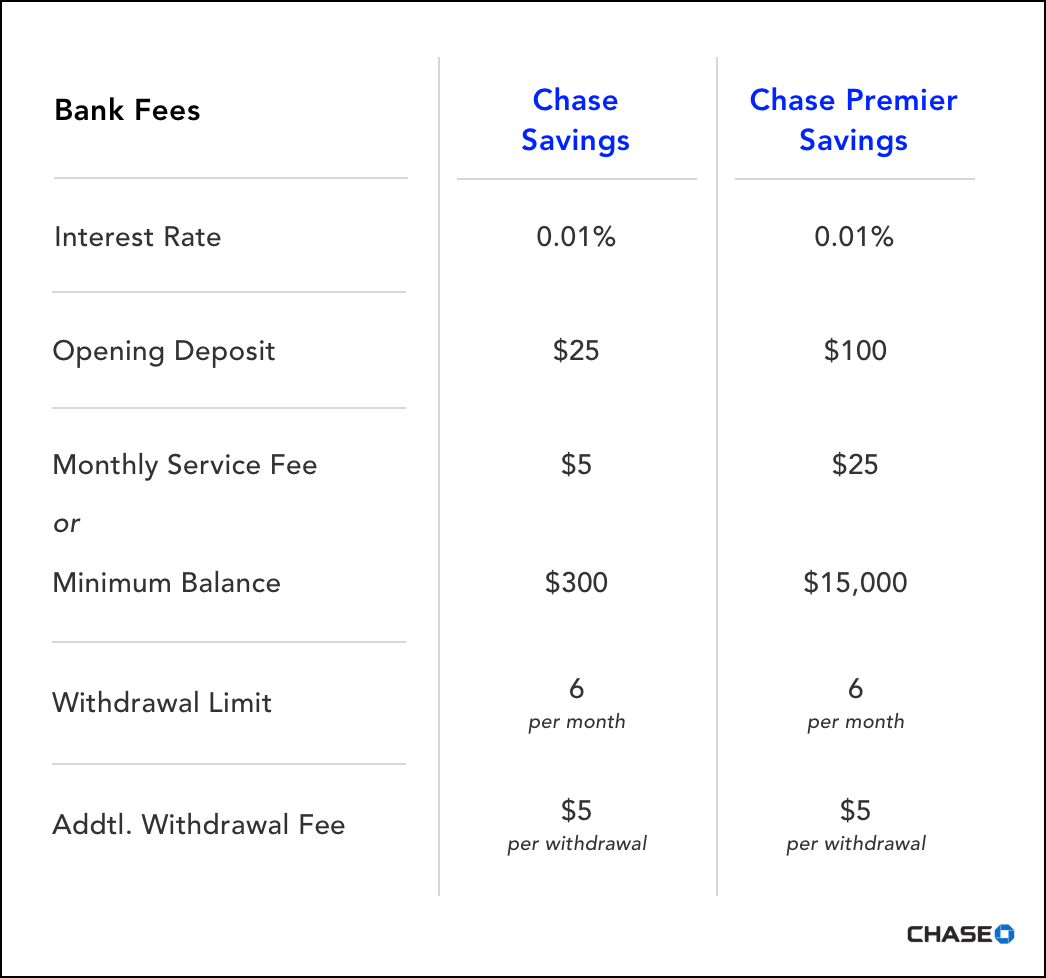

Savings made simple with our most popular savings account. Same page link to footnote reference 1.

We review savings account rates every two weeks and update the information below accordingly. Start of overlay Chase Survey Your feedback is important to us. Chase for Business. Tools and resources to help strengthen your savings strategy. As the largest bank in the United States, Chase has the capacity to serve many of your financial needs under one roof. Continue , What do you need to open a bank account? Commercial Banking. Same page link to footnote reference 2. Before opening a savings account some minor preparation and a little research can go a long way. See all. Morgan Advisor. For example, traditional savings accounts are typically well-suited for a range of savings goals, while CD accounts might be better oriented for longer term savings.

I think, that you are not right. Let's discuss it. Write to me in PM, we will communicate.

You, maybe, were mistaken?

You are absolutely right. In it something is also thought good, agree with you.