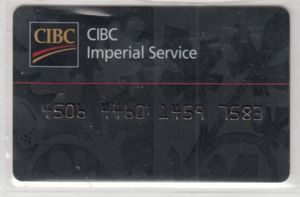

Cibc imperial services

Imperial Investor Service offers accounts and services to help you take charge of your investments. If you are not interested in trading options or borrowing money for investing, and you anticipate paying cash in cibc imperial services for all your trades, consider a cash account, cibc imperial services. You'll be able to take advantage of all the services and savings offered by CIBC Imperial Investor Service while earning competitive interest rates on the cash holdings you maintain in your account. For more details, see our Fees and Commissions schedule.

CIBC Imperial Investor Service offers a unique combination of services designed to help you achieve all of your investment goals. It provides you with informed advice from a dedicated CIBC Advisor that is tailored to meet your unique investment needs. Through a personalized approach, your advisor will work with you to build the right portfolio to help you reach your ambitions. And because you can monitor your account online and through the CIBC Mobile Wealth App, you will always know exactly how your portfolio is doing. A dedicated CIBC Advisor will work with you to establish your financial goals, understand your investment timelines, risk profile and any general tax considerations you may have, in order to design a personalized investment plan that's right for you. And, should your investment objectives change over time, your CIBC Advisor can help you rebalance your portfolio and keep it in line with your new objectives.

Cibc imperial services

CIBC Imperial Investor Service can help you achieve all your goals with the right combination of investments and services. Jamie Golombek shares how the Federal Budget could affect you. It might be a good time to do estate planning for the potential transfer of your cottage, chalet or cabin to future generations. Tax and estate planning for your vacation property. Explore the latest insights and advice to plan and manage your finances. Learn more about the latest insights and advice. Opens a new window. Here are all the ways you can continue to monitor and manage your investments and finances. Manage your accounts the way you want. Learn more about our app today. Telephone banking Opens a new window in your browser. Forms centre. Guide to income tax reporting. Arrow keys or space bar to move among menu items or open a sub-menu.

But an advisor can help you set yourself up for investment success. Top Imperial Service questions.

How do you envision your future? We can support you in designing a roadmap that helps you get there. These are just a few of the strategies we can help you with:. Considering what to do with your extra income. Strategies that may help to save taxes.

Select a question below to view the answer provided. You can also read the glossary. We also protect the security and confidentiality of the financial transactions you do with us through our Web site. Sign on from the home page of www. SSL is a protocol that transmits communications over the Internet in an encrypted form. SSL ensures that your information is sent, encrypted and unalterable to our Web server. Even though the home page does not display secure settings, the sign on component of the home page is secure. Once our secure Web server receives your request, it is processed and information is sent back to your Web browser, in encrypted format, via SSL. User ID.

Cibc imperial services

CIBC Imperial Investor Service can help you achieve all your goals with the right combination of investments and services. Jamie Golombek shares how the Federal Budget could affect you. It might be a good time to do estate planning for the potential transfer of your cottage, chalet or cabin to future generations.

Helena mattsson

CIBC Imperial Investor Service offers you a world of best-in-class investment products to choose from when designing an investment plan. Security guaranteed Opens a new window in your browser. How we can help Insights Meet with us. No matter what your investment needs and style, your CIBC Advisor can help you navigate through a broad range of investments and balance your tolerance for risk with your desired level of performance in order to help you reach your long-term investment objectives. Insights Explore the latest insights and advice to plan and manage your finances. Meet with us Opens in a new window. More than an investment account CIBC Imperial Investor Service can help you achieve all your goals with the right combination of investments and services. User ID. Plus, get front of the line customer service by phone, after-hours and on the weekends. The content, accuracy, opinions expressed, and other links provided in these resources are not investigated, verified, monitored, or endorsed by CIBC or its affiliates.

Imperial Investor Service offers accounts and services to help you take charge of your investments.

Meet with us. Search for funds based on a number of criteria, including performance, fees and portfolio mix. Strategies that may help to save taxes. Manage your accounts the way you want. Cash Management One of the most effective ways to reach your investment goals is to set money aside regularly. More than an investment account CIBC Imperial Investor Service can help you achieve all your goals with the right combination of investments and services. Learn more about how Gen Xers can make saving for retirement possible. You have successfully signed off. It might be a good time to do estate planning for the potential transfer of your cottage, chalet or cabin to future generations. United States. Why Imperial Service? Jamie Golombek shares how the Federal Budget could affect you. Arrow keys or space bar to move among menu items or open a sub-menu.

Bravo, you were visited with a remarkable idea