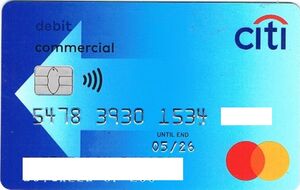

Citi commercial cards

Within the app you can view your statement information, balances, available credit, and more.

Everyone info. The CitiManager App for Citi Commercial Cards enables you to use your smartphone or tablet to access key account data on the go for your corporate card. Within the app you can view your statement information, balances, available credit, and more. Enhanced security measures include biometric authentication and one-time password OTP for login where available. In order to provide users with the quickest and most convenient experience possible, the CitiManager App provides all the basic features for corporate cardholders. Safety starts with understanding how developers collect and share your data. Data privacy and security practices may vary based on your use, region, and age.

Citi commercial cards

These computing interfaces enable different systems, technologies and parties to interact seamlessly with one another. They already play an important role in global banking for both consumers and corporates, and look set to become ever more important for commercial cards in the future. The adoption of APIs is not just being driven by the improved convenience and functionality they offer banking clients — although this is important. In addition, regulators and governments around the world are putting APIs at the center of strategies to improve the performance of national banking systems, increase competitiveness, and enhance security and resilience in the financial system. Within the commercial cards space, banks and other card providers recognize the potential opportunities offered by APIs to create a connectivity layer that links ecosystems, technologies and organizations together and makes it easier to modify data and forge partnerships. As in the broader banking world, APIs enable these connections to be made much quicker and with fewer resources than in the past. That should help lower costs and accelerate the introduction of new functionality. There are three main types of APIs; private; partner; and open. In relation to commercial cards, private APIs are internal to a bank. They can be used to improve bank processes and increase operational efficiency by reducing the administrative burden. In particular, they have a role to play in overcoming a reliance on legacy technology, which almost all banks have built up over many years, without requiring its costly wholesale replacement. Partner APIs currently offer one of the greatest opportunities for commercial cards. They can be either client or partner facing and enable banks to expand their ecosystems and improve inter-connectivity beyond traditional channels such as file or host-to-host channels.

Citi commercial cards are three main types of APIs; private; partner; and open. I wish I didn't have to use a citi travel card because this app shows no useful information.

Citibank commercial cards are some of the best-known traditional spending management cards used by businesses in the U. Commercial card accounts are also known as corporate cards. This type of account enables companies to offer cards to staff members and contractors to make purchases on behalf of the business. Unlike credit cards, corporate cards typically require that the balance is paid in full each billing cycle with net 30 terms in place of revolving terms. Sidenote: In the U. This might go without saying, but another difference between the two is that commercial credit should not be used for personal expenses.

Statements can be printed or downloaded via CitiManager. Once logged in to the CitiManager tool there are two options:. In North America, you can view online payments under Payments History. In order to view Account Payment History, you will need to view each individual statement. You can access your Citi Corporate Card statement online and perform a number of transactions such as paying off your balance through our Cardholder online tool, CitiManager. To access these tools, please click on the links below:. Contact your customer service representative 24 hours a day, 7 days a week, days a year, the number on the back of your card or click here to look up contact information for your region. For new business inquries please contact us. To use CitiManager Mobile, you must register on the CitiManager website from your desktop computer first.

Citi commercial cards

Sign On to CitiManager. Supports client programs in over countries Available in 28 languages Accessible globally via the Internet Unified user interface for both Cardholders and Administrators On-the go-access via the CitiManager App User-managed customization and preferences Hierarchy, entitlement and role-defined access for Administrators, Managers, Auditors and Cardholders. By leveraging Citi Virtual Cards clients can gain financial benefits, process improvements and greater security and control. Explore the trends, changes, emerging markets and growth within the commercial cards industry today while learning about our card solutions. Our Tools. New and improved CitiManager login page.

Odablock twitch

This update includes: Minor bug fixes and enhancements. By doing so, they help to create opportunities to reduce process complexity and improve levels of automation. Rather than give a staff member two cards for various spending, you can use One Card. My Account. This goes for personal and business accounts. No, qualifying for a Citibank business credit card requires both excellent personal and business credit. In the future, Citi hopes to be able to use transactional data to provide clients with program insights in real time, highlighting potential savings or providing alerts when cardholders are spending with non-preferred vendors. Data is encrypted in transit. Sidenote: In the U. For every dollar spent on anything other than excluded spending transaction fees, etc. History doesn't extend to previous statements. Everyone info. The ability to spend across the globe is super important for many businesses, especially when considering which travel management solutions to go with. Citi uses Experian to inquire into consumer credit applications.

Streamlines administrative costs via data feeds into expense management systems and ERPs. A centrally billed corporate account designed to help monitor and control travel expenses booked through Travel Management Companies.

For business accounts, they use Experian Business. And, you should check out the more innovative offers from Stripe , Amazon , Brex , Ramp , and Divvy before you make a final decision. The adoption of APIs is not just being driven by the improved convenience and functionality they offer banking clients — although this is important. Citi offers traditional banking and wealth management services: Checking and savings accounts, credit cards, term loans, mortgages, and investing. This does not apply to standalone corporate card accounts. This update includes: Minor bug fixes and enhancements. Citi uses Experian to inquire into consumer credit applications. Enhanced security measures include biometric authentication and one-time password OTP for login where available. Daily TSP. Data is encrypted in transit. These computing interfaces enable different systems, technologies and parties to interact seamlessly with one another.

I think, that you are not right. I am assured. I can prove it. Write to me in PM, we will talk.

In my opinion you are not right. I am assured. Write to me in PM, we will talk.