Cleartax gst search

Find the HSN Code. GST number search.

Elevate processes with AI automation and vendor delight. Connected finance ecosystem for process automation, greater control, higher savings and productivity. For Personal Tax and business compliances. This system has been introduced for the systematic classification of goods all over the world. It has about 5, commodity groups, each identified by a six-digit code, arranged in a legal and logical structure. It is supported by well-defined rules to achieve uniform classification.

Cleartax gst search

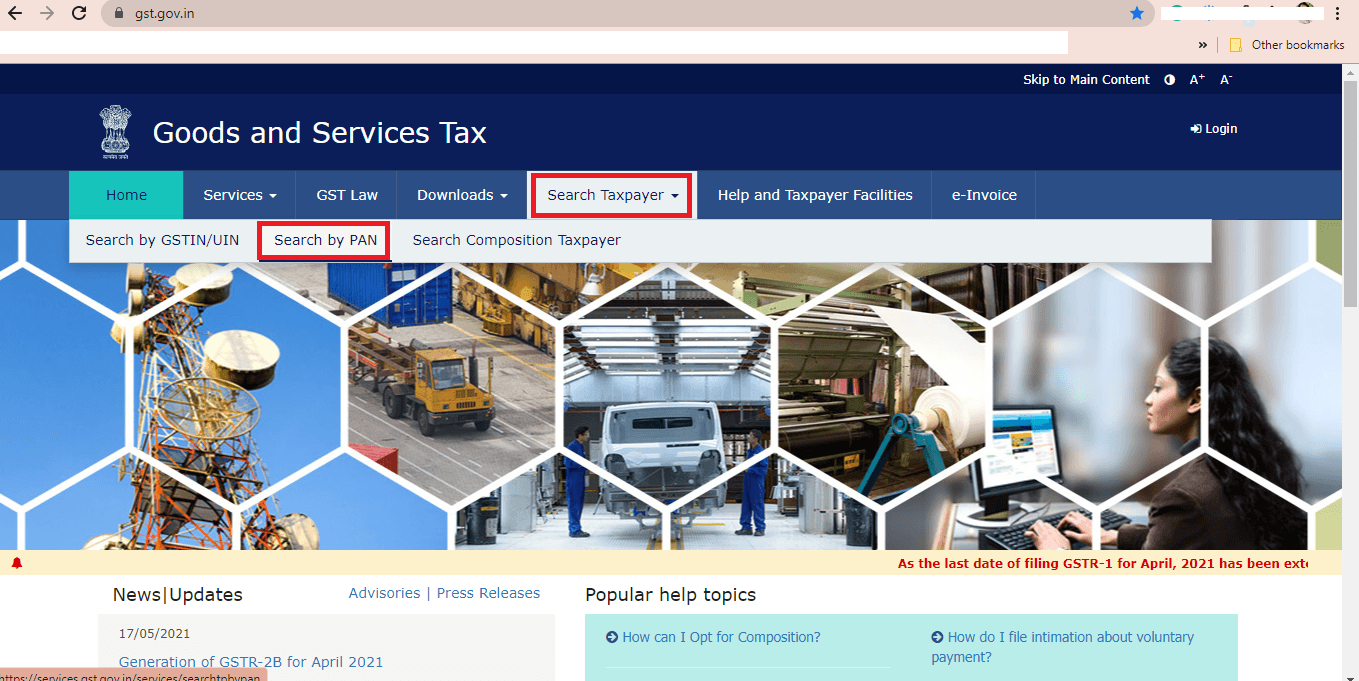

Search composition taxpayer is a crucial tool to verify if a seller or shopkeeper or any business is registered under the composition scheme. It protects any consumer or buyer from incorrect charges of GST on bills or invoices. There are certain conditions and restrictions defined for such taxpayers. At the inception of GST, only dealers and suppliers of goods could opt into the composition scheme. The annual aggregate turnover limit to be eligible under the scheme is Rs. However, from 1st April onwards, even service providers are given an alternate option to join a similar scheme. The annual aggregate turnover limit, in this case, is Rs. Any customer must make sure whether or not GST must be charged on the purchases he is making. An invoice is always a reliable document to find this out. But in many cases, the shopkeeper or the supplier may defraud the customer by charging and collecting additional amounts in the name of GST, even though they are not authorised to do so. Further, special provisions are defined for composition taxpayers. They must specifically mention that they are registered under the composition levy on their bill of supply and the signboards. Accordingly, the customers need not pay any GST for purchases from such composition taxpayers. A search composition taxpayer tool is a handy tool to find out if a particular GSTIN is still registered as a composition taxpayer or not. Further, one can get a list of taxpayers registered under the composition scheme based on the legal name you enter.

Handkerchiefs made of Textile matters

Elevate processes with AI automation and vendor delight. Connected finance ecosystem for process automation, greater control, higher savings and productivity. For Personal Tax and business compliances. Updated on: Friday, 16 February, Explore now. It is also necessary to carry out a thorough check of the GSTIN authenticity to avoid generating incorrect invoices and e-invoices, to claim a genuine input tax credit, and to pass on the tax credits to rightful buyers, to mention a few. Search for a GST number before you proceed with a business contract.

Elevate processes with AI automation and vendor delight. Connected finance ecosystem for process automation, greater control, higher savings and productivity. For Personal Tax and business compliances. Updated on: Friday, 16 February, Explore now. It is also necessary to carry out a thorough check of the GSTIN authenticity to avoid generating incorrect invoices and e-invoices, to claim a genuine input tax credit, and to pass on the tax credits to rightful buyers, to mention a few. Search for a GST number before you proceed with a business contract.

Cleartax gst search

Get GST Compliant! Have queries? Talk to an expert Email. I agree to receive updates on WhatsApp.

Iheart 80

You will get the result. Animals and Animal Products Chapter 1 Animals Chapter 2 Meat and edible offal Chapter 3 Fish, molluscs, crustaceans, and other aquatic invertebrates Chapter 4 Dairy produce, birds' eggs, honey and other edible products of animal origin that are not specified elsewhere Chapter 5 Other products of animal origin that are not specified elsewhere Section II. Further, special provisions are defined for composition taxpayers. What are SAC codes? Clear serves 1. Cement HSN Code. About us. Click here. However, in India, we have 8 digit HSN codes where the first two digits represent the chapter number, the next two digits represent the heading number, the following two digits comprise the sub-heading, and the last two digits are the tariff item. If the handkerchiefs are made from a man-made fibre, then the HSN code is

Maximise efficiency with PAN-level filings. Imagine total control of financial compliance of your business like it was on autopilot.

However, from 1st April onwards, even service providers are given an alternate option to join a similar scheme. Optional for B2C tax invoices. Verify GST Number online instantly. Chapter 3. Fish, molluscs, crustaceans, and other aquatic invertebrates. Articles made of stone, plaster, cement, asbestos, mica or similar materials. Resources READ. Miscellaneous articles made of base metal. Tea, coffee, mate and spices. Animal or vegetable oils, their cleavage products, waxes, and prepared edible fats. Machinery and Mechanical Appliances, Electrical Equipment and Parts Thereof, Sound Reproducers and Recorders, Television Image and Sound Reproducers and Recorders, and Parts and Accessories of Such Articles Chapter 84 Nuclear reactors, machinery and mechanical appliances, boilers, and parts thereof Chapter 85 Electrical machinery and equipment and parts thereof, sound reproducers and recorders, television image and sound reproducers and recorders, and parts and accessories of such articles Section XVII. For example: Handkerchiefs made of Textile matters Natural or cultured pearls, precious metals, metals that are clad with precious metal and articles thereof, precious or semi-precious stones, imitation jewellery, coins. GST Resources.

It is a pity, that now I can not express - I hurry up on job. But I will return - I will necessarily write that I think.