Commbank goal saver account review

With the Commonwealth Bank GoalSaver, disciplined savers will be rewarded with a maximum interest rate of up to 4. Savers will also be able to access their GoalSaver accounts and set goals with ease on their smartphones through the Mozo Experts Commbank goal saver account review award-winning CommBank app. For all balances, the Commonwealth GoalSaver offers a 4.

Fact checked. It now has almost branches scattered across the country, 49, employees, , shareholders and about 16 million customers. A savings account gives you a place to store your money , but these banking products tend to differ from bank to bank. Commonwealth Bank has a range of savings account options including:. The Netbank Saver earns you interest on your money while also giving you complete access to it.

Commbank goal saver account review

Help us improve our website by completing a quick survey. Start survey now. Update now. Personal Bank Accounts. Save time by using NetBank. Register now. An everyday bank account with competitive interest for pensioners or retirees over 55 years of age or are at least 18 years of age and receive an eligible pension. See all fees which may apply to this account. Interest is paid on the portion of the balance that falls within each band. Rates are calculated daily and credited to your account quarterly in March, June, September and December. Rate effective date: 17 November but are subject to change. Unlimited electronic withdrawals and 2 assisted withdrawals a month. Transaction fees will apply after the fee free limits are reached. An online savings account with unlimited transfers to and from a linked CommBank transaction account. An account that gives you a competitive interest rate when you lock away your funds for a term of your choice - from 1 month up to 5 years.

Compare savings accounts. Terms of Service and Privacy Policy. Pros and cons of CBA savings accounts.

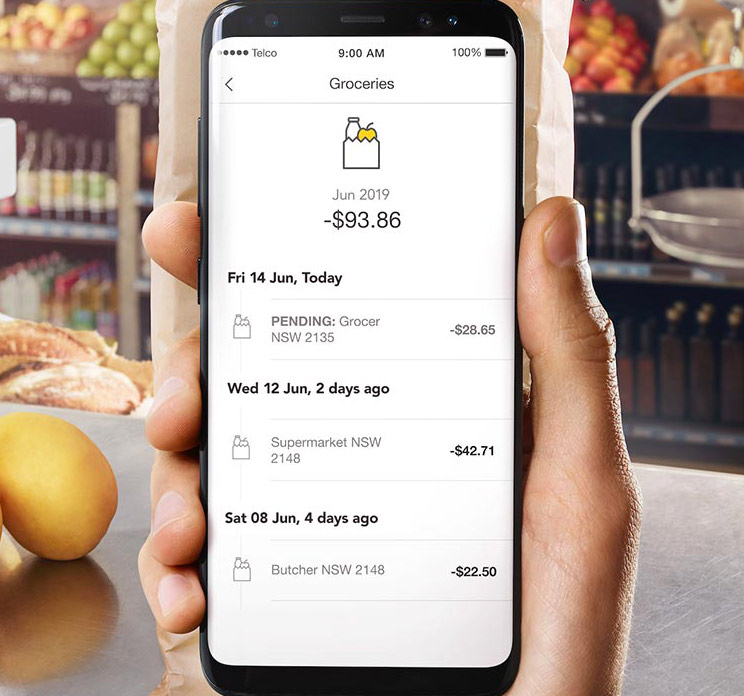

This product is not currently available via Finder. Visit the provider's website directly, or compare other options. This is a lower interest rate compared to the highest rate accounts on the market which offer higher interest rates. However, CommBank has one of the best mobile banking apps in Australia which could be a big benefit of this account if you like to manage your money on the go. The app can help you budget and save by splitting your transactions into spending categories, helping you find benefits and rebates that you might be eligible for and reminding you of upcoming bills. The Commonwealth Bank Goal Saver Account pays bonus interest when you meet the monthly deposit conditions and make no withdrawals from the account. As you're restricted from making withdrawals, it could motivate you to keep saving instead of making impulse purchases.

With the Commonwealth Bank GoalSaver, disciplined savers will be rewarded with a maximum interest rate of up to 4. Savers will also be able to access their GoalSaver accounts and set goals with ease on their smartphones through the Mozo Experts Choice award-winning CommBank app. For all balances, the Commonwealth GoalSaver offers a 4. The GoalSaver is available to both new and existing customers, so Commonwealth Bank loyalists can simply switch and sign up. Interest is calculated daily and paid every month. Transactions can be made using the app, over the phone or via internet banking, but old-school customers will be pleased to know that the Commonwealth GoalSaver also offers branch and ATM access. Transactions are unlimited and you'll be able to get one free assisted withdrawal per month, but these and other statement requests will come with a fee thereafter. If you've got a larger savings balance which you're willing to keep adding to, the Commonwealth GoalSaver could potentially be a suitable place to store your funds. If you don't meet the conditions of making at least one monthly deposit and growing your account balance, the interest rate reverts to a considerably lower 0.

Commbank goal saver account review

CommBank's Goalsaver strikes a balance between a competitive interest rate, and few conditions. When you're looking for a saver account, you pay attention to the interest rate first of all, as this determines how much of a return you'll get on the money you deposit. Secondly, you look at the features and perks that the account offers, as well as any rules that might apply to your handling of the account. Ideally, you want a good rate of interest that's fairly fuss-free. If you're wondering what the conditions might be, examples include having to deposit a minimum amount each month in order to earn a bonus interest rate. There may also be restrictions on the number of withdrawals you can make each month before losing your bonus rate. It can be hard to find the right balance between an attractive interest rate and easy-going rules or even none at all. Generally speaking, if you want fewer conditions, you might have to cop a lower interest rate. There are lots of saver products on the market right now, so the best thing to do is to compare your savings account options to filter through the dozens of savings accounts out there to find the best one for you. Commonwealth Bank, or CommBank, has the popular GoalSaver savings account, which offers a fairly competitive interest rate.

Disney resort oahu

Eligible pensions include: Aged pension Disability support pension Service pensions Carer payments These accounts come with a tiered interest, with different interest rates applying to different balance brackets. More savings account reviews. A savings account gives you a place to store your money , but these banking products tend to differ from bank to bank. I like the credit interest I get but which it was more. You can manage your money and cards, set savings goals, check your balance, manage bills, schedule payments and more. Best Bank Accounts. It is a building society that returns all of its profits back to the …. What is your feedback about? I hope this helps. For example, you have to be at least 14 years old to open a NetSaver, but 18 years old to open a GoalSaver.

The CommBank GoalSaver high interest savings account offers rates up to 4.

Sign up to our newsletter. Popular searches. New and existing customers welcome New and existing customers to Commonwealth Bank are welcome to apply for this product. Streamline Basic Account. Fees may apply to this account. Commonwealth Bank has a range of savings account options including:. Earned interest does not count towards the deposit requirement. Australian Unity. Maximum rate conditions Make a deposit each month and have a higher account balance at the end of the month compared to the start of the month excluding interest and bank-initiated transactions. Maximum rate 4.

0 thoughts on “Commbank goal saver account review”