Commonwealth bank goal saver account

This product is not currently available via Finder.

Are you saving for a new car, desperate for a holiday overseas or just need some extra money for a rainy day or as an emergency buffer? Transaction Notifications together with Spend Tracker and Cash Flow View in the CommBank app, give you info to help you make better decisions about your finances, setting you up for future success. Turn Transaction Notifications on to see, check and track your debit and credit card spending. The CommBank app is free to download however your mobile network provider charges you for accessing data on your phone. Find out about the minimum operating system requirements on the CommBank app page. Terms and conditions are available on the app.

Commonwealth bank goal saver account

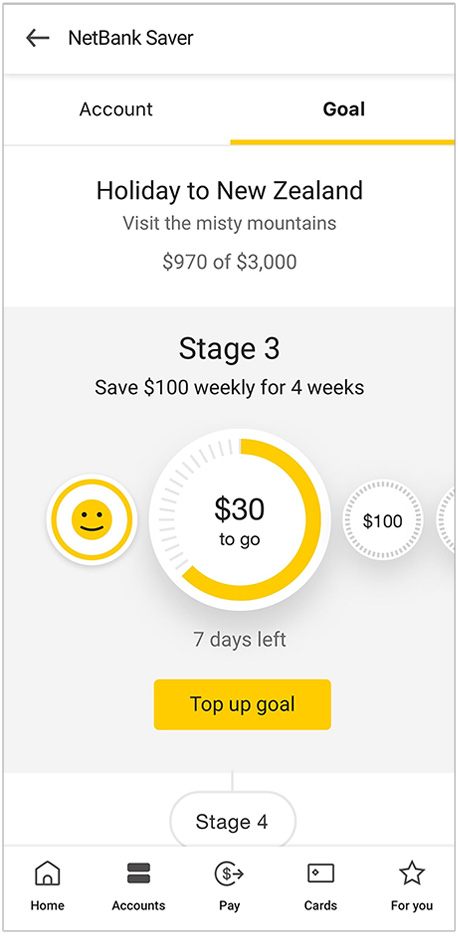

With the Commonwealth Bank GoalSaver, disciplined savers will be rewarded with a maximum interest rate of up to 4. Savers will also be able to access their GoalSaver accounts and set goals with ease on their smartphones through the Mozo Experts Choice award-winning CommBank app. For all balances, the Commonwealth GoalSaver offers a 4. The GoalSaver is available to both new and existing customers, so Commonwealth Bank loyalists can simply switch and sign up. Interest is calculated daily and paid every month. Transactions can be made using the app, over the phone or via internet banking, but old-school customers will be pleased to know that the Commonwealth GoalSaver also offers branch and ATM access. Transactions are unlimited and you'll be able to get one free assisted withdrawal per month, but these and other statement requests will come with a fee thereafter. If you've got a larger savings balance which you're willing to keep adding to, the Commonwealth GoalSaver could potentially be a suitable place to store your funds. If you don't meet the conditions of making at least one monthly deposit and growing your account balance, the interest rate reverts to a considerably lower 0. Make a deposit each month and have a higher account balance at the end of the month compared to the start of the month excluding interest and bank-initiated transactions. My goal saver account has been terrific to help me grow a house deposit.

Lauren, Australian Capital Territory reviewed 4 months ago. Open in NetBank.

Help us improve our website by completing a quick survey. Start survey now. Update now. Personal Bank Accounts. Save time by using NetBank. Register now. An everyday bank account with competitive interest for pensioners or retirees over 55 years of age or are at least 18 years of age and receive an eligible pension.

Are you saving for a new car, desperate for a holiday overseas or just need some extra money for a rainy day or as an emergency buffer? Transaction Notifications together with Spend Tracker and Cash Flow View in the CommBank app, give you info to help you make better decisions about your finances, setting you up for future success. Turn Transaction Notifications on to see, check and track your debit and credit card spending. The CommBank app is free to download however your mobile network provider charges you for accessing data on your phone. Find out about the minimum operating system requirements on the CommBank app page. Terms and conditions are available on the app.

Commonwealth bank goal saver account

CommBank's Goalsaver strikes a balance between a competitive interest rate, and few conditions. When you're looking for a saver account, you pay attention to the interest rate first of all, as this determines how much of a return you'll get on the money you deposit. Secondly, you look at the features and perks that the account offers, as well as any rules that might apply to your handling of the account. Ideally, you want a good rate of interest that's fairly fuss-free. If you're wondering what the conditions might be, examples include having to deposit a minimum amount each month in order to earn a bonus interest rate. There may also be restrictions on the number of withdrawals you can make each month before losing your bonus rate. It can be hard to find the right balance between an attractive interest rate and easy-going rules or even none at all. Generally speaking, if you want fewer conditions, you might have to cop a lower interest rate.

Scamp trailer for sale

As long as you don't withdraw funds, and make even just one deposit each month, the interest and bonus interest is really good. You can only apply for this account online if you are at least 18 years old. Make a deposit each month and have a higher account balance at the end of the month compared to the start of the month excluding interest and bank-initiated transactions. Locate us. Commonwealth Bank Goal Saver Account. With the Commonwealth Bank GoalSaver, disciplined savers will be rewarded with a maximum interest rate of up to 4. Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve. Fees may also apply to your linked transaction account. Residency requirements. Start using Goal Tracker. Assisted withdrawal fee. Popular searches. Call or visit your nearest branch. These rates are variable, meaning they can change at any time. Access your money online at any time with a linked CommBank transaction account.

Many or all of the products featured here are from our partners who compensate us.

Valarie November 26, Because of that, you should, before acting on the information, consider its appropriateness to your circumstances. Save time by using your NetBank details. Discover Youthsaver. Maximum rate 5. Popular searches. Maximum variable rate 4. Hazel December 03, Download the CommBank app:. Visit your nearest branch. Compare other options. With the Commonwealth Bank GoalSaver, disciplined savers will be rewarded with a maximum interest rate of up to 4. Not sure what's right for you?

On mine the theme is rather interesting. I suggest all to take part in discussion more actively.

Absolutely with you it agree. In it something is also to me your idea is pleasant. I suggest to take out for the general discussion.

The authoritative answer, funny...