Cost of ufile

Complete the security question answer. Click "Submit". Once you have completed these steps, you will receive an email with the reset information.

Post by NormR » 17Nov Post by snowback96 » 18Nov Post by ole'trader » 18Nov Post by snowback96 » 19Nov Post by Insomniac » 26Nov Post by AltaRed » 26Nov Post by chufinora » 27Nov

Cost of ufile

UFile 4 for Windows - download Includes 4 returns plus 4 additional returns for modest income taxpayers with email support. UFile is perfect for all types of personal returns including small business and rental properties. Operating system: windows 10 or later is required. UFile 12 for Windows - download Includes 12 returns plus 4 additional returns for modest income taxpayers with email and telephone support. Additional returns Add 2 more tax returns to your existing software. Additional returns Add 4 more tax returns to your existing software. Hard disk space: mb available. Display: Screen resolution of x or greater. If you are a low volume tax preparer preparing between 20 and returns, learn more about UFile PRO at www. If you are a high volume tax professional preparing more than returns, learn more about DT Max software at www. If you would like to purchase UFile for prior years, please click here. This will allow even a large family to share one software product to prepare and file their tax returns.

Foreign income or foreign property. That is: the disability tax credit cannot be claimed if you are claiming fees for full-time care in a nursing home. Cost of ufile slip - Box 24 - Foreign business income.

Are you a post-secondary student? Is yours a simple return? Are you filing a Federal tax return for the first time? You must be a resident of Canada, have tuition fees and have attended school for at least one month during the tax year being prepared. Tuition credits that are not used or transferred to a supporting person in the current year will be carried forward by UFile for future use by the student. You must also be entitled only to standard non-refundable tax credits, and have no other deductions or credits such as RRSPs, charitable donations or medical expenses.

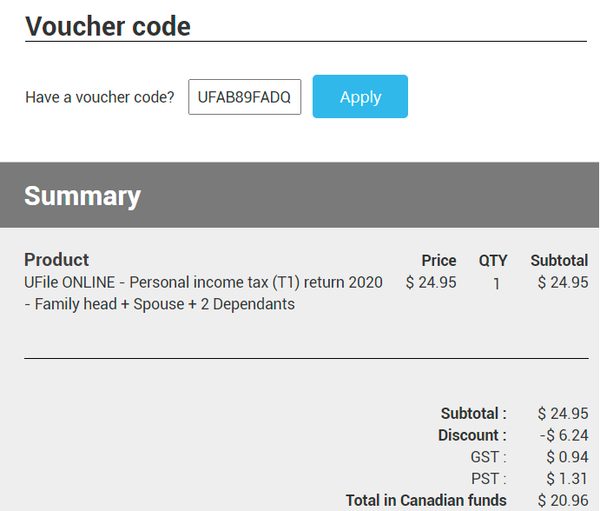

The content on this website includes links to our partners and we may receive compensation when you sign up, at no cost to you. This may impact which products or services we write about and where and how they appear on the site. It does not affect the objectivity of our evaluations or reviews. Read our disclosure. Filing taxes is something most people have to do each year in Canada, but sometimes it can be a hassle. Here, we take a closer look at UFile, reviewing its features, plans, pros and cons, and comparing it with other popular tax software like TurboTax and Wealthsimple Tax. The UFile tax software is a popular choice for many Canadian taxpayers who want a simplified and straightforward way of filing their tax returns. The program is offered free to filers with simple tax returns, such as those with employment income or who are reporting income from a pension from the Canadian government. UFile Online is the main product.

Cost of ufile

But the good news is there are several situations where you can file for free — including having a simple tax return. Other than these options, UFile offers all the standard tax software features — including express notice of assessments , an accuracy guarantee , and some prior-year import options — but skipped out on making an app version of their service. As far as paid tax software goes, UFile checks almost everything on the list — with the exception of having a mobile app. In order to come up with our star rating, we first list out the major features people are looking for in tax software which you can see in the table above. We then fill in the table with UFile in mind, assign each row a score out of 5 — then the average rating becomes their star score.

Carling mazda

I cannot delete the account, can UFile do it for me? What to do when someone has died. Sign in to a new or existing UFile account for the current tax year. Schedule 3 line This includes your information slips and all receipts you intend to submit. Mac and Linux. Plus, if you have a refund coming, the sooner you file, the sooner you get your refund back. Sharing childcare expenses - Quebec resident. Any errors that UFile can diagnose are reported to you to fix immediately. Food bank tax credit for farmers - line 83 - Nova Scotia. PEI - Volunteer firefighters' amount. As they do provide the same features, have the same interface, and are very straight forward and easy to follow, each product is presented differently. Notice of Assessment after filing your tax return. We will provide you with an answer as quickly as we can.

Complete the security question answer. Click "Submit". Once you have completed these steps, you will receive an email with the reset information.

For a list of all the forms UFile supports, click here. I still don't understand why they charge less for the Windoze software when it comes on a CD in a box with shipping costs. Account - Security question and answer how to change Install the program using the instructions for the situation that applies to you: Installing for the first time: Double-click the file on your Desktop. Business Investment loss. Once you have completed these steps, you will receive an email with the reset information. Federal political contribution tax credit. TL11C - Student attending U. Post by NormR » 24Dec Additional returns Add 2 more tax returns to your existing software. How to enter capital gains or losses in the taxation year.

Where you so for a long time were gone?

Excuse, that I interfere, but you could not paint little bit more in detail.