Credit karma revenue 2019

We're a company of builders, dreamers and credit karma revenue 2019 with a passion for helping people make financial progress. We've helped over 80 million members better understand their finances through free access to credit scores, reports, tools, education - and even free tax filing. But now, we're pushing into new territory. We're reimagining and streamlining the marketplaces for credit cards, loans, home mortgages and more.

Do you know your credit score? Credit Karma will show it to you for free. How does a company offering free services make money? This article reviews Credit Karmas' revenue model. Credit Karma makes money by charging referral fees, interest on cash, and interchange fees. Founded in , this fintech firm helps Americans manage their finances and investments, allowing them to control their spending, saving, and investing.

Credit karma revenue 2019

February 24, , is a day Ken Lin will never forget. Meanwhile, the stock market was in free fall. We had a lot of decisions to make. By the time the deal closed — on December 3, one year ago — Credit Karma had seen its business impacted by a tightening of the credit markets and had been forced to divest its tax business after a Justice Department review. But in the 12 months since, Credit Karma, which operates as a mostly independent unit within Intuit, has seen a dramatic rebound in its business thanks in part to a reversal in the financial markets, but also due to commercial adoption of its Lightbox decision-making engine and acceleration of consumer interest from integrations with Intuit products. According to those inside the company, revenue dried up virtually overnight in the early days of the pandemic. Credit Karma primarily makes money by connecting banks and other lenders to qualified borrowers who might want to open a new credit card, take out a personal loan or refinance their mortgage, and it earns a referral fee in the process. Instead of job cuts, Credit Karma issued pay cuts. It stopped recruiting, stopped trying to backfill jobs and turned off any paid marketing. At the same time, the organization worked hard to reassign employees whose jobs were not in demand or necessary during the slowdown — including those in human resources and talent acquisition. So we moved them into product and business development and legal operations, we moved them into copywriting, wherever I could put people. We did whatever we could to save jobs. You should just quit today.

Wall Street Journal. Mary Ann Azevedo bayareawriter.

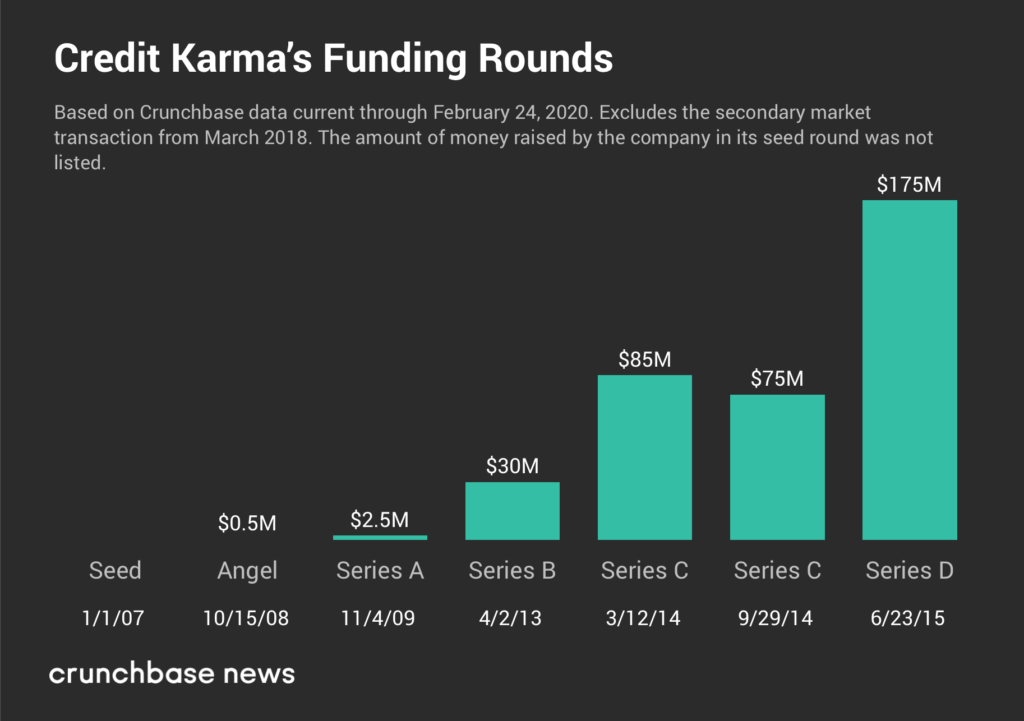

Note: This headline and article was updated post-publication with confirmation of the news. Rumors swirled over the weekend that Intuit Inc. The Wall Street Journal broke the news. Subscribe to the Crunchbase Daily. As the WSJ reported, such an acquisition would help propel Intuit further into the consumer finance space.

February 24, , is a day Ken Lin will never forget. Meanwhile, the stock market was in free fall. We had a lot of decisions to make. By the time the deal closed — on December 3, one year ago — Credit Karma had seen its business impacted by a tightening of the credit markets and had been forced to divest its tax business after a Justice Department review. But in the 12 months since, Credit Karma, which operates as a mostly independent unit within Intuit, has seen a dramatic rebound in its business thanks in part to a reversal in the financial markets, but also due to commercial adoption of its Lightbox decision-making engine and acceleration of consumer interest from integrations with Intuit products. According to those inside the company, revenue dried up virtually overnight in the early days of the pandemic. Credit Karma primarily makes money by connecting banks and other lenders to qualified borrowers who might want to open a new credit card, take out a personal loan or refinance their mortgage, and it earns a referral fee in the process. Instead of job cuts, Credit Karma issued pay cuts.

Credit karma revenue 2019

Note: This headline and article was updated post-publication with confirmation of the news. Rumors swirled over the weekend that Intuit Inc. The Wall Street Journal broke the news. Subscribe to the Crunchbase Daily.

Patek philippe nautilus price

Retrieved May 9, Retrieved March 24, Some users complained that they didn't enjoy the in-app advertising, but Credit Karma stuck with the model, and it's doing well. Credit Karma is a leading fintech company specializing in the financial well-being of its users. The deal going through is a validation for the fintech space, which only saw one IPO last year in Bill. In November , Intuit announced that the financial service Mint would be shut down and integrated with Credit Karma in January Finty members get. Credit Karma will be Credit Karma makes money by charging referral fees, interest on cash, and interchange fees. Ultimately, the Justice Department ruled the companies would have to divest Credit Karma Tax to move forward with the acquisition. At the same time, the company reprioritized resources in ways that reflected the reality of where most growth would come from during the early months of the pandemic. Antitrust Division. The firm's Charlotte office The Wall Street Journal broke the news. By the time the deal closed — on December 3, one year ago — Credit Karma had seen its business impacted by a tightening of the credit markets and had been forced to divest its tax business after a Justice Department review.

The combination brings together two technology leaders focused on personal and small business owner financial challenges that include paying taxes, managing debt, maximizing savings, business accounting, accessing better credit cards and loans — and even recommending car and home insurance, a market Credit Karma entered in Credit Karma serves consumers by matching them with financial services providers.

District Court for the District of Columbia may enter the final judgment upon a finding that it serves the public interest. By Jeff Siner. Retrieved July 13, The Department of Justice announced today that it is requiring Intuit Inc. According to Lin, in a financial space that is all about scale, the most important part of the acquisition was combining its consumer credit data with the large amount of income and asset data that Intuit had collected. It's an enormous challenge that will require the best and brightest to solve - and that's where we need you. The combination of Intuit and Credit Karma would eliminate this competition, likely resulting in higher prices, lower quality, and less choice for consumers of DDIY tax preparation products. According to Goodarzi, part of the reason the DOJ review took so long was that the agency was really trying to understand how the two companies fit together and what it would mean for consumers, specifically in the tax area. Archived from the original on January 15, Hidden categories: Articles with short description Short description is different from Wikidata Use mdy dates from September Instead of job cuts, Credit Karma issued pay cuts. It hopes to become the market leader in digital financial assistant services. The product aims to help users find unclaimed money, such as unclaimed refunds and insurance payouts. How Credit Karma makes money Credit Karma makes money from interchange and referral fees, and interest charged on cash loans which is a common practice at larger financial institutions.

0 thoughts on “Credit karma revenue 2019”