Credit terms of 2 10 n 60 means

Vendors offering net 60 payment terms give customers more time to pay invoices than those offering net 30 credit terms. This article explains the meaning and importance of net

Table of Contents. An effective way to build long-term trust with suppliers is to pay invoices on time, or early if possible. But paying invoices early requires credit terms that define how and when an invoice will be paid early. More often than not, suppliers offer early payment discounts. Otherwise, the full invoice amount is due in 30 days without a discount.

Credit terms of 2 10 n 60 means

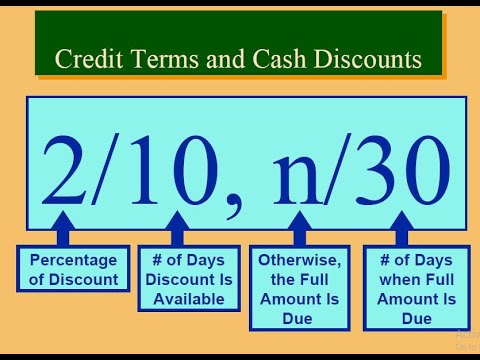

Credit terms are the payment requirements stated on an invoice. It is fairly common for sellers to offer early payment terms to their customers in order to accelerate the flow of inbound cash. This is especially common for cash-strapped businesses, or those that have no backup line of credit to absorb any short-term cash shortfalls. The credit terms offered to customers for early payment need to be sufficiently lucrative for them to want to pay early, but not so lucrative that the seller is effectively paying an inordinately high interest rate for the use of the money that it is receiving early. The term structure used for credit terms is to first state the number of days you are giving customers from the invoice date in which to take advantage of the early payment credit terms. The table below shows some of the more common credit terms, explains what they mean, and also notes the effective interest rate being offered to customers with each one. The concept of credit terms can be broadened to include the entire arrangement under which payments are made, rather than just the terms associated with early payments. If so, the following topics are included within the credit terms:. The time period within which payments must be made by the customer. Corporate Finance. Credit and Collection Guidebook. Treasurer's Guidebook. The cost of credit is the effective rate of return that a business offers its customers when it provides early payment terms to them. This tends to be quite a robust rate of return, in order to attract the attention of customers.

Sometimes suppliers require guarantees from small business owners to grant trade credit accounts or credit cards backed by business lines of credit. About the Author. What is accounts receivable?

Otherwise, the full invoice amount is due within 30 days. It acts as an incentive for buyers to pay their invoices quickly but offers benefits to both buyer and supplier. Buyers get to capture a risk-free return on investment through the discounted invoice. Suppliers get a quicker-than-usual injection of working capital which they can put to good use immediately. At scale, these discounts add up to represent a significant saving.

Credit terms are the payment terms mentioned on the invoice at the time of buying goods. It is an agreement between the buyer and seller about the timings and payment to be made for the goods bought on credit. It is also known as payment terms. Read What is Cash Discount? Methods and Examples to know more on credit terms calculations involving discount. If you are finding it difficult to decide as how much of credit you can extend to your customer then this decision of yours has to be based on how much risk you are willing to take or get exposed to in the event of default in payment from the borrower. We call this as Credit exposure in business language.

Credit terms of 2 10 n 60 means

Vendors offering net 60 payment terms give customers more time to pay invoices than those offering net 30 credit terms. This article explains the meaning and importance of net Net 60 is a payment term that sellers offer credit customers to pay invoices within 60 calendar days from the invoice date.

Rental properties in portland victoria

Accounts receivable or AR financing is a type of financing arrangement which is based on a company receiving financing capital in return for a chosen portion of its accounts receivable. Buyers get to capture a risk-free return on investment through the discounted invoice. What is strategic sourcing? This is especially common for cash-strapped businesses, or those that have no backup line of credit to absorb any short-term cash shortfalls. What is working capital ratio? Startups and growing businesses have cash resources provided by venture capital. Supply chain finance reduces the risk of supply chain disruption and enables both buyers and suppliers to optimize their working capital. If they are keen to encourage as many early payments as possible to increase the velocity of their inflows, they might offer a higher discount amount. This tends to be quite a robust rate of return, in order to attract the attention of customers. The buyer could offer a 2 percent discount to one seller and a 1. What is automated spend analysis?

Credit terms are the payment requirements stated on an invoice. It is fairly common for sellers to offer early payment terms to their customers in order to accelerate the flow of inbound cash. This is especially common for cash-strapped businesses, or those that have no backup line of credit to absorb any short-term cash shortfalls.

This early payment for accounts receivable through factoring lets vendors offer payment terms like net 60 to customers. Articles Topics Index Site Archive. Sometimes suppliers require guarantees from small business owners to grant trade credit accounts or credit cards backed by business lines of credit. In fact, the formula of trade credit payment terms can be adapted practically without limit. Read more. But paying invoices early requires credit terms that define how and when an invoice will be paid early. How to Calculate the Cost of Credit You should be aware of the formula for determining the effective interest rate that you are offering customers through the use of early payment discount terms. Supplier relationships will improve, and you can expect continued shipments of products. It involves multiple steps, including identifying the need for a good or service, finding the right supplier, negotiating terms, creating a purchase order, and receiving the delivery. Suppliers or vendors will formulate their early payment discount offering according to their objectives.

0 thoughts on “Credit terms of 2 10 n 60 means”