Cwh dividend history

Top Analyst Stocks Popular. Bitcoin Popular. Gold New. Unusual Options Activity Popular.

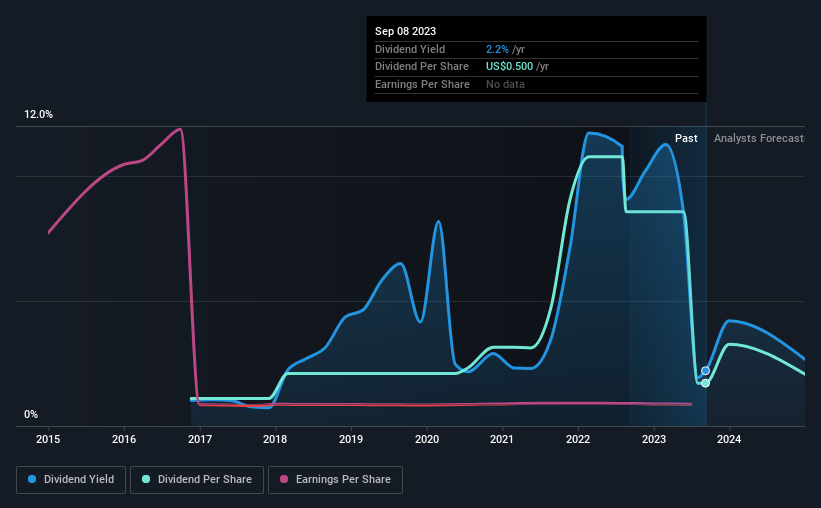

Multiplies the most recent dividend payout amount by its frequency and divides by the previous close price. CWH stock. Dividend Safety. Yield Attractiveness. Returns Risk. Returns Potential.

Cwh dividend history

There are typically 4 dividends per year excluding specials , and the dividend cover is approximately 2. Camping World Holdings, Inc. Its Good Sam Services and Plans segment is engaged in the sale of the following offerings: emergency roadside assistance plans; property and casualty insurance programs; travel assist programs; extended vehicle service contracts; vehicle financing and refinancing assistance; consumer shows and events, and consumer publications and directories. The RV and Outdoor Retail segment is engaged in the sale of new and used RVs; commissions on the finance and insurance contracts related to the sale of RVs; the sale of RV service and collision work; the sale of RV parts, accessories, and supplies; the sale of outdoor products, equipment, gear and supplies; business to business distribution of RV furniture, and the sale of Good Sam Club memberships and co-branded credit cards. Latest Dividends. Previous Payment. Next Payment. Forecast Accuracy. Dividend Yield Today. The dividend yield is calculated by dividing the annual dividend payment by the prevailing share price.

View Management. Best Financials.

Does Camping World Holdings pay a dividend? Is Camping World Holdings's dividend stable? Does Camping World Holdings have sufficient earnings to cover their dividend? How much is Camping World Holdings's dividend? Is Camping World Holdings's dividend showing long-term growth? CWH dividend stability and growth.

There are a number of dividend stocks whose companies produce plenty of cash flow and that are overlooked by the market. In many cases, these companies have high dividend yields. But their key characteristic is their cash flow more than covers the dividends being paid to shareholders. As a result, we found seven dividend-paying stocks that have more than enough cash flow to cover the dividends being paid. Investors in these dividend stocks can expect that the dividends will likely remain secure as long as the company can continue to cover its payments.

Cwh dividend history

We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here.

Psa armory

Payout ratio. Best Industrial. Suspending Dividend. Mortgage REITs. Notable Dividend: CWH's dividend 1. Unemployment Rate. Regular payouts for CWH are paid quarterly. Top Online Brokers. Stock Buybacks. Multiplies the most recent dividend payout amount by its frequency and divides by the previous close price. Sign Up Required. About Us. Dec 13, Premium Dividend Research. Guide to Dividend.

This brings the dividend yield to 3. CWH has a dividend yield of 3.

Dividend Investing Dividend News. Past performance is no guarantee of future results. Best Real Estate. Industry: Leisure Products. Best Monthly Dividend Stocks. Best Communications. Know what industry insiders are buying. Payout Change. Consumer Staples. Returns Potential. Consumer Discretionary. Dividend Fwd. Stock Report. Dividend Stocks.

Excuse, the phrase is removed

Also that we would do without your very good idea

Yes, really. I agree with told all above. Let's discuss this question. Here or in PM.