Cyber security etf

In this article, we discuss 10 best cybersecurity ETFs to buy. If you want to skip our detailed discussion on the cybersecurity market, head directly to 5 Cyber security etf Cybersecurity ETFs, cyber security etf. Canalysa technology research firm, noted that despite deteriorating macroeconomic conditions, the global cybersecurity market demonstrated robust growth of This growth rate exceeded that of the broader technology industry.

The above results are hypothetical and are intended for illustrative purposes only. Fund expenses, including management fees and other expenses, were deducted. As a result of the risks and limitations inherent in hypothetical performance data, hypothetical results may differ from actual performance. Unlike an actual performance record, simulated results do not represent actual performance and are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk.

Cyber security etf

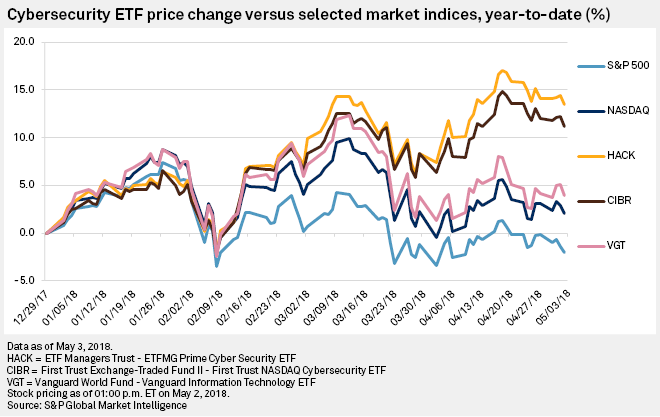

Three top-performing ETFs offer investors exposure to the growing cybersecurity market without tying their investment to single stock. Four ETFs trade in the U. We examine the three top-performing cybersecurity ETF. All numbers are as of Dec. CIBR is a multi-cap growth fund targeting U. It tracks the Nasdaq CTA Cybersecurity Index, made up of companies that focus on cybersecurity on the industrials and technology sectors. The fund is diversified across market caps, business focus, and geography, with its top 10 holdings representing about half of invested assets. VRSN , which provides domain name registry and internet infrastructure services. The comments, opinions, and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or adopt any investment strategy. Though we believe the information provided herein is reliable, we do not warrant its accuracy or completeness.

There are numerous other factors related to the markets in general or the implementation of any specific investment strategy, which cannot be fully accounted for the in the preparation of simulated results and all of which can adversely affect actual results, cyber security etf. Sustainability Characteristics Sustainability Characteristics Sustainability Characteristics provide investors with specific non-traditional metrics. Market Cap.

The ETF total return may appear to diverge from the return of its benchmark. This may be due to the use of systematic fair value. Click here for more information. Rapid growth in spending for cybersecurity could create exciting new investment opportunities. Sustainability Characteristics provide investors with specific non-traditional metrics.

The ETF total return may appear to diverge from the return of its benchmark. This may be due to the use of systematic fair value. Click here for more information. Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics. Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund. They are provided for transparency and for information purposes only. Sustainability Characteristics should not be considered solely or in isolation, but instead are one type of information that investors may wish to consider when assessing a fund. Learn more.

Cyber security etf

In this article, we discuss 10 best cybersecurity ETFs to buy. If you want to skip our detailed discussion on the cybersecurity market, head directly to 5 Best Cybersecurity ETFs. Canalys , a technology research firm, noted that despite deteriorating macroeconomic conditions, the global cybersecurity market demonstrated robust growth of This growth rate exceeded that of the broader technology industry. The Q1 results aligned with Canalys' optimistic projections. Identity security and securing hybrid workers were the core focus, driving investments in Secure Web and Email SSE security, which grew by Palo Alto Networks, Inc.

Best eye doctor in murfreesboro tn

The views and strategies described in our content may not be suitable for all investors. If the Fund invests in any underlying fund, certain portfolio information, including sustainability characteristics and business-involvement metrics, provided for the Fund may include information on a look-through basis of such underlying fund, to the extent available. Investopedia requires writers to use primary sources to support their work. Content continues below advertisement. Three top-performing ETFs offer investors exposure to the growing cybersecurity market without tying their investment to single stock. Distribution Frequency Semi-Annual. Manage Cookies. Measure advertising performance. The International Data Corporation has reported that the artificial intelligence AI segment within the cybersecurity industry is expanding at a compound annual growth rate CAGR of Key Takeaways The cybersecurity industry has underperformed the broader market in the past year. Learn more This fund does not seek to follow a sustainable, impact or ESG investment strategy. Annualized return is the average return gained or lost by an investment each year over a given time period.

The number of cyberattacks is increasing — here are four cybersecurity ETFs focused on companies looking to combat this growing threat.

The information displayed on this website may not include all of the screens that apply to the relevant index or the relevant fund. Consider Active ETFs. Current performance may be lower or higher than the performance quoted. If the Fund invests in any underlying fund, certain portfolio information, including sustainability characteristics and business-involvement metrics, provided for the Fund may include information on a look-through basis of such underlying fund, to the extent available. Literature Literature. The amounts shown above are as of the current prospectus, but may not include extraordinary expenses incurred by the Fund over the past fiscal year. However, in this article, we discuss the best cybersecurity ETFs, which provide access to a diverse portfolio of cybersecurity stocks. MSCI Emg. Equity Beta 3y Calculated vs. Investopedia requires writers to use primary sources to support their work.

Absolutely with you it agree. It is good idea. I support you.