Does doordash provide a 1099

How do taxes work with Doordash? Read more.

As an independent contractor, the responsibility to pay your taxes falls on your shoulders. Each year, tax season kicks off with tax forms that show all the important information from the previous year. These items can be reported on Schedule C. Note: Form NEC is new. Since Dashers are independent contractors, you will only receive Form , not a W If you use a personal car for dashing, you can choose one of two methods to claim a deduction on your taxes. However, using the standard mileage method you can generally still deduct the following items separately: tolls and parking fees, auto loan interest, and personal property taxes.

Does doordash provide a 1099

DoorDash is a food delivery service that has been gaining popularity over the past few years. For a lot of taxpayers, DoorDash is the 1st place that they worked that they were issued a NEC tax form and have to pay taxes on a Schedule C. This form must be reported on your tax return as self-employment income on a Schedule C. Deductions for delivery drivers — Filing quarterly taxes as a freelance delivery driver for Postmates is a massive task. Instacart delivery drivers are responsible for paying taxes on their income and need the right information about every Instacart tax form. Doordash most likely issues a NEC form to the drivers as the business owner. Then the independent contractor taxpayer has to report this on Schedule C on their tax return to generate their tax bill during the tax season. Some states may require that they pay the drivers with a W2. DoorDash is responsible for filing appropriate forms with each jurisdiction, including NEC forms for subcontractors. The taxpayer can deduct business expenses from this amount to lower their tax during the tax season. As a Driver, you have to keep track of your expenses.

These taxes are generally deductible on Schedule C.

Christian is a copywriter from Portland, Oregon that specializes in financial writing. He has published books, and loves to help independent contractors save money on their taxes. Being a self-employed delivery driver definitely has its perks. You never know where you'll go next, and there's nobody looking over your shoulder. And if you know all the DoorDash tips and tricks , you can stand to make a lot of money.

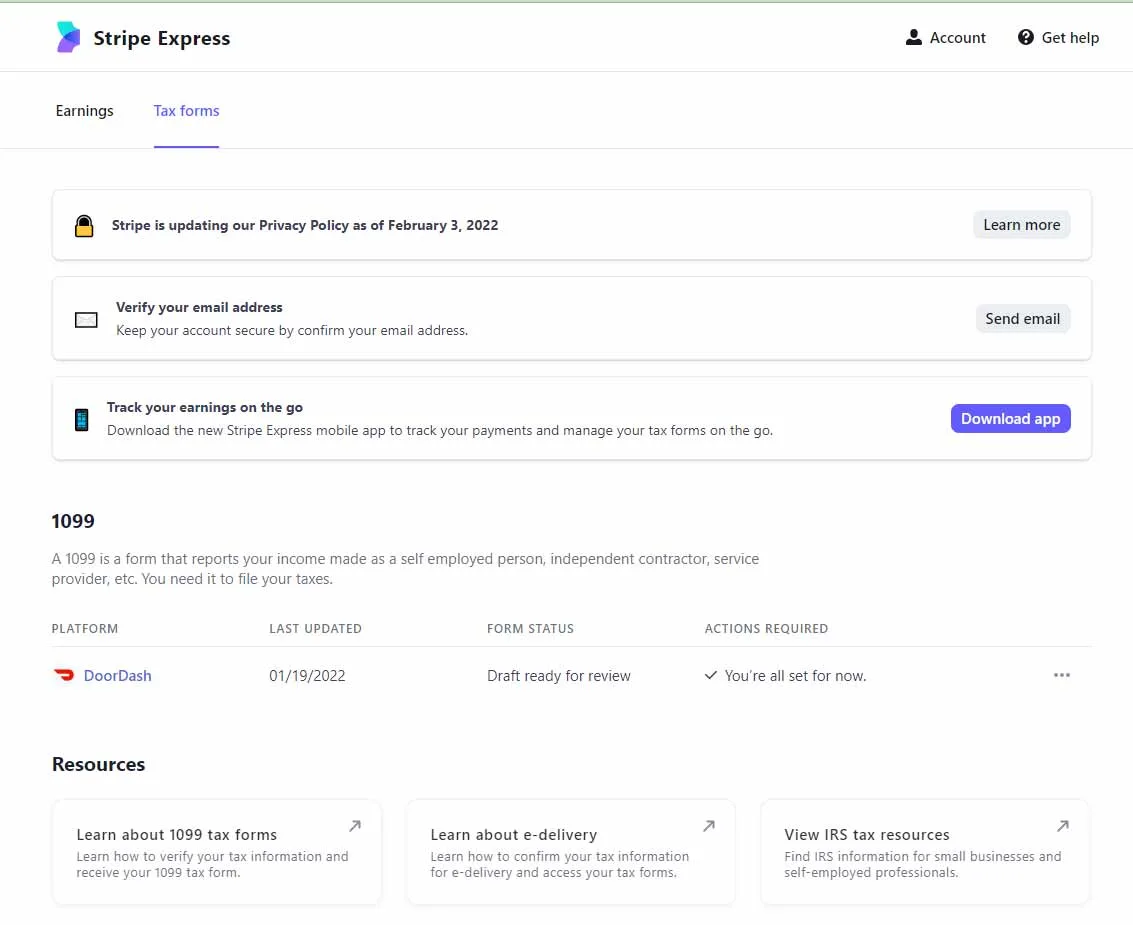

DoorDash partners with Stripe to file tax forms that summarize your earnings or sales activities. If you have already created a Stripe Express account, you can log in to manage your tax information at connect. A K form summarizes your sales activity as a Merchant. Stripe Express allows you to update your tax information, download your tax forms, and track your earnings. You should expect to sent an E-delivery notification for your K if you meet the following criteria in If you are unable to find that email, head to our Support Site where you can request a new link to be sent to your email. If you still are not able to locate your invite email, please reach out to DoorDash support for help updating your email address.

Does doordash provide a 1099

Home Delivery. Since , Brett Helling has built expertise in the rideshare and delivery sectors, working with major platforms like Uber, Lyft, and DoorDash. He acquired Ridester. Expanding his reach, Brett founded Gigworker. More about Brett How we publish content. DoorDash recognizes its dashers as independent contractors responsible for keeping track of their total earnings and filing their taxes. These DoorDash tax deductions apply to employees and self-employed workers. They cover social security 6. For employees, the above figures apply because employers cover half of the estimated tax payments for their W-2 employees amounting to 7. This means if you work with DoorDash as a full-time gig with no W-2 employer to cover half of the bill, your self-employment tax rate goes up to

Tapetes de halloween

Please refer to Dasher guide to taxes and a Merchant guide to taxes for these inquires. Technically, both employees and independent contractors are on the hook for these. This will help give you peace of mind, knowing how to process Door Dash or Uber tax returns. Real estate agent. Now, let's talk about how you can get your lowest possible tax bill by writing off business expenses. Self-Employment Tax: Independent contractors as small business owners are responsible for paying their federal and FICA taxes every quarter. Learn more about the safeguards we've put in place to protect your information. In early January, expect an email inviting you to set up a Stripe Express Account. You have two options for receiving your from Doordash: electronic copy by email or paper copy by mail. Filing quarterly taxes as a freelance delivery driver for Postmates is a massive task. If this all sounds intimidating, take heart. It is important to review tax summary and ensure it is accurate to ensure you do not face any penalties or fees should the IRS audit you. The IRS requires you to keep detailed records of all business-related transactions, including receipts, to ensure compliance with tax regulations. Some states may require that they pay the drivers with a W2.

Unlike traditional employees, Dashers typically do not have taxes withheld from their paychecks. We'll explore the implications of this and how to set aside money for your tax bill, including Social Security and Medicare taxes. Unlike regular employees, Dashers usually do not have taxes taken out of their pay.

DoorDash and Uber will also provide you with a tax form. Online seller. Luckily, you can also estimate your tax bill using our income tax calculator. If you create a Stripe Express account and agree to paperless delivery, Stripe will email you to let you know when your tax form is available for download via Stripe Express. A K form summarizes your sales activity as a Merchant. Of course, there are advantages to doing it this way. There is some good news here: you're allowed to write off the employer portion of your FICA taxes on your income tax return. Childcare provider. Pressure washer owner. Schedule C Used to figure out how much profit or loss you made as a sole proprietor. Truck driver. DoorDash also withholds taxes from the earnings of its drivers and other contractors.

0 thoughts on “Does doordash provide a 1099”