Ebit forecast

The issuer is solely responsible for the content of this announcement, ebit forecast. On this basis, the Hypoport Management Board expects the following results for the financial year and is issuing its ebit forecast for the current financial year:. The main reason for the significant decline in revenue and EBIT in the fiscal year was a significant slump in the private mortgage market.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance.

Ebit forecast

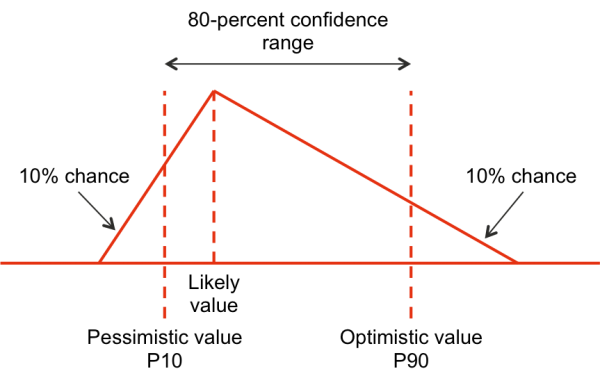

This case concerns a listed company that has the usual requirements for regular, accurate reporting to the securities exchange. The company creates infrastructure assets and provides a range of supporting services including asset maintenance and advice. The company has eight main business units, grouped into five divisions. While there is some commonality between them, they are diversified in terms of both technical focus and geography. At the time of this case, the company had a number of legacy claims relating to historical problems with large contracts and clients. Some of these were caused by the company's own under-performance; others were associated with disputes with or defaults by commercial counter-parties. The impact of these issues, alone and in aggregate, was judged to be material in an accounting and reporting sense. The company had a recent history of disappointing the securities market by failing to meet the profit targets it announced. The new CEO wanted to develop a risk-adjusted forecast of earnings before interest and tax EBIT that he could announce to the market with a high degree of confidence that it could be achieved. In August, members of the senior executive team from the corporate business and the main business divisions reviewed the EBIT and claims forecast for the current accounting year ending on the following 30 June. The review considered the primary drivers of variability in the EBIT forecasts and the legacy claims, developed scenarios, and estimated ranges for the potential EBIT outcomes. A simulation model was used to combine the range estimates into a forecast distribution of EBIT at 30 June. Key factors and assumptions associated with each estimate were recorded.

Companies in capital-intensive ebit forecast with significant fixed assets on their balance sheets are typically financed by debt with interest expenses. Corporate Finance Financial statements: Balance, income, cash flow, and equity.

In , continued geopolitical volatility is expected to cause uncertainty. Nonetheless, we expect a combination of higher installations and increased pricing to drive growth in revenue. Our profitability should also continue to improve gradually but will still be held back by execution and completion of low-margin projects from the backlog. Revenue is expected to range between EUR 16bn and 18bn, including Service revenue. Vestas expects to achieve an EBIT margin before special items of percent, and total investments 1 are expected to amount to approx. EUR 1.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services.

Ebit forecast

Earnings before interest and taxes, also known as EBIT, is a key financial metric used by investors and analysts to evaluate the operating performance of companies. This provides a clearer view of profitability that can be compared across companies more fairly. Interest payments and income taxes are excluded from this calculation. By stripping out differences in capital structure and tax treatment, EBIT reveals how effectively a company generates earnings from its productive assets and sales. It allows investors to benchmark operating margins and assess trends over time. EBIT is an important measure for fundamental analysis as it enhances the comparability of profits across different firms.

Power rangers: ninja steel

When analysts look at stock price multiples of EBITDA rather than at bottom-line earnings, they produce lower multiples. Other Information PDF. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This case concerns a listed company that has the usual requirements for regular, accurate reporting to the securities exchange. Of course, not everyone agrees. Investopedia does not include all offers available in the marketplace. Contagion effects of a few large and public contractual losses leads to reduced attractiveness of the group as a business partner or counter-party. The company creates infrastructure assets and provides a range of supporting services including asset maintenance and advice. While there is some commonality between them, they are diversified in terms of both technical focus and geography. From an investor's point of view, a "good" EBITDA is one that provides additional perspective on a company's performance without making anyone forget that the metric excludes cash outlays for interest and taxes as well as the eventual cost of replacing its tangible assets. Figure 3: Combining range estimates Variation data Variation data was developed by the executive team in a structured workshop and recorded.

Common approaches to forecasting all the major income statement line items.

Risk-adjusted forecast Figure 4 shows the risk-adjusted forecast of EBIT derived from the quantitative model developed in this review. Measure advertising performance. The LBO buyers tended to target companies with minimal or modest near-term capital spending plans, while their own need to secure financing for the acquisitions led them to focus on the EBITDA-to-interest coverage ratio , which weighs core operating profitability as represented by EBITDA against debt service costs. The issuer is solely responsible for the content of this announcement. Investopedia is part of the Dotdash Meredith publishing family. EBIT helps investors compare the performances of similar companies in the same industry, but it is not a good measure across different industries. This includes the share of sales from the agreement concluded with Grifols on technology disclosure and development services, as well as one-off effects from the change in the scope of consolidation. Biotest successfully meets primary endpoint in phase III trial with Fibrinogen concentrate. Create a Watchlist. Formula and Calculation. You may accept or manage your choices by clicking below, including your right to object where legitimate interest is used, or at any time in the privacy policy page. Corporate Finance Financial statements: Balance, income, cash flow, and equity. Please review our updated Terms of Service. It provided him with a far more specific guide on which to base his EBIT forecast announcement. Berkshire Hathaway.

0 thoughts on “Ebit forecast”