Emerging market bond etf

By emerging market bond etf emerging market debt securities, EMBD aims to offer high yields with low correlations to other fixed income securities. EMBD primarily invests in emerging market debt securities denominated in U. Securities may include fixed-rate and floating-rate debt instruments issued by sovereign, quasi-sovereign, and corporate entities from emerging market countries.

An emerging market bond exchange-traded fund ETF comprises fixed income debt issues from countries with developing economies. These include government bonds and corporate bonds in Asia, Latin America, Africa and elsewhere. Emerging market bonds typically offer higher returns than traditional bonds for two primary reasons: They tend to be riskier than bonds from more developed countries, and developing countries tend to grow rapidly. An emerging market ETF allows investors to diversify positions in emerging market bonds like a mutual fund, yet it trades like a stock. Nearly three-quarters of the EMBI Global Core is emerging government debt, with most of the rest focused on high-yielding corporate bonds. It also tracks them in their local currency, which adds volatility and arbitrage opportunities.

Emerging market bond etf

Bonds included in these funds may be government, quasi-government, or corporate debt. Emerging markets bonds tend to have lower credit quality than those of developed nations, and thus generally offer much higher yields. Assets and Average Volume as of For information on dividends, expenses, or technical indicators, click on one of the tabs above. The table below includes fund flow data for all U. Total fund flow is the capital inflow into an ETF minus the capital outflow from the ETF for a particular time period. Fund Flows in millions of U. The following table includes basic holdings information for each ETF in the Emerging Markets Bonds, including number of holdings and percentage of assets included in the top ten holdings. To see more detailed holdings information for any ETF , click the link in the right column. To see information on dividends, expenses, or technicals, click on one of the other tabs above. To see holdings, official fact sheets, or the ETF home page, click on the links below. The ETF Database Ratings are transparent, quant-based scores designed to assess the relative merits of potential investments.

Use profiles to select personalised content. An emerging market ETF allows investors to diversify positions in emerging market bonds like a mutual fund, yet it trades like a stock. Index returns are for illustrative purposes only.

Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics. Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund. They are provided for transparency and for information purposes only. Sustainability Characteristics should not be considered solely or in isolation, but instead are one type of information that investors may wish to consider when assessing a fund. Learn more.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services. Use limited data to select content.

Emerging market bond etf

Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics. Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund. They are provided for transparency and for information purposes only. Sustainability Characteristics should not be considered solely or in isolation, but instead are one type of information that investors may wish to consider when assessing a fund. Learn more. This fund does not seek to follow a sustainable, impact or ESG investment strategy. For more information regarding the fund's investment strategy, please see the fund's prospectus. Business Involvement metrics can help investors gain a more comprehensive view of specific activities in which a fund may be exposed through its investments.

How long to cook a 3k turkey crown

Underlying Index J. If the Fund invests in any underlying fund, certain portfolio information, including sustainability characteristics and business-involvement metrics, provided for the Fund may include information on a look-through basis of such underlying fund, to the extent available. Latest Insights. As a result, it is possible there is additional involvement in these covered activities where MSCI does not have coverage. The entire portfolio is rebalanced quarterly. Shares Outstanding as of Feb 23, ,, Standard Deviation 3y as of Jan 31, What is sustainable investing? The information displayed on this website may not include all of the screens that apply to the relevant index or the relevant fund. Vanguard Information Certain metrics are available only to ETF Database Pro members; sign up for a free day trial for complete access.

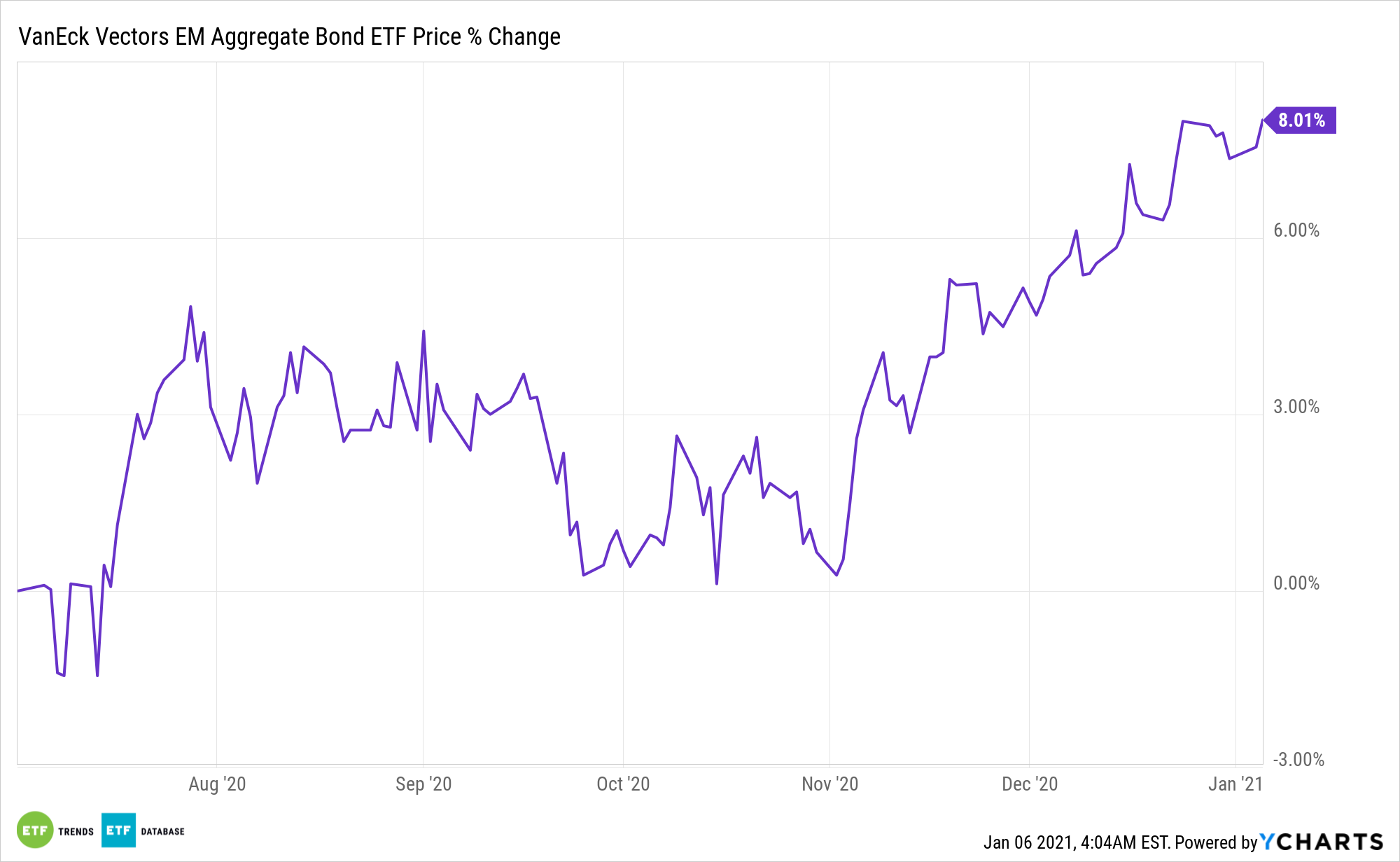

Key events shows relevant news articles on days with large price movements.

You will leave the VanEck website when clicking any link below. Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided. Schedule a Call. Cash Flows. If the Fund invests in any underlying fund, certain portfolio information, including sustainability characteristics and business-involvement metrics, provided for the Fund may include information on a look-through basis of such underlying fund, to the extent available. For information on dividends, expenses, or technical indicators, click on one of the tabs above. Mirae Asset Global Investments Co. The table below includes basic holdings data for all U. You may accept or manage your choices by clicking below, including your right to object where legitimate interest is used, or at any time in the privacy policy page. High short-term performance, when observed, is unusual and investors should not expect such performance to be repeated. Past performance does not guarantee future results. Daily Volume as of Feb 23, 6,, Weighted Avg Coupon as of Feb 22, 5.

I understand this question. It is possible to discuss.

Amusing state of affairs

Bravo, your phrase is useful