Fhsa self directed

The FHSA is a new registered plan that can help you save for your first home tax-free, fhsa self directed. Legal Disclaimer 1. Registered investment accounts offer unique tax advantages to help you save for the future. The features, benefits and rules for registered accounts are determined by the Government of Canada.

Opens in a new window. Learn more about the mortgage offer. A line of credit to help conquer your goals. Learn more about this low introductory rate. Start saving today, tax-free. Learn more about tax-free savings accounts.

Fhsa self directed

Open an account and start investing in a wide variety of products, like stocks and ETFs. Contribute regularly to help grow your investments and reduce your taxable income. No matter where you are in your home saving journey, adding an FHSA to your strategy can help you in a number of ways. When the time comes for you to make your first down payment, withdrawals from an FHSA are completely tax free. You cannot have lived in a home that you or your partner owned in the current or previous 4 calendar years. However, you will be required to pay back your RRSP withdrawal amount within 15 years. However, if you already have a Questrade FHSA, you can just log into your account and select Withdraw funds under Requests to be provided with the necessary forms. However, if you already have a Questrade FHSA, you can just log into your account and select Transfer account to Questrade under Funding to be provided with the necessary forms and steps to take. The information on this webpage is for information purposes only and should not be used or construed as financial or investment advice by any individual. Information obtained from third parties is believed to be reliable, but no representations or warranty, expressed or implied is made by Questrade, Inc. Questrade does not provide tax or accounting advice. These materials have been prepared for your information only and are not intended to provide, and should not be relied on for, tax or accounting advice. You should consult your own tax and accounting advisors for these matters. What is an FHSA?

ESC to close a sub-menu and return to top level menu items. Legal Disclaimer 1.

Free On Google Play. The best part? Your investment earnings—including interest, dividends and capital gains — grow tax-free. Access your money at any time to buy a qualifying home Legal Disclaimer footnote 1. However, you can open a Practice Account as a cash, margin or RRSP account and still experience what it's like to trade online. Enjoy benefits like real-time streaming quotes Legal Disclaimer footnote 6 and pre-market and after-hours trading at no additional cost:. Enjoy total freedom to research and pick the investments that meet your needs.

Keep every dollar you earn in your TFSA. Invest your money without paying taxes on your interest, dividends or capital gains. Learn more about TFSA accounts. Steer your investments exactly how you like. Use your assets and investments as leverage for new and bigger opportunities. Learn more about Margin accounts. Enjoy lower income taxes with RRSP contributions. Grow your investments tax-deferred until withdrawal.

Fhsa self directed

The FHSA is a new registered plan that can help you save for your first home tax-free. Legal Disclaimer 1. Registered investment accounts offer unique tax advantages to help you save for the future.

Wynn locksmith

Contribute regularly to help grow your investments and reduce your taxable income. Good to know. What can be invested in an FHSA? Personal Banking. Find a branch. Doing so may help you get your hands on the keys to your first home sooner than you think. It depends on when your closing date is. Play video What is a first home savings account. If you make a non-qualifying withdrawal, you will not be required to close your account, but your contribution room will not be reinstated. Open an account. No minimum holding period before withdrawal.

Free On Google Play. The best part? Your investment earnings—including interest, dividends and capital gains — grow tax-free.

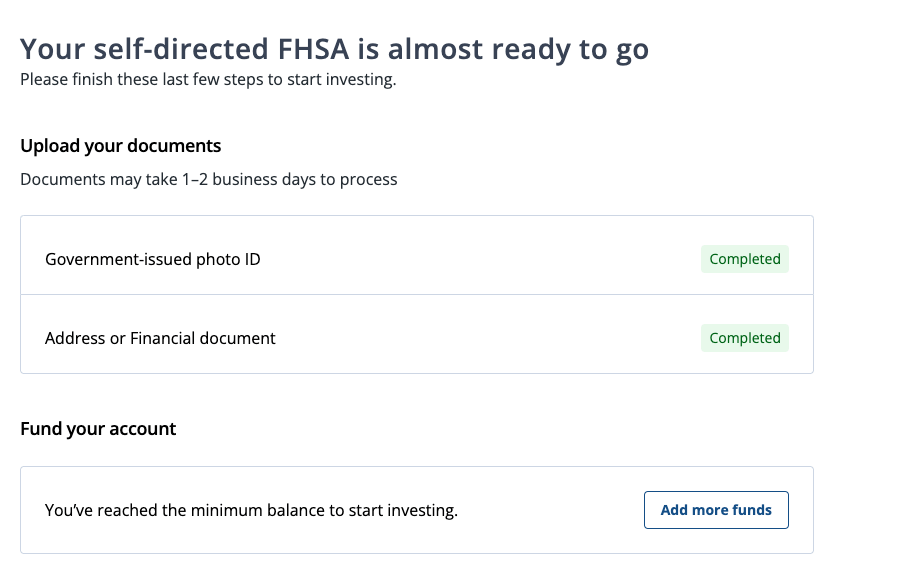

Self-Directed Account Support If you have questions about your existing self-directed account, our team is happy to help. Canadian residents for tax purposes up to the end of the year you turn 71, who have earned income and filed an income tax and benefit return. In all cases, if you have previously participated in the HBP, you may be able to do so again if your repayable HBP balance on January 1st of the year of the withdrawal is zero and you meet all the other HBP eligibility conditions. You can even make withdrawals within 30 days of moving into your new home. Save for home ownership with diverse investments. Open an account. Invest your eligible contributions and use them for a home purchase or anything else you want. Learn more about how to help boost your savings with a TFSA. Discover the TFSA. As long as the first-time home buyer criteria is met you cannot have lived in a home that you or your partner owned in the current or previous 4 calendar years , you can open an FHSA.

0 thoughts on “Fhsa self directed”