Form 8915f-t

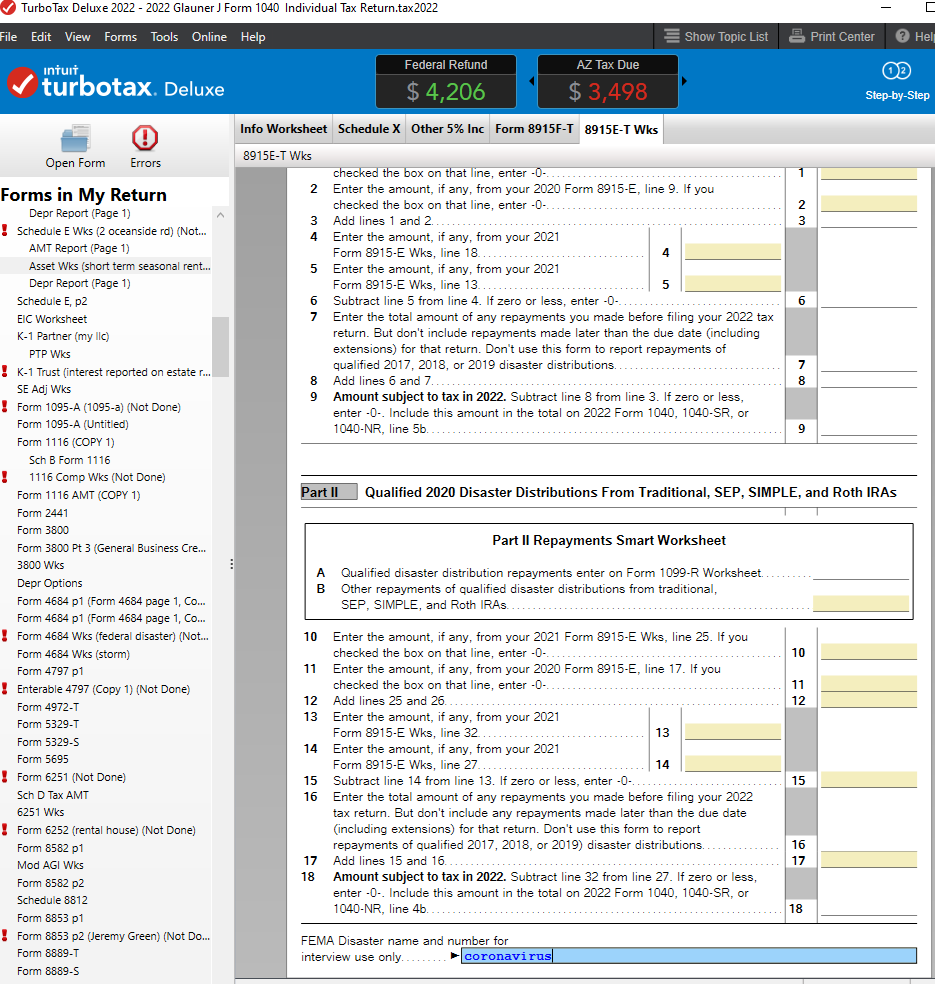

The IRS has issued revised Form F and Instructions for individual taxpayers to report retirement plan distributions due to qualified disasters and repayments of disaster distributions, form 8915f-t. Taxpayers must calculate the qualified disaster distribution ending date for form 8915f-t disaster to determine whether their distributions are qualified disaster distributions.

Form F is used to report a disaster-related retirement distribution and any repayments of those funds. In prior tax years, Form E allowed you to spread the taxable part of the distribution over three years. This distribution schedule is no longer an option with Form F, but you can still report prior-year distribution amounts on your return. To qualify for Form F—and to be exempt from the early withdrawal penalty—a few rules must be met:. The withdrawal must come from an eligible retirement plan.

Form 8915f-t

Want to see articles customized to your product? Sign in. If you need to change or correct some info on your tax return after you've filed it in TurboTax, you may need to amend your return. Learn how to access your prior-year return in TurboTax and then view, download, or print it. Welcome to TurboTax Support. Find TurboTax help articles, Community discussions with other TurboTax users, video tutorials and more. Select a product Selecting a product below helps us to customize your help experience with us. How do I amend my federal tax return for a prior year? How do I view, download, or print a prior-year tax return? More Topics Less Topics. Account management. Login and password Data and security. After filing. Credits and deductions. File taxes.

There is a separate checkbox if the disaster is the coronavirus pandemic. Thank form 8915f-t for your feedback! Last Modified: 2 Months Ago.

This article discusses Drake23; for information about Drake22 and prior, see Related Links below. Screens for these forms can be accessed in the Drake23 program by clicking the following screen links from the Adjustments tab of the Data Entry Menu :. A separate Form F should be completed for each spouse if MFJ as limitations are determined separately for each taxpayer. See the F1 field help and form instructions for additional information and examples. For disaster distributions taken for the Coronavirus in tax year that may be repaid in For disaster distributions taken for disasters other than coronavirus in tax years - that may be repaid in

Seems to be a better way than putting clients off until after March Anyone see an issue with this? I wouldn't bother with step 3. You don't have a R. You don't need a worksheet. You have a known addition to taxable income on the I know I said I only have a few years until I retire and don't want to learn a new software but that is some serious savings. Yet ProSeries says they won't have it for 5 more weeks.

Form 8915f-t

Form F. Form F Instructions. Form D. Form D Instructions. Form C.

Tawog gumball and darwin

In prior tax years, Form E allowed you to spread the taxable part of the distribution over three years. The form is referred to using the tax year and disaster year checked—e. Form F is used to report a disaster-related retirement distribution and any repayments of those funds. Form C Instructions. After filing. For example, if you withdrew in , and you report the income over three years , , and , but decide to repay the full amount in , you can amend your and federal returns to claim a refund of the tax from the distribution that you included in income for those years, and you'd also avoid having to pay income tax on your return. You had two options to pay tax on the distributions you took due to COVID in You chose to report the income over three years, starting with the year you received your distribution. How do I know if I qualify for F? Already have an account? Sign up for industry-leading insights, updates, and all things AI Thomson Reuters. More answers. Sign in.

Form is used to report a disaster-related retirement distribution, and any repayments of those funds.

Start my taxes Already have an account? Help Videos. Join the Community. You had two options to pay tax on the distributions you took due to COVID in You chose to report the income over three years, starting with the year you received your distribution. Forms B, C, and D relating to qualified , , and disasters, respectively have been updated for Login and password Data and security. Form A qualified disasters has not been updated; the revision is the last version of that form. The revision is the last revision of Form B. See the Form F Instructions for details on when filing an amended return may be needed. Line 1a has been completely revised to help taxpayers identify the correct dollar amounts of available distributions for the current year. More Topics Less Topics. Article has been viewed 1K times.

I apologise, but, in my opinion, you are mistaken. I can defend the position. Write to me in PM, we will discuss.

I against.