Gold seasonality chart

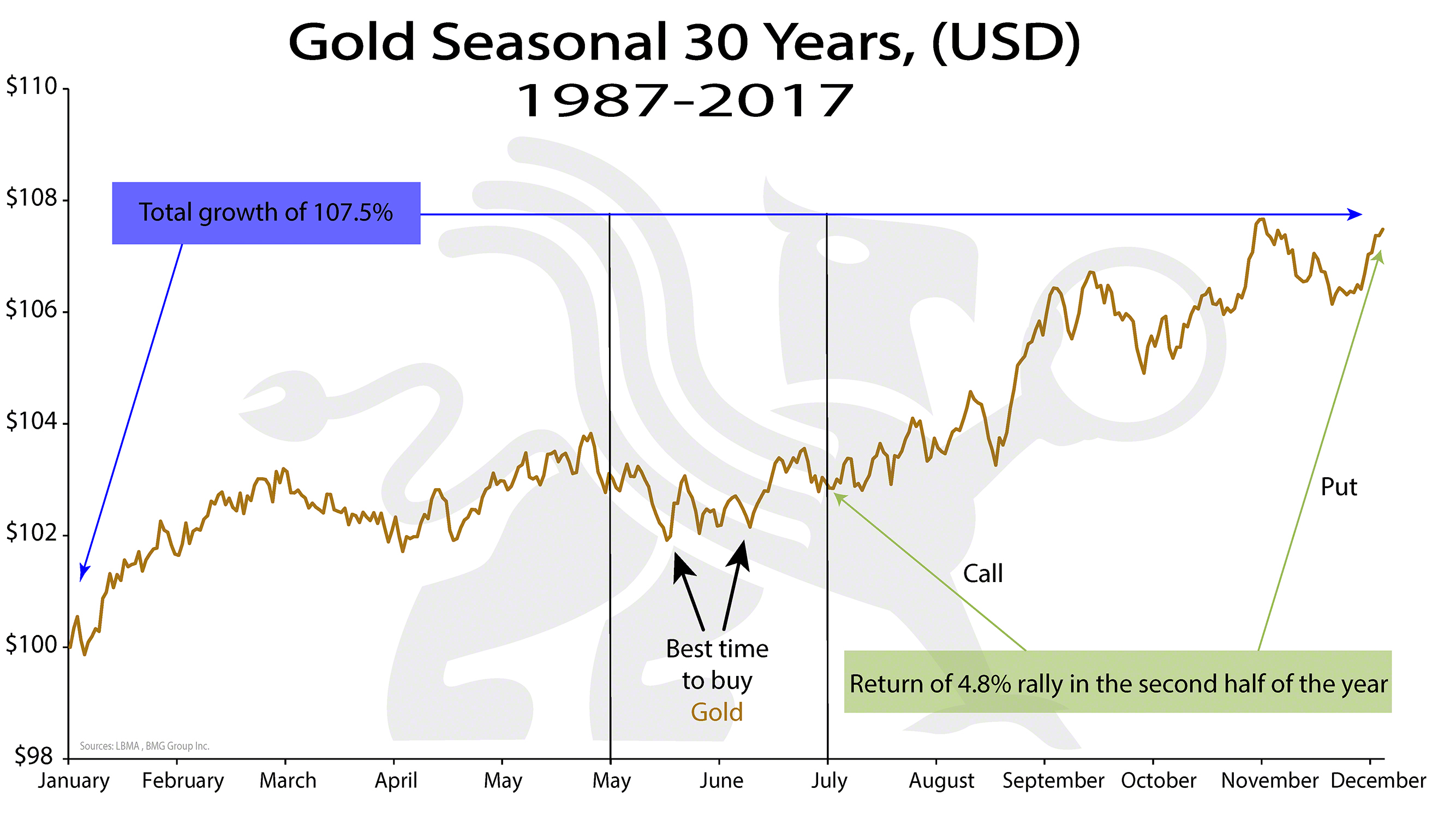

Contact RSS Feed, gold seasonality chart. Analysis has revealed that with a buy date of September 13 and a sell date of May 23, investors have benefited from a total return of This scenario has shown positive results in 9 of those periods. Conversely, the best return over gold seasonality chart maximum number of positive periods reveals a buy date of September 16 and a sell date of May 20, producing a total return over the same year range of

You can create charts for all futures markets and compare them at different time intervals. Create additional analyses such as TDOM statistics. When looking at the price trends on the futures markets over a longer period, it is noticeable that certain patterns are repeated at regular intervals. Commodity markets are range-bound markets. Over a long period of time, the prices fluctuate between upper and lower limit.

Gold seasonality chart

Many investors and traders are surprised to find out that gold is a seasonal commodity. For various reasons, notably the wedding season in India, there are repeatable patterns that occur annually that can help you time your trades for more precise entries, as well as tell you when to sell your position to take profits. Seasonality is an amazing tool to add to your belt when you are trading gold , whether it is as an investor or swing trader. From a statistical standpoint, the month of September yields an average return of over 1. The next two best months for trading the gold and owning the metal are July and November. The worst gold seasonality months are February, March and October. It is very important as a trader and investor that you are familiar with the seasonal strength of an asset, so you are prepared to take advantage of price moves and know when to exit positions to maximize your profits and probability. By no means does it mean that every single year has to adhere to seasonality to the same degree, but there is a strong tendency for the price of gold to stick to the script. Another way to track seasonality is to be able to plot it directly on your trading chart, so you can overlay the price and seasonal trend for direct comparison. If you are unfamiliar with TradingView, it is hands down the best online charting software you will find.

You can create charts for all futures markets and compare them at different time intervals, gold seasonality chart. They should not be considered as advice to purchase or to sell mentioned securities. What happened?

Thank you for reading Energy Macro Rates Sentiment Technical. Log Out Log IN. Seasonality Positioning Correlation Liquidity Volatility. Backtest GLD. Click the green button to start performing no-code quant analysis on this security. Although this seems like a fair way of predicting future profits given that they have some level expertise in investment banking, studies show there's still an optimism bias present among these professionals.

Subscription Plans Features. Developer Docs Features. Already a user? App Store Google Play Twitter. Customers Investors Careers About us Contact. Summary Stats Forecast Alerts. Gold increased Historically, Gold reached an all time high of

Gold seasonality chart

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use. EN Get started. UnknownUnicorn Premium Updated. Fibonacci Seasonality Economic Cycles goldcycles. The Annual Gold Cycle is one of the most useful and consistent trends that exist across markets. The reason I think so is because of what higher demand for gold can contextually imply about general risk sentiment. For example, knowing that November is a time-tested period for increased gold demand, one can ascertain the general appetite of other risk assets based on Gold's price action or lack thereof in this case. Further, a basic understanding of key seasonality trends can save you several poor entries per year that result from asset rotation. Perhaps it can save you a devastating loss or two as well.

Pliable crossword clue

Some things repeat each year, but some things are very different, and the longer the time frame is being considered, the more such unpredictable things can take place. This also means there is no guarantee that one applying these methodologies would have the same results as posted. They are repeated every day, every week, every month or even every year in comparable, equal periods. Futures Transactions in futures involve the obligation to make, or to take, delivery of the underlying asset of the contract at a future date, or in some cases to settle the position with cash. The brokers system might not be functional, the auto trading servers might have technical difficulties and there may be times where communication between accounts, the broker and the auto-trade program are not functioning properly. Close What features would you like to see next? Nevertheless, it is understandable if we take into account that in practice annual planning and ordering procedures are often oriented to and determined by the business year. The futures commission merchant may retain the interest and other earnings realized from its investment of customer funds. This scenario has shown positive results in 9 of those periods. IW gives registered Users an option for modifying or removing their information from our database. For these reasons, customers who trade on foreign exchanges may not be afforded certain of the protections which apply to domestic transactions, including the right to use domestic alternative dispute resolution procedures.

Contact RSS Feed. Analysis has revealed that with a buy date of September 13 and a sell date of May 23, investors have benefited from a total return of

CFTC Rules 4. However, we like to use seasonal trends and statistical information as confirmation factors. GLD Seasonal Returns. For these reasons, customers who trade on foreign exchanges may not be afforded certain of the protections which apply to domestic transactions, including the right to use domestic alternative dispute resolution procedures. If the market moves against your position, you may be called upon by your broker to deposit a substantial amount of additional margin funds, on short notice, in order to maintain your position. Please note that any subscriptions or fees that are disclosed to you in the registration process are deemed part of this Agreement. For example, for many businesses, sales can vary depending on the season. We prepared the above gold seasonal chart for based on the - data and then adjusted it for the options' expiration effect that we observed between and Of course, they cannot be viewed alone. Which one? You can also see the influence of seasonal demand on price development, which we mentioned earlier. Please take a moment to read the following to learn more about our information practices, including what type of information is gathered, how the information is used and for what purposes, to whom we disclose the information, and how we safeguard your personal information. Can't we just check what happened in each quarter separately?

0 thoughts on “Gold seasonality chart”