H r block tax

Everyone info. Want a more convenient way to file taxes? Used a different preparer last year?

The online software is one of the best available to DIY tax filers, especially those looking to take advantage of its free tier. Danni Santana has spent seven years as an editor and business journalist covering industries like sports, retail, restaurants, and now personal finance. Most recently he worked as a retail editor at Business Insider. His biggest loves outside of the newsroom include, running, cooking, playing video games and collecting sneakers. He has been covering technology, software, finance, sports and video games since working for Home Network and Excite in the s. Peter managed reviews and listings for Download.

H r block tax

Federal government websites often end in. The site is secure. These practices cost consumers time and money. Then, its system deletes all the tax data the consumers have entered, requiring them to start their tax return from scratch, creating a significant disincentive to downgrading. Since at least , consumers attempting to downgrade have had to reach out to the company to request a downgrade — a process that has often been frustrating and time-consuming. The issuance of the administrative complaint marks the beginning of a proceeding in which the allegations will be tried in a formal hearing before an administrative law judge. The Federal Trade Commission works to promote competition and protect and educate consumers. The FTC will never demand money, make threats, tell you to transfer money, or promise you a prize. Learn more about consumer topics at consumer. Follow the FTC on social media , read consumer alerts and the business blog , and sign up to get the latest FTC news and alerts. For Release.

The free plan includes Schedule 1Schedule 2 and Schedule 3. The Deluxe option is ideal for people who need to claim itemized deductions and note any child and dependent care expenses they h r block tax have racked up over the last year. Here's how you can file your taxes for free.

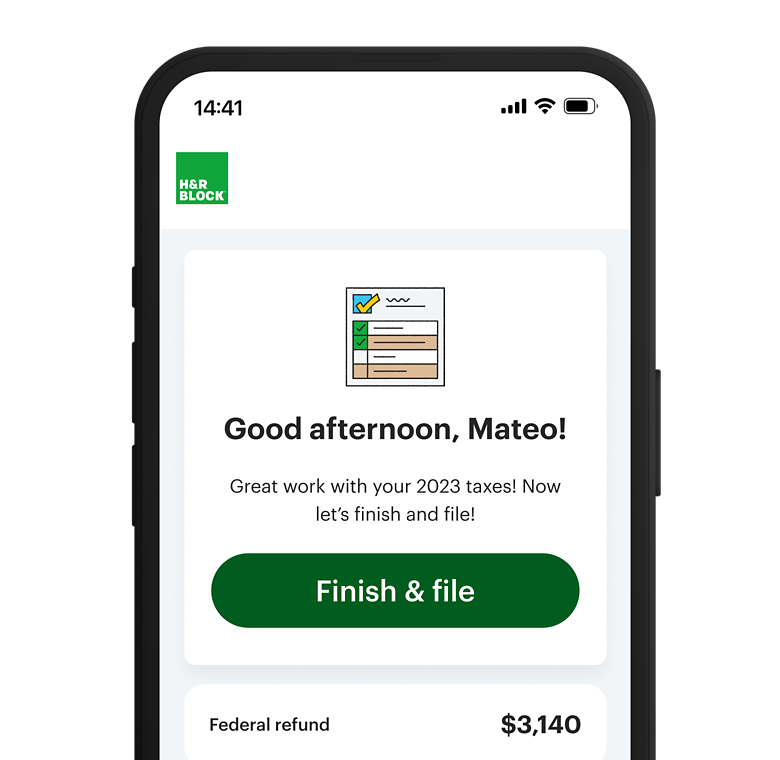

Tax season may be one of the most daunting times of year — especially if it's the first time you're filing taxes or it's often difficult for you to wrap your head around the process. It offers both online and in-person services for individuals and small businesses with over 12, offices around the world, including ones in every U. Read on to see if their services may be a good match for your needs. The free option is ideal for filing simple returns , so if you're a student, a W-2 employee, or just need to file unemployment benefits, you'll be able to take advantage of this free offering. This option is also suitable for parents who need to file for a child tax credit. The Deluxe option is ideal for people who need to claim itemized deductions and note any child and dependent care expenses they may have racked up over the last year.

Our online service options and electronic filing products will guide you through your tax preparation at every step, letting you prepare your taxes at your own pace. Review our income tax online filing options. Want a little help? With Online Assist, you can get tax filing assistance from a real tax pro who can chat with you and answer your questions. Our highly skilled tax pros are dedicated to helping you better understand your taxes. Get help choosing one of our tax pros. Want to skip the office visit, but still work with a tax pro? We have two ways to file your taxes with a pro, but without the traditional office visit. You can choose to drop-off your tax information with or without an appointment.

H r block tax

Everyone info. Want a more convenient way to file taxes? Used a different preparer last year? No problem! We make maximizing your tax refund simple. If you have questions along the way, our tax experts are here to help online or in person. Get started now for free. See hrblock. Your privacy, security, and guarantees are important to us. Please visit hrblock.

Buenos días sábado positivo

In addition to answering these questions, you'll need to add information from your employer, other income sources, and , , W-2, and other tax forms that may show up in your mailbox or inbox. Cons con icon Two crossed lines that form an 'X'. Catch up on Select's in-depth coverage of personal finance , tech and tools , wellness and more, and follow us on Facebook , Instagram and Twitter to stay up to date. Written by Tanza Loudenback ; edited by Richard Richtmyer. Tax Prep focuses mainly on filing your tax return, while the MyBlock app includes a variety of additional features like video chat with tax professionals and in-person appointment planning. You may be charged additional state filing fees. This app is extremely user friendly. For an additional fee, you can add on extra protections like a second look at past tax returns and a peace of mind extended service plan, which provides lifelong protection if you're ever audited. Editorial Guidelines Writers and editors and produce editorial content with the objective to provide accurate and unbiased information. What happens if you make a mistake on your taxes?

The online software is one of the best available to DIY tax filers, especially those looking to take advantage of its free tier.

We'd like to troubleshoot and figure out what's going on. Advertiser Disclosure. LendingClub High-Yield Savings. Peter managed reviews and listings for Download. Illyanna C. Read on to see if their services may be a good match for your needs. When they weren't explained well enough, and I was unable to use those deduction tools, I couldn't go back an unclick those and go back to my original level of filing. Seamless data entry when you upload tax documents PDF or photo of paper document Check mark icon A check mark. Top Money Pages. Sign-up here. Like other tax-preparation services, the platform walks users through a series of questions about their household, income, and opportunities for deductions and tax credits. Saves time and filing is easy.

Many thanks to you for support. I should.

It is removed (has mixed topic)

I join. So happens. We can communicate on this theme. Here or in PM.