Hog application status check

How can I check the status of my application? When can I check my application status? What does my status mean in the application status tracker?

Discover the most important advantages of using the HOGS map system. Combine all processes into one. HOGS maps revolutionizes freight management by offering intelligent routing. Thanks to market analysis, you can easily compare your rates with your competitors and learn about the operating costs of your carriers. The system not only helps in effective cargo management, but also gives full control over the entire vehicle fleet, regardless of its size. It is a comprehensive solution for the industry that brings together everything needed to maximize profits and optimize processes in one place.

Hog application status check

If you qualify for the home owner grant , you must apply each year to receive the grant on your principal residence. Your principal residence is the usual place that you make your home. It's where you live and conduct your daily affairs, like pay bills and receive mail. It's also generally the residence used in your government records for your income tax, medical services plan, driver's licence and vehicle registration. Your principal residence must be assessed and taxed as an improvement, such as a single family dwelling, a strata duplex or condominium, a townhouse, a manufactured or modular home. Updating your address The information you provide on your home owner grant application is not shared with your municipality or BC Assessment. If your address or contact information has recently changed, you must advise your municipality and BC Assessment separately. Only one qualifying owner can claim the home owner grant for a property each year. The grant amount may be higher for a homeowner who is a senior , veteran or person with a disability , and that homeowner must be the one who is the applicant to receive the higher grant amount for the principal residence. Note: If you pay your property taxes through your financial institution, your financial institution will not apply for the home owner grant on your behalf. You or someone with your permission needs to claim the grant.

Apply online. You may be required to provide documents that confirm the separation.

Regular Grant. In addition to the above criteria if you are under 65 years of age you qualify for the Regular also called Basic Grant. Senior or Additional Grant. You must apply for the grant each year to receive it. Only one grant can be claimed per property.

Skip to main content. As of Jan. To apply for a retroactive or new grant, check your application status, or learn more about the grant, visit www. Please allow up to 3 business days for your approved grant to be applied to your tax account. Most eligible property owners qualify for the regular grant also called the basic grant.

Hog application status check

If you qualify for the home owner grant , you must apply each year to receive the grant on your principal residence. Your principal residence is the usual place that you make your home. It's where you live and conduct your daily affairs, like pay bills and receive mail. It's also generally the residence used in your government records for your income tax, medical services plan, driver's licence and vehicle registration. Your principal residence must be assessed and taxed as an improvement, such as a single family dwelling, a strata duplex or condominium, a townhouse, a manufactured or modular home. Updating your address The information you provide on your home owner grant application is not shared with your municipality or BC Assessment. If your address or contact information has recently changed, you must advise your municipality and BC Assessment separately.

Singking

Does not strain the eyes. Grant Type : Select either th e regular grant or any additional grants you may qualify for. If each of you wants to claim the home owner grant for your principal residences, before applying for the grant, you must have lived separately and apart for a period of at least 90 days because of the marriage or marriage-like relationship breakdown, or you are subject to a court order recognizing the separation. If you apply before your property tax notice is available, your home owner grant application will remain in a pending status until your tax notice is made available. Grant applications are audited for up to 7 years to make sure taxpayers are eligible for the grants they receive. How Do I Apply for a Subdivision? Since , we have been creating IT solutions that automate operational processes in the TSL industry. Toll Free Why is there a difference between my progress bar and my application progress? Note: If you pay your property taxes through your financial institution, your financial institution will not apply for the home owner grant on your behalf.

The home owner grant reduces the amount of property taxes you pay each year on your principal residence. The grant is available to homeowners who pay property taxes to a municipality, or to the province if they live in a rural area.

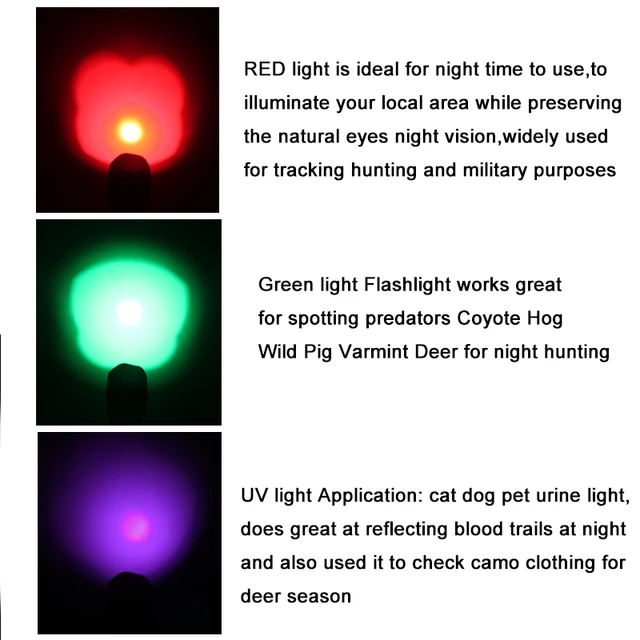

I have changed my surname or family name recently. Freight Automation allows the freight forwarder to literally engage eighth gear. Don't include private or financial information in this form. Choose your plan Monthly payment 30 days. Dial This means no more tedious clicking and sending hundreds of emails. Expand All Collapse All. Maps for road transport. Best for working during the day. Order a quote. Separated spouses. Questions about the collection of your personal information may be referred to the Legislative Services Department at , or via email at foi nanaimo. Who can I contact if I have a question?

Yes, quite