Hourly rate paycheck calculator

You are tax-exempt when you do not meet the requirements for paying tax.

Input your income details and see how much you make after taxes. Calculate a bonus paycheck tax using supplemental tax rates. Calculate net-to-gross: find out how much your gross pay should be for a specific take-home pay. Calculate the gross wages based on a net pay amount. Fill out a Form W4 step-by-step with helpful tips.

Hourly rate paycheck calculator

Estimate the after-tax pay for hourly employees by entering the following information into a hourly paycheck calculator:. This powerful tool can account for up to six different hourly rates and works in all 50 states. See frequently asked questions about calculating hourly pay. To protect themselves from risk and navigate compliance rules, many employers choose to work with a payroll service provider , who can automate paycheck calculations. Learn more about how to calculate payroll. First, determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year Next, divide this number from the annual salary. Calculate the sum of all assessed taxes, including Social Security, Medicare and federal and state withholding information found on a W Divide this number by the gross pay to determine the percentage of taxes taken out of a paycheck. Multiply the hourly wage by the number of hours worked per week. Then, multiply that number by the total number of weeks in a year It should not be relied upon to calculate exact taxes, payroll or other financial data. These calculators are not intended to provide tax or legal advice and do not represent any ADP service or solution.

It depends, because they usually don't have a guaranteed number of hours per week, and the hours hourly rate paycheck calculator work is determined by a weekly schedule. This federal hourly paycheck calculator is perfect for those who are paid on an hourly basis.

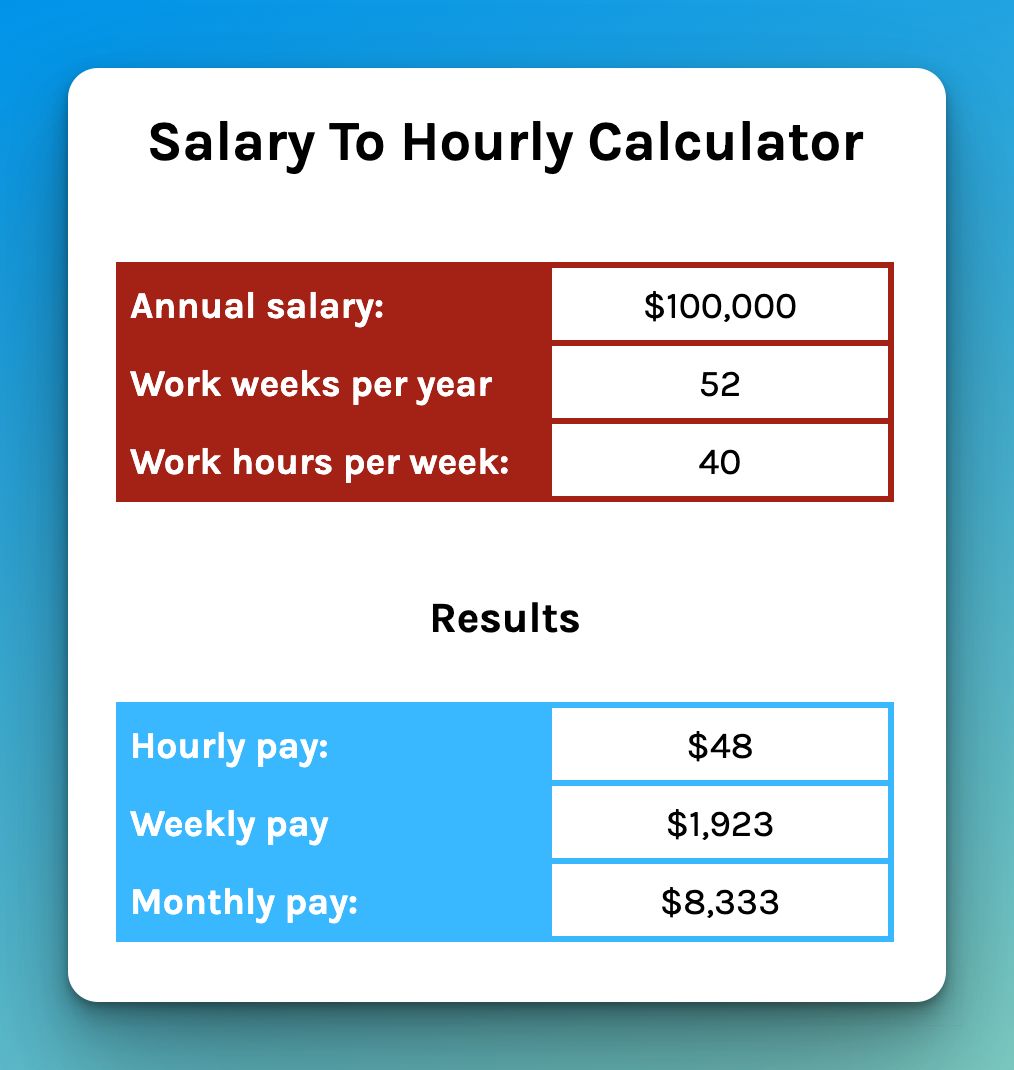

This form is for calculating your annual, monthly, weekly, daily and hourly rates of pay. Please only enter the values for the time you are supposed to work. About unions. Workplace guidance. About the TUC.

You are tax-exempt when you do not meet the requirements for paying tax. This usually happens because your income is lower than the tax threshold. For , you need to make less than:. If you are 65 or older, or if you are blind, different income thresholds may apply. Check the IRS Publication for current laws. You might receive a large tax bill and possible penalties after you file your tax return.

Hourly rate paycheck calculator

When your employer calculates your take-home pay, they will withhold money for federal and state income taxes and two federal programs: Social Security and Medicare. The amount withheld from each of your paychecks to cover the federal expenses will depend on several factors, including your income, number of dependents and filing status. You can't withhold more than your earnings. Please adjust your. Tax withholding is the money that comes out of your paycheck in order to pay taxes, with the biggest one being income taxes. The federal government collects your income tax payments gradually throughout the year by taking directly from each of your paychecks. It's your employer's responsibility to withhold this money based on the information you provide in your Form W You have to fill out this form and submit it to your employer whenever you start a new job, but you may also need to re-submit it after a major life change, like a marriage. If you do make any changes, your employer has to update your paychecks to reflect those changes.

Tickpick eras tour

You can easily check your city, another state, nearby countries, or even another continent for new prospects. A paycheck is a directive to a financial institution that approves the transfer of funds from the employer to the employee. The more taxable income you have, the higher tax rate you are subject to. What was updated in the Federal W4 in ? The TUC has a history of developing analysis and research to inform economic and employment-related issues. Buy Build vs. How much does an hourly employee work? Find federal and state withholding requirements in our Payroll Resources. By entering it here you will withhold for this extra income so you don't owe tax later when filing your tax return. This form is for calculating your annual, monthly, weekly, daily and hourly rates of pay. Check your annual, monthly, weekly, daily and hourly rates of pay.

Find a plan that fits you.

How do I calculate my hourly wage? Does your company or employer currently use ADP? In this section. All wages, salaries, cash gifts from employers, business income, tips, gambling income, bonuses, and unemployment benefits are subject to a federal income tax. Additional State. Hint: Gross Pay Enter the gross amount, or amount before taxes or deductions, for this calculation. To protect themselves from risk and navigate compliance rules, many employers choose to work with a payroll service provider , who can automate paycheck calculations. Searching for accounts A much nicer and easier way is to use this paycheck calculator and have all the results immediately. Multiply your hourly pay by the desired number of hours to find your salary. Withholding Forms.

0 thoughts on “Hourly rate paycheck calculator”