How to find pin on hsbc app

If you need any help with accessing online or mobile banking, please check out our help tool below before going any further. Activating your Secure Key.

You must use your PIN with your debit or credit card when asked to do so by retailers in the UK, or you will not be able to pay for goods and services. If you have incorrectly tried three consecutive times to key in your PIN - even on three separate occasions - your PIN will be locked. This is to prevent fraudulent use. Your PIN will automatically unlock and can be used with your card in retailers. The key to choosing a PIN is familiarity - it's much easier to remember a number with unique associations than a random series of digits.

How to find pin on hsbc app

Biometrics is a new technology which uses human features to make logging on more secure. Instead of needing to remember a password, you can use fingerprint or face recognition. Your biometrics is an excellent security device; you've always got it with you and no two are exactly the same. To enable Android Fingerprint, your phone must be running Android 8 or above and have fingerprint log on functionality. When you enable biometrics, any fingerprint or face stored on your device, now or in the future, can be used to log on to the HSBC UK Mobile Banking app. You should only enable biometrics if you're the only person who has fingerprints or faces registered on your device. You can find these in the app menu. Just use your unique biometric credentials, such as fingerprint or face recognition. When you enable biometrics, any fingerprint or face stored on your device - now or in the future - can be used to log on to the mobile banking app. You should only enable biometrics if you are the only person who has fingerprints or faces registered on your device. If you change the biometrics stored on your device, or reset your Digital Security Key PIN, you'll need to set up your biometrics again when you next log on to the mobile banking app. Biometrics A simple and secure way to log on to our mobile banking app. Ways to bank. Mobile banking. Use your biometrics to log on to the mobile banking app.

I just got a new phone - how do I transfer my Digital Security Device? Your PIN will automatically unlock and can be used with your card in retailers. Plan ahead.

Discover an ever growing range of services and features on the app to make your banking more convenient. Use our money management tools to stay on track of your spending and work towards your future goals. For a full list of features, read our guide to banking from home. You must enter this code as well as your normal username and password. This is known as two factor authentication. Find out more about staying safe when banking digitally. When an update is completed for an app or iOS or Android operating system on a device with low memory, some apps are removed and then reinstalled.

View your portfolio and holdings information, now available conveniently in the Mobile Banking App. Check and update your personal details so that we know how to contact you. Now you can view your Mortgage or HELOC account details including payment information, current due date, interest rate, and more. Discover a wide range of features and services on the app, and experience an ease of use like never before. Register from your mobile device.

How to find pin on hsbc app

For debit cards, select 'View more' from the options and then 'Manage cards' from the options. For credit cards, select 'Manage cards'. Your re-issued PIN should arrive within 7 working days and you can use it as soon as it arrives. Your card will be blocked, including contactless payments, if you enter the wrong PIN 3 times in a row. If you're near an ATM, you can unlock it and use your card again. If you've locked your PIN at an ATM machine by entering it incorrectly 3 times in a row, you'll need to wait until the following day before you can try again. Please see our guidance for changing your PIN.

World elite hotel istanbul

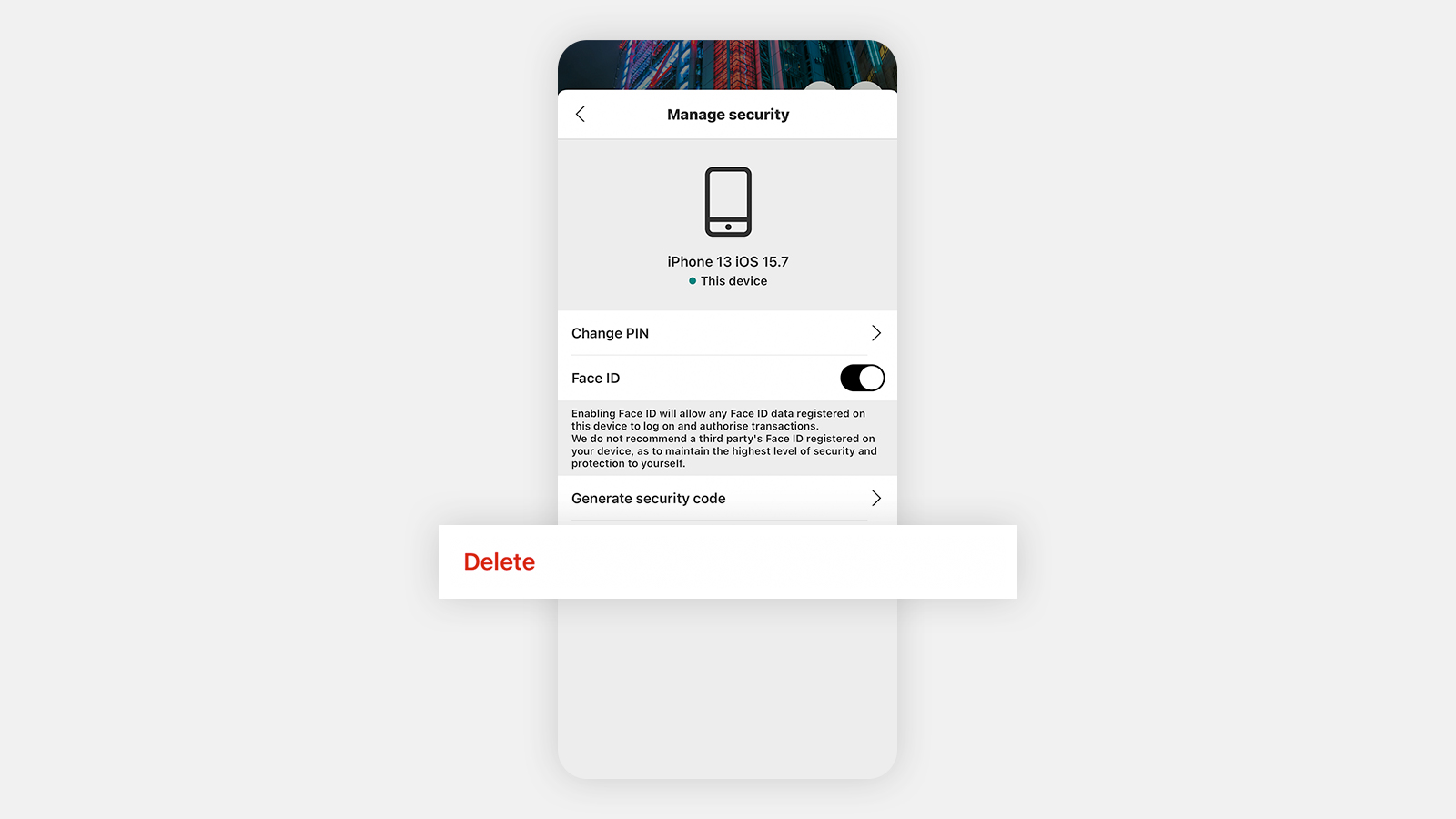

To find out what's happening, go to our digital banking help tool , select the option for 'Physical Secure Key error messages' and confirm which error message you're seeing. Select 'Continue' and you'll see confirmation that your Secure Key has been set up successfully. If you're using online banking, select 'Account services' in the top menu to find 'Manage devices'. Visit our Help page to find out how. Follow what it says on the screen to enable Face ID. Key App Features. If you have access to the app through a device you no longer use, you should remove it via 'Manage devices'. Mobile app on multiple devices. Do I need my Security Device every time I log on? This is where you can amend your existing security details. If your Secure Key has a low battery, you can still use this to access online banking for 30 days until you have to activate your new one. If you can't do this, please contact us on so we can deactivate the old device for you. From 24 November , it does not include any arranged overdraft limit.

If you need to talk to us about a problem with your Security Device, find out how to contact us. You can log on to Personal Internet Banking via browser by using your username and password. This is the password you used previously to access Online Banking.

Chat with us. Visit our Help page to find out how. If you don't have this or it's expired, there's an option to generate a new activation code on-screen Follow the instructions to generate a security code on your Secure Key and enter it in the required field Select 'Continue' and you'll see confirmation that your Secure Key has been set up successfully. Take me straight to. Back to top. If you can't do this, please contact us on so we can deactivate the old device for you. It's important to let us know right away if you lose your device so we can remove it from your account. More ways to bank. Access the full app on up to 3 devices, adding or removing them at any time. Choose a number that means something to you personally and you can't go wrong. I have bad eyesight. It's easy to unfreeze it once you find it.

Bravo, what necessary phrase..., a remarkable idea

Rather excellent idea

What remarkable question