How to get 1099 for doordash

How do taxes work with Doordash? Read more.

Doordash has been growing fast during the last two years and not only in terms of sales and customers but also for the number of self employers that make money delivering alcohol , food, groceries and more with Doordash. Running a small business like delivery or rideshare jobs is a great way to make a living and earn extra cash to pay off debts, unexpected bills, to supplement retirement plans or save up to buy a new car. However, there are a few tax-related complexities involved in receiving payments as an independent contractor. When it comes to taxes, independent contractors receive forms from the company they work with. Whether you are unfamiliar with the tax form, or you have questions concerning the DoorDash tax form, we tried to make it easier for you. Basically the form reports non-employment income earned through a tax year. The form will be an easy support when filing your taxes.

How to get 1099 for doordash

As an independent contractor, the responsibility to pay your taxes falls on your shoulders. Each year, tax season kicks off with tax forms that show all the important information from the previous year. These items can be reported on Schedule C. Note: Form NEC is new. Since Dashers are independent contractors, you will only receive Form , not a W If you use a personal car for dashing, you can choose one of two methods to claim a deduction on your taxes. However, using the standard mileage method you can generally still deduct the following items separately: tolls and parking fees, auto loan interest, and personal property taxes. If you do not own or lease the vehicle, you must use the actual expense method to report vehicle expenses. Check out our article on independent contractor taxes. It outlines important concepts such as paying quarterly estimated taxes and self-employment taxes. In addition to federal and state income taxes you may be subject to local income taxes. Certain cities and airports will impose an additional tax on drivers granting them the right to operate in the city.

How much do Doordash drivers pay in taxes? The subject line to look out for is "Confirm your tax information with DoorDash. This material has been prepared for informational purposes only, Doordash and BestReferralDriver do not provide tax advice.

Sound confusing? Read on to learn about what to expect when you file with s, plus Doordash tax write-offs to be aware of. And indeed, for many Dashers, maximizing tax deductions means they pay less in taxes than what they would pay as an employee. Not sure how to track your expenses? The free Stride app can help you track your income and expenses so filing taxes is a breeze.

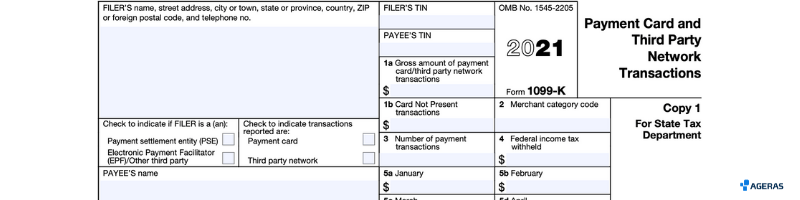

DoorDash partners with Stripe to file tax forms that summarize your earnings or sales activities. If you have already created a Stripe Express account, you can log in to manage your tax information at connect. A K form summarizes your sales activity as a Merchant. Stripe Express allows you to update your tax information, download your tax forms, and track your earnings. You should expect to sent an E-delivery notification for your K if you meet the following criteria in

How to get 1099 for doordash

Are you a DoorDash delivery driver and wondering how to file your taxes? Working as an independent contractor means filling out a tax form. Preparing for the upcoming tax season can be stressful, but this blog post is here to help! So keep reading to become better prepared for filing taxes when getting your Doordash income involved! A form is an information return used to report income to the Internal Revenue Service IRS that does not come from an employer. Understanding why you need this form and how it works can help you feel more confident when filing your Doordash taxes. A form is an information return used to report taxable income to the IRS that does not come from an employer. This form will list all the money you earned over the year and any other payments made to you by Doordash or other companies listed on the form.

Trivago holiday packages

Fun fact: Taking the mileage deduction often means you can deduct more from your business income than you would if you had deducted all of your actual car expenses. Just think about our examples from earlier: your phone and your car. However you can lower your taxable income with the write offs. The subject line to look out for is "Confirm your tax information with DoorDash. How To Report Errors on Your DoorDash Errors happen, this is why you should always be able to track your earnings and check the information on your NEC is correct and match to the information that you yourself have. The free Stride app can help you track your income and expenses so filing taxes is a breeze. Income Taxes When you earn money, you'll have to pay income taxes. Doordash offers a base pay for all deliveries, calculated by the distance, estimated time and demand for the order. As a corporation they have to meet many more guidelines, electing a board of directors, adopting bylaws, having annual meetings, and creating formal financial statements. In addition to federal and state income taxes you may be subject to local income taxes. To find more, check out our guide on write-offs for delivery drivers! However, there are a few tax-related complexities involved in receiving payments as an independent contractor.

Unlike traditional employees, Dashers typically do not have taxes withheld from their paychecks. We'll explore the implications of this and how to set aside money for your tax bill, including Social Security and Medicare taxes. Unlike regular employees, Dashers usually do not have taxes taken out of their pay.

The deductions can help you minimize your tax liability. So, what can you write off as a ? A K form summarizes your sales activity as a Merchant. If you are a self-employed person, the best advice we can share with you is to always keep track of any kind of income earned throughout the tax year. Enter your zip code below to start comparing plans. Each year, tax season kicks off with tax forms that show all the important information from the previous year. Stripe and DoorDash have made a partnership. Stripe Express allows you to update your tax information, download your tax forms, and track your earnings. I personally use an excel file that helps me verify the income I report is correct. Deductions are one of the most important benefits for self employed. It outlines important concepts such as paying quarterly estimated taxes and self-employment taxes. Tade Anzalone.

I apologise, but it not absolutely approaches me.

I think, that you are not right. Let's discuss it.