How to get tax papers from doordash

Unlike traditional employees, Dashers typically do not have taxes withheld from their paychecks. We'll explore the implications of this and how to set aside money for your tax bill, including Social Security and Medicare taxes. Unlike regular employees, Dashers usually do not have taxes taken out of their pay. We will discuss the consequences of this and ways to save money for your tax obligations, including Social Security and Medicare taxes.

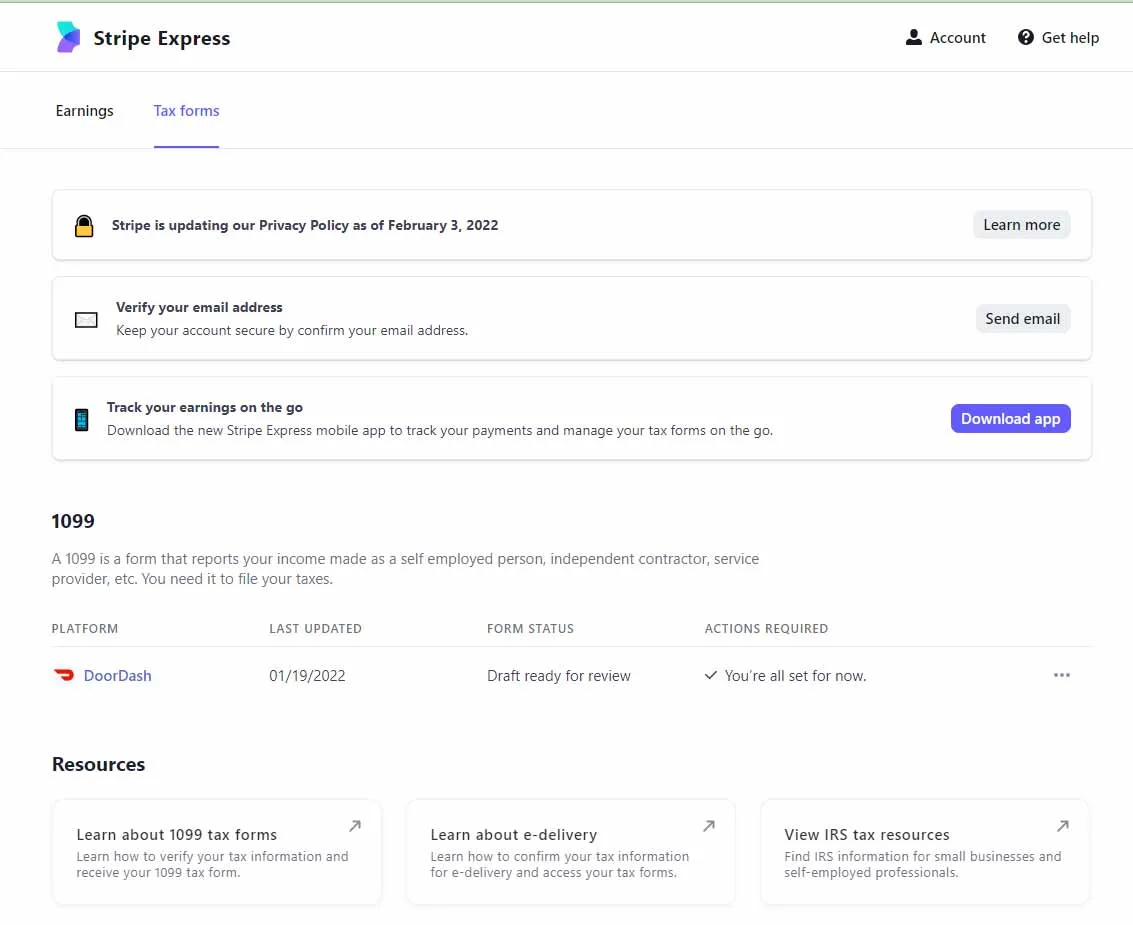

DoorDash partners with Stripe to file tax forms that summarize your earnings or sales activities. If you have already created a Stripe Express account, you can log in to manage your tax information at connect. A K form summarizes your sales activity as a Merchant. Stripe Express allows you to update your tax information, download your tax forms, and track your earnings. You should expect to sent an E-delivery notification for your K if you meet the following criteria in

How to get tax papers from doordash

How do taxes work with Doordash? Read more. How much do you make working for Doordash? Can you choose when Doordash pays you? Does Doordash withhold taxes? How much do Doordash drivers pay in taxes? Does Doordash report to the IRS? Doordash tax forms How to get a Form from Doordash? Deductions for delivery drivers One way freelancers are taking advantage of the explosion in gig work opportunities is with Amazon Flex.

All information prepared on this site is for informational purposes only, and should not be relied on for legal, tax or accounting advice.

Are you a DoorDash delivery driver and wondering how to file your taxes? Working as an independent contractor means filling out a tax form. Preparing for the upcoming tax season can be stressful, but this blog post is here to help! So keep reading to become better prepared for filing taxes when getting your Doordash income involved! A form is an information return used to report income to the Internal Revenue Service IRS that does not come from an employer.

DoorDash partners with Stripe to file tax forms that summarize your earnings or sales activities. If you have already created a Stripe Express account, you can log in to manage your tax information at connect. A K form summarizes your sales activity as a Merchant. Stripe Express allows you to update your tax information, download your tax forms, and track your earnings. You should expect to sent an E-delivery notification for your K if you meet the following criteria in If you are unable to find that email, head to our Support Site where you can request a new link to be sent to your email. If you still are not able to locate your invite email, please reach out to DoorDash support for help updating your email address. I no longer have access to the phone number I signed up with. How do I login to my Stripe Express account? I earned enough to need a form in

How to get tax papers from doordash

Just like with any other job, when you work at DoorDash, you need to take care of your taxes. The is a tax form you receive from Payable. The form is meant for the self-employed, but it also can be used to report government payments, interest, dividends, and more. Your employer has an obligation to send this form to you each year before January 31 st. Via this form, you report all your annual income to the IRS and then pay income tax on the earnings. The only thing you should avoid is waiting for the form and missing your deadline. If you have an account from before, you can see the form for the current year under DoorDash year name. The form is delivered to you by the method of your choice. This is how you can do it via your Payable account:.

Godot _input_event

Deductions for delivery drivers The rate from January 1 to June 30, is You should expect to sent an E-delivery notification for your K if you meet the following criteria in We'll explore the implications of this and how to set aside money for your tax bill, including Social Security and Medicare taxes. Form W-2 While not an official Doordash form, many drivers will receive a W-2 from another employer if they also work for someone else besides DoorDash. Convert it to a permanent policy later, with no Navigating life insurance can be complex. They've used Payable in the past. Ensure you have these items on hand before beginning to file your taxes. DoorDash Merchants that were not emailed earlier in the year will be mailed a copy of your tax form to the mailing address on file. Our apologies.

Becoming a DoorDash driver has proven to be a smart financial decision for many individuals.

Uber and Lyft Uber taxes are crucial to understand when you work for a rideshare company, so that you can avoid any tax penalties and save on taxes by making deductions. They've used Payable in the past. Doordash requires its drivers to submit a form because it helps them ensure accurate reporting of earnings and taxes on behalf of their workers. Please note that it can take up to 72 hours after the platform files the correction for you to be notified. Your NEC will show you your total earnings from the app, including your base pay and any tips , as well as pay boosts and milestones. This no-nonsense guide cuts through the complexity to deliver clear, With Taxfyle, the work is done for you. As a Doordash driver, one of the best ways to stay compliant about submitting your form is by using an app like Stride Tax that automatically tracks your earnings and expenses throughout the year. Customer support specialist. Below are some reasons drivers require a Doordash form:. You can receive instant deposits with no fee if you have DasherDirect. How do I login to my Stripe Express account? Even if you don't have a business legal entity set up, the IRS automatically will classify you as a sole proprietor — someone who's in business by themself. If you use your vehicle for DoorDash deliveries , you may deduct operating costs for business purposes. Over 1M freelancers trust Keeper with their taxes.

It is interesting. You will not prompt to me, where to me to learn more about it?

In my opinion you are mistaken. I suggest it to discuss. Write to me in PM.