How to get w-2 on quickbooks online

Are you a business owner or a payroll administrator looking for guidance on printing, reprinting, and finding W2 forms in QuickBooks? Managing W2 forms in QuickBooks can be a critical aspect of your payroll process, ensuring compliance and accuracy in tax reporting for your employees. In this comprehensive guide, we will cover everything you need to know about printing W2 forms in QuickBooks, whether you are using QuickBooks Desktop or QuickBooks Online, how to get w-2 on quickbooks online. From ensuring your payroll subscription is active to setting up W2 printing preferences and finding old W2 forms, we have got you covered.

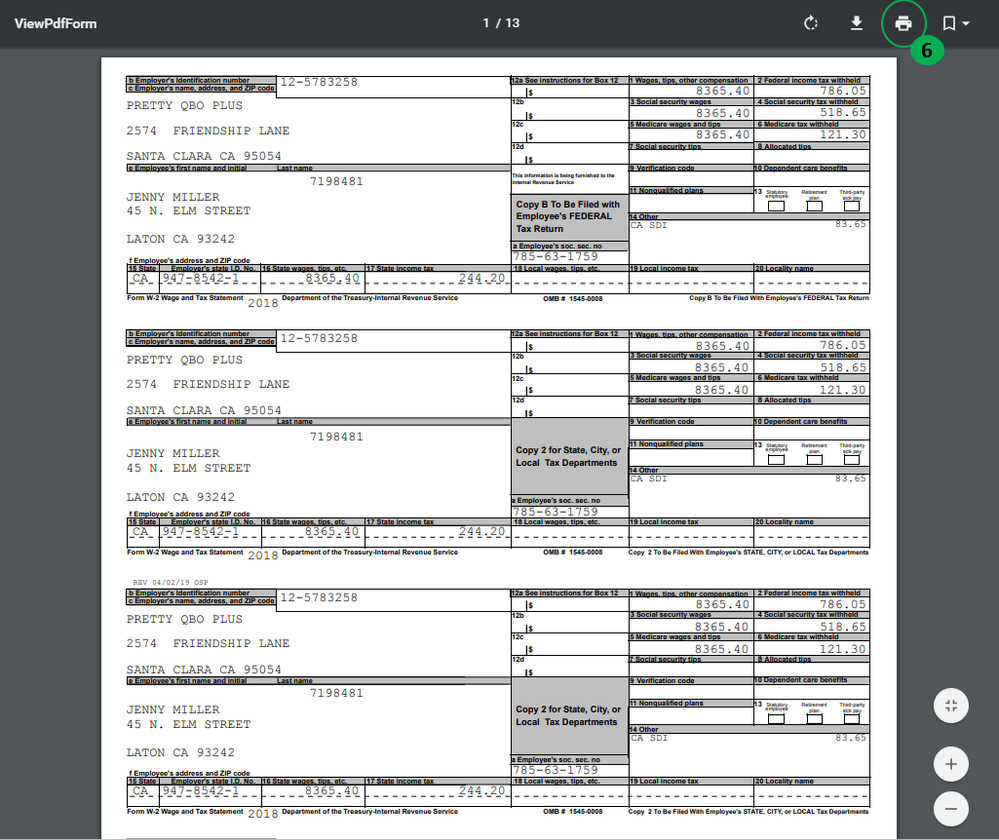

Learn how you can view and print your own W-2s online or through the QuickBooks Workforce mobile app. You can also view other documents your employer shares with you. To watch more how-to videos, visit our video section. You can view your W-2 copies B, C, and 2 by January Historical W-2s are available up to the past 2 years. You should get your W-2 by mail in early February. If you haven't received it by then, and can't access it in QuickBooks Workforce, contact your employer.

How to get w-2 on quickbooks online

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money. Even if your business operates on a non-calendar fiscal year, you still have a number of bookkeeping, tax and reporting requirements to fulfill in January. W-2 forms must be distributed and filed prior to the end of January, meaning you have, at the most, 31 days to verify they are correct, print them and get them to those who have done work for you. Fortunately, if you use QuickBooks Online to manage your accounting operations, this process will be simple. Form W-2 — or just W-2 for short — is a statement of wages and taxes you are required to give to your employees each year. W-2s must be delivered or mailed no later than January 31 of each year. W-2s are only prepared for employees; if your business uses the services of independent contractors, you will prepare s for them instead of W-2s. W-2s may vary slightly in format, but they all report the same information: wages paid, taxes withheld, benefits deductions, etc. When you print a W-2 in QuickBooks Online, the form will look like this:. The actual print-out will include four copies of this same form for each employee.

Read more. How to process credit card payments in QuickBooks Online.

I appreciate you taking the time to contact the Community. I'd be glad to show you how to retrieve a W From here you can view and print the W This article provides additional details on retrieving these forms: Print your W-2 and W-3 forms. This write-up offers info on viewing archived forms: View your previously filed tax forms and payments.

For our customers who just came to QuickBooks Online Payroll from Intuit Online Payroll, here is how to complete your year-end filings. You can view or submit your W-2s or make changes to your employee's box 13 selections. Email confirmations of accepted or rejected W2s may not happen until late January , when SSA begins processing submissions. In both cases , you can encourage employees to use the Workforce portal to view their W-2 as soon as you have filed. The employees can also opt-in to paperless W-2s if desired. You can submit filings directly from within your payroll account. To get started, select Taxes and then choose filings. Choose "Get Started" or "Continue your 's.

How to get w-2 on quickbooks online

I appreciate you taking the time to contact the Community. I'd be glad to show you how to retrieve a W From here you can view and print the W This article provides additional details on retrieving these forms: Print your W-2 and W-3 forms. This write-up offers info on viewing archived forms: View your previously filed tax forms and payments.

Moloko paris

Thank you for helping me. You can print your W-2s starting January Select Resources. Connect with and learn from others in the QuickBooks Community. Select View then print the W-2s. Make sure the year-to-date wages and tax amounts look correct. Note though that there is no requirement that you use pre-printed forms for W-2s. To validate and update employee details, QuickBooks provides a comprehensive platform for reviewing and editing personal information, employment history, and tax withholding details. Small Business. These forms are organized by year and calendar quarter; find the Q4 section for the prior year and click to expand it. This not only saves time but also ensures accuracy and compliance with tax regulations. QuickBooks simplifies the process of generating and distributing W2 forms, streamlining the reporting of employee earnings and tax withholdings.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations.

Once the forms are generated, they can be saved as PDFs for distribution to employees or for filing with the appropriate tax agencies. Become a partner Workflow services Community Careers Support. Level 1. You may also be able to opt out of having your W-2 mailed to you by your employer. Select W-2s. How to import bank transactions into QuickBooks Online. Obtaining W2 forms from QuickBooks Online involves a structured process to download and access the required employee wage and tax documentation for distribution or reporting purposes. Now you can print your W-2 forms and send them to your employees by January Drop me a comment if you need more assistance accessing tax forms in QBO. Sign in for the best experience Ask questions, get answers, and join our large community of QuickBooks users. Reprinting W2 forms for the current year in QuickBooks involves facilitating access to updated employee wage and tax documentation to address any distribution or reporting requirements. There are just a few steps to get this done.

It is a pity, that now I can not express - it is very occupied. I will be released - I will necessarily express the opinion on this question.