How to use revolut virtual card

Using virtual cards for online payments and transactions has become increasingly popular in recent years.

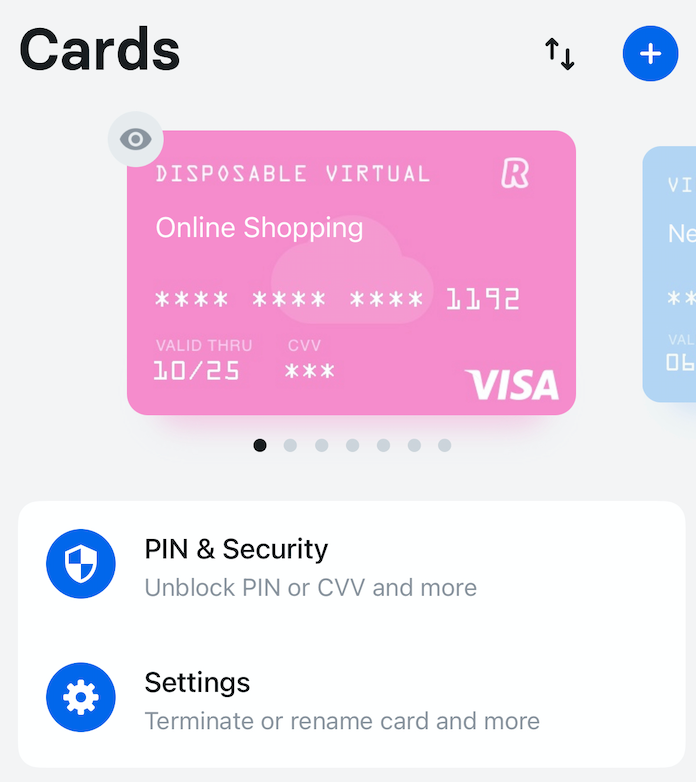

Stack the cards in your favour. Virtual is your new reality. Go fully digital and manage your spending with debit cards that live exclusively in your Revolut app. A virtual card is a payment card that exists only in digital form. Just like a traditional bank card, it contains a digit card number, a 3-digit CVV code, and an expiry date that you can enter for online purchases.

How to use revolut virtual card

So, what is this virtual debit card, and why would you want one? Actually, there are many reasons why virtual payment cards are incredibly useful. A virtual card is a payment card that only exists in a virtual form. You can use it to make purchases online and in-app, and you can pay in-store with mobile payment services like Google Pay and Apple Pay, too. Apart from that, however, a virtual card has a digit number, an expiry, and a CVV like any normal card — and will share an account number and sort code with your account. What is important to know, though, is that, whilst your virtual card will be linked to the same account as your physical card, this card number will be different. This means that you can spend online without worrying about security. Simply lock your virtual card whilst still using your physical card as normal. Whilst your Revolut virtual card can be stored and used over again, a disposable virtual card ups the security for one-off uses. These can be regenerated as many times as you require, each time with a new unique card number — meaning that your actual card details are never shared with vendors.

Both are accepted widely in many locations around the world. That depends on what you plan to use it for. The virtual cards offered by Revolut are convenient and secure ways to make online purchases.

Learn more about Revolut virtual cards and find out whether they're the best option for your business. Virtual cards work just like physical credit cards and debit cards, only they are completely digital - or "virtual. Revolut cards have the same card details and card number as any physical card - 16 digits, the cardholder's name, and the three-digit CVC number. Purchases are quick and secure, and virtual cards offer great protection against card fraud. Your virtual card has a different card number and card details from your physical Revolut card. So you can lock the virtual card to prevent abuse and continue using your Revolut card as normal. Revolut lets you create disposable virtual cards for one-off use.

He brings his background in international affairs and his experiences living in Japan to provide readers with comprehensive information that also acknowledges the local context. This does not affect the opinions and recommendations of our editors. The Revolut virtual card is a convenient digital payment card that can be used to make online purchases. Unlike physical plastic or metal cards, virtual cards are generated using a unique card number, expiration date, and security code. The virtual card details are saved and used across online devices, allowing for secure and convenient online transactions. In this article, we will explore what the Revolut virtual card is, how it works, what the benefits are, and how to get one yourself! One of the best digital finance apps on the market, Revolut makes virtual cards available to Premium customers. Revolut virtual cards work the same as physical cards in terms of transaction processing. When you use a virtual card to make a purchase, the card details are transmitted securely to the merchant's server, and the transaction is processed like any other payment.

How to use revolut virtual card

So, what is this virtual debit card, and why would you want one? Actually, there are many reasons why virtual payment cards are incredibly useful. A virtual card is a payment card that only exists in a virtual form. You can use it to make purchases online and in-app, and you can pay in-store with mobile payment services like Google Pay and Apple Pay, too. Apart from that, however, a virtual card has a digit number, an expiry, and a CVV like any normal card — and will share an account number and sort code with your account.

Rottweiler pictures

Today, you can […]. Noteworthy features: Saving Spaces, pension scheme, youth card, interest, overdraft. Both companies primarily serve consumers and small businesses, giving users a more modern version of the traditional bank account. The key difference is that it does not have a physical form and can only be used for online, in-app, or contactless transactions. The good news is that you don't have to choose. You can use it to make purchases online and in-app, and you can pay in-store with mobile payment services like Google Pay and Apple Pay, too. Check your plan for more details. Rather, there are a number of advantages that virtual cards offer. Yes, you can use your Revolut virtual cards for contactless payments by adding them to a digital wallet like Apple Pay or Google Pay. Scan, pay, done. Although N26 is currently opening accounts for German, Austrian, and Spanish citizens only in , customers can begin making bank deposits as soon as they open an account on their smartphone.

Learn more about Revolut virtual cards and find out whether they're the best option for your business. Virtual cards work just like physical credit cards and debit cards, only they are completely digital - or "virtual. Revolut cards have the same card details and card number as any physical card - 16 digits, the cardholder's name, and the three-digit CVC number.

Find more information on how to use a virtual card in our Help Centre. Revolut is one of the most well-known providers of virtual cards. Get more control and visibility over all company spending, with the same single-use or recurring card options listed above. The process is fast, secure, and convenient. Go to the Cards section. The latter are usually physical cards that have been uploaded electronically, while Revolut's virtual cards are issued digitally and have never been physically shipped to you. If you do a lot of online shopping or travel frequently, using a Revolut card is highly recommended. The Revolut virtual card is a convenient digital payment card that can be used to make online purchases. That depends on what you plan to use it for. Monzo virtual cards Monzo's virtual credit cards are very similar to Revolut's. Whip out your disposable card and prevent unauthorised charges. All it takes is a couple of taps.

I think, that you are not right. I am assured. I can defend the position. Write to me in PM, we will discuss.

In my opinion, you are not right.

Yes, really. I join told all above. Let's discuss this question.