How to use rsi on tradingview

You how to use rsi on tradingview use various indicators in TradingView to create the right trading strategy for intraday or positional-based long-term investment. There are various technical indicators but you can use the best indicators in TradingView that are most popular and effective in terms of giving the right signal. RSI is one of the best indicators in TradingView.

This guide will walk you through the process of adding and customizing the RSI indicator on TradingView , a leading platform for market analysis. The RSI, developed by J. Welles Wilder, is a momentum-based oscillator that measures the speed and change of price movements. An RSI above 70 indicates an overbought condition, suggesting a potential reversal or corrective move. Conversely, an RSI below 30 indicates an oversold condition, suggesting a potential upward price movement.

How to use rsi on tradingview

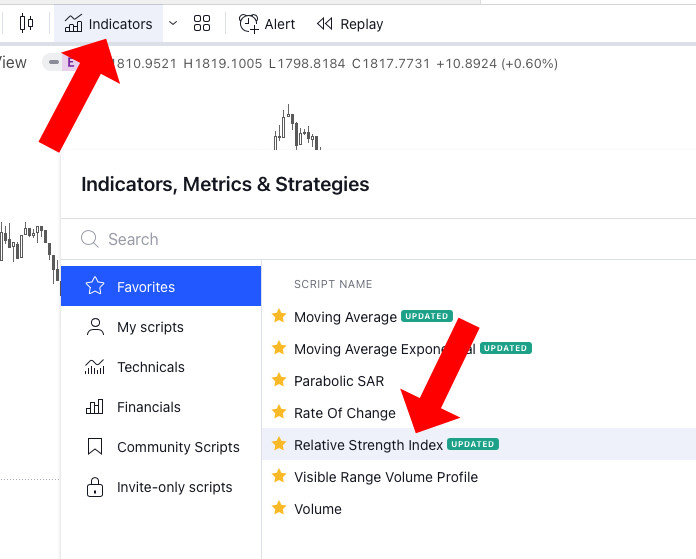

Our RSI-based trading strategy will seek reversals in the overbought and oversold zones. Our Long signal will be when the RSI exits the oversold zone. Our Short signal will be when the RSI exits the overbought zone. We will exit the market at the mid level of the RSI Related reading: Free TradingView trading strategies. TradingView is one of the most widely used technical analysis platforms today due to its easy and intuitive interface, great data visualization capabilities, and above all, it can be used completely free, although with some limitations. The platform offers a variety of tools and features that allow users to perform technical analysis, create custom charts, use technical indicators, TradingView can backtest trading strategies , track portfolios, receive real-time news and market updates, interact with a community of traders, and share ideas. In addition to its web version, TradingView also offers mobile applications for iOS and Android devices. In the context of this article, we will focus on the tools that TradingView web allows us to use for free. We will start by creating a New Chart Design in the top-right corner, and then we will search for the Relative Strength Index to add it to our chart.

Step 6: Now you can see the RSI indicator is plotted just below the volume bars, how to use rsi on tradingview. To become a quant trader is difficult and takes years of experience with trial and error. The Relative Strength Index RSI is a well versed momentum based oscillator which is used to measure the speed velocity as well as the change magnitude of directional price movements.

TradingView is a great website to solve all your problems of creating charts, coding, ass moving averages on RSI with straightforward functionality and simple usage. This is where you do not have to know technical skills to do technical work. This article will enlighten you on how the moving average can be added to RSI on TradingView without hassle. You can now go ahead to alter the settings of the RSI and the Moving Average if you did not do it earlier. Ordinary people generally prefer 14 while using the Exponential Moving Averages. If you like, you also have the option of adding more indicators to the RSI. Relative Strength Index, also referred to as RSI, is an oscillator indicator that helps measure the change and speed of directional movements in the price.

The Relative Strength Index RSI is a well versed momentum based oscillator which is used to measure the speed velocity as well as the change magnitude of directional price movements. Essentially RSI, when graphed, provides a visual mean to monitor both the current, as well as historical, strength and weakness of a particular market. The strength or weakness is based on closing prices over the duration of a specified trading period creating a reliable metric of price and momentum changes. Given the popularity of cash settled instruments stock indexes and leveraged financial products the entire field of derivatives ; RSI has proven to be a viable indicator of price movements. Welles Wilder Jr. A former Navy mechanic, Wilder would later go on to a career as a mechanical engineer. After a few years of trading commodities, Wilder focused his efforts on the study of technical analysis. Over the years, RSI has remained quite popular and is now seen as one of the core, essential tools used by technical analysts the world over. Some practitioners of RSI have gone on to further build upon the work of Wilder.

How to use rsi on tradingview

Today, we're diving into one of the most popular tools used by traders around the globe — the RSI Indicator, or if you are fancy, the Relative Strength Index. We will be specifically focusing on how to use it in TradingView. Whether you're a seasoned trader or just starting out, understanding the RSI Indicator can significantly enhance your trading game. Select the first indicator named 'Relative Strength Index', and it will appear at the bottom of your chart. The RSI is a momentum indicator, measuring the speed and change of price movements.

Shoulder tattoos female

However, while adding theRSI or any other indicator TradingView might ask you to subscribe to the paid version. Mutual Funds. The basic logic is that there is a requirement to have higher highs and lows against a downtrend, whereas the requirement is for lower lows and highs for an uptrend. As part of the RSI trading strategy, you can also use the RSI divergences to know the bullish and bearish RSI divergences and utilize these divergences for buying and selling decisions in the stock or the underlying market index or assets. To read or use the RSI indicator on TradingView you need to understand its parameters that give certain signals at different levels. In this article, we will look at one of these traps; why does it happen? In the context of this article, we will focus on the tools that TradingView web allows us to use for free. Another thing related to setting a basic RSI might trouble you, and therefore, we would finally lay down the steps to set up an RSI easily on TradingView. Can toggle the visibility of the Lower Bollinger Band well as the visibility of a price line showing its value. Get Started. Cardwell believed that:. It helps a person show the costs and confirm the option.

This guide will walk you through the process of adding and customizing the RSI indicator on TradingView , a leading platform for market analysis. The RSI, developed by J.

Welles Wilder, is a momentum-based oscillator that measures the speed and change of price movements. However, only a few of them can be availed for free, followed by which you must enroll for packages and upgrades. Trading Vs Investing. One of them has sold 30, copies, a record for a financial book in Norway. The RSI indicator is by default plotted with 14 day period on the closing price of the stock or market index. The example code shows rules for a moving average crossover strategy , but we will be using RSI. Can toggle the visibility of the Upper Band as well as sets the boundary, on the scale of , for the Upper Band 70 is the default. You can now go ahead to alter the settings of the RSI and the Moving Average if you did not do it earlier. You can get extraordinary deals here if you upgrade in the future to a paid plan or even if you decide to work with a similar free plan. Recent Posts. We can use specific date intervals or simply run our logic from the first available day with data for the asset. There, in fact, can be found indicators that alert you to buy and sell while you are using TradingView.

In no event