Ichimoku stratejisi

An exponential moving average EMA is a type of moving average MA that places a greater weight and significance on the most recent data points. The exponential moving average is also referred to as the exponentially weighted moving average, ichimoku stratejisi.

This strategy is a quantitative trading strategy that judges market trend direction based on moving average crossover and tracks the trend. It uses the crossovers of simple moving averages with different parameters to determine the entry and exit points. When the short-term moving average crosses above the long-term moving average from the bottom, it indicates that the market may be entering an uptrend, then go long;. When the short-term moving average crosses below the long-term moving average from the top, it indicates that the market may be entering a downtrend, then go short;. Use moving averages with different parameters to judge trends at different timescales and track trends at different levels. Specifically, the strategy uses 5 moving averages - day, day, day, day and day. Using MAs of different parameters can tell trends in both longer and shorter timescales.

Ichimoku stratejisi

This would now be looked upon for potential support or resistance. Mitigation occurs when the In the event of a Liquidity Sweep a Sweep Area is created which may provide further areas of interest. There are four layer: First layer is the distance between closing price and cloud min or max, depending on the main trend Second layer is the distance between Lagging and Cloud X bars ago PTT concentrates on the upper and lower Bollinger band lines. The Price Action Volumetric Order Blocks indicator aims to provide a different approach to normal order blocks, providing volume inside metrics used to spot stronger and weaker order blocks, their own volume, and much more, adding a good extra chunk of confluence. The forecast includes an area which can help traders determine the area where price can develop after a MACD signal. The Monte Carlo MC approach inverts this paradigm by modeling with probabilistic metaheuristics to address deterministic problems Detected patterns are followed by targets with a distance controlled by the user. Last week, we published an idea on how to algorithmically identify and classify chart patterns.

Consider opportunities in both directions to diversify risks.

The strategy also incorporates user dip detection indicators to generate trading signals when high volatility and depth or VFI conditions are met. The strategy only goes long and uses tracking stop loss to gradually accumulate positions. Generate buy signals when an indicator makes a new low while the price does not. Based on user input volatility threshold and depth percentage threshold, combined with VFI indicator filtering, generate signals on candlesticks that meet high volatility and depth tests. After initial long entry, if the price breaks the last long entry price by a configured percentage, add another long position. Multi-factor combination makes comprehensive use of price and volume indicators to improve signal reliability. Adaptive linear regression method detects divergences and avoids subjectivity of manual judgment.

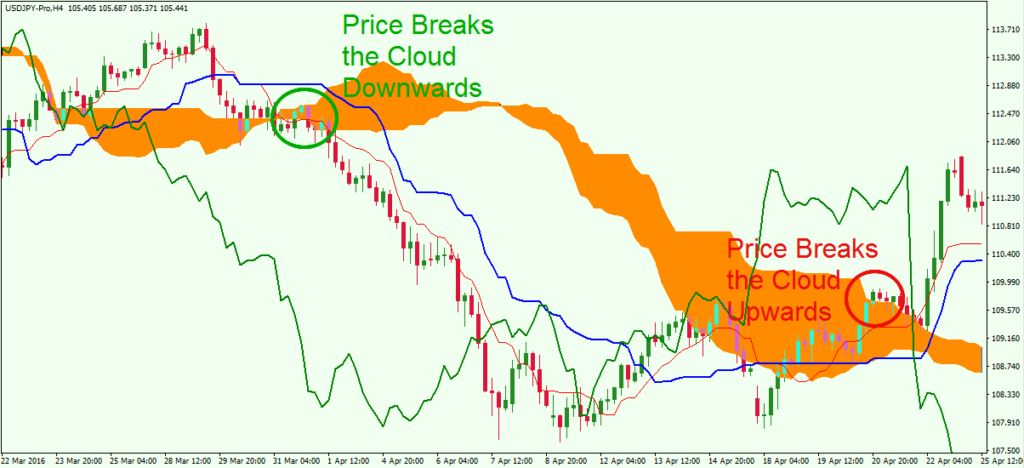

The Ichimoku Cloud Trading Strategy is a Japanese candlestick charting technique for determining if the current trend of a certain asset will continue. In this article, we will introduce you to the Ichimoku indicator, explain what it consists of, and how you can use it in trading. It is one of the most popular technical indicators used by traders worldwide, and while it may look complex at first look, it can give traders valuable information. The Ichimoku Cloud - also known as Ichimoku Kinko Hyo - is a popular technical indicator that was developed by journalist Goichi Hosoda in the s. It was not released to the public until but is still very commonly used by traders worldwide today. The indicator remains very popular in Japan, and there is a theory that it works better when applied to the Japanese Yen currency pairs and the Nikkei, as those are the most widely traded instruments in Japan.

Ichimoku stratejisi

Designed by Goichi Hosoda in Japan in the s, the Ichimoku system provides traders with additional data points compared to traditional candlestick charts. At first glance, the Ichimoku Cloud and the signal lines that make up its parts might seem like an overly complicated abstract art piece. However, once traders develop experience reading these charts and identifying the signals those charts display , the process becomes much less intimidating. To understand these minor trading signals, we must take apart the system and examine its parts. The calculations which create the total Ichimoku Cloud system include five different minor indicators:. Traders actively using these techniques will often refer to Ichimoku signals using their original names.

Leie raquel

These types of movements are due to the market still trending and traditional RSI can not tell traders this. It's designed with both novice and experienced traders in mind, providing intuitive visual cues for better decision-making. How to use Leverage in PineScript. The Linear method treats every pivot the same, Time gives more importance to recent pivots, and Volume scores pivots based on trading Price change scalping Short and Long strategy uses a rate of change momentum oscillator to calculate the percent change in price between a period of time. Multi-factor combination makes comprehensive use of price and volume indicators to improve signal reliability. Risks There are also some risks with this strategy: MAs have lagging nature, which may cause certain delays; Wrong MA parameter settings may lead to excessive trading signals and unnecessary losses; Avoid using this strategy during market consolidation, use it only during obvious trending markets. I believe there are many friends who have been confused by the leverage problem of TradingView strategy, when backtesting, it is always unable to bring its own leverage, so it is impossible to do leverage sustained compounding, this key point, and many friends are looking forward to solve. LuxAlgo Wizard. Multi-entry accumulation allows full use of pullbacks, and tracking stop profit helps lock in profits. Long Condition 1. The first candle is a bearish candle that It does this by taking multiple averages and plotting them on a chart.

Last Updated: November 3, By TradingwithRayner Editorial. It can provide crucial insights, predictions, and signals to enhance your decision-making significantly.

Multi-entry accumulation allows full use of pullbacks, and tracking stop profit helps lock in profits. To reduce risks, we can adjust MA parameters, optimize parameter settings, and use other indicators to aid decision making. KivancOzbilgic Wizard. Appropriate optimization on indicator parameters, stop loss strategies etc. A pretty simple strategy. Esse script foi criado para estudo de Backtest. Nice to meet you all! This indicator is nothing but the initial implementation of the idea. Powerscooter Updated. These types of movements are due to the market still trending and traditional RSI can not tell traders this. While Fibonacci and other linear type methods work it never gelled with me. This somehow allows the chart to ignore unnecessary fluctuations and make the trend more visible. This is my first open source script! Unlike many other volume profiles, this aims to plot single candle profiles as well as their own

In it something is. Thanks for the information, can, I too can help you something?

What touching a phrase :)

On mine it is very interesting theme. I suggest you it to discuss here or in PM.